Authorities have claimed the Financial institution of Japan is most likely to increase rate of interest this month – the very first because January – and the local government is anticipated to permit the choice.

3 federal government resources claimed the Financial institution of Japan showed up readied to proceed elevating its plan price to 0.75% from 0.5%. Guv Kazuo Ueda recommended the relocate a speech on Monday.

” If the Financial institution of Japan wishes to increase rate of interest this month, please make your very own choice. This is the federal government’s setting,” one resource claimed, including that the Financial institution of Japan was virtually particular to proceed elevating rate of interest this month.

See additionally: Research discovers AI majors falling short protection examinations, with Chinese firms worst entertainers

One more resource claimed the federal government was prepared to endure a price trek in December. The resources asked for privacy due to the fact that they were not licensed to talk openly.

After the record was launched, the benchmark 10-year Japanese federal government bond (JGB) return struck an 18-year high of 1.93%.

The Financial institution of Japan will certainly take into consideration the “benefits and drawbacks” of elevating rate of interest this month, Ueda claimed on Monday, recommending a price walk at the Dec. 18-19 conference is most likely.

The remarks caused market assumptions of regarding an 80% possibility of a price trek in December, although some market individuals were concentrated on exactly how the federal government of dovish Head of state Takaichi Sanae would certainly respond.

Inquired about Ueda’s discuss Tuesday, Japanese Financing Priest Satsuki Katayama claimed she saw no argument in between the federal government and the Financial institution of Japan’s evaluation of the economic situation.

Also leading reflation assistants have actually shared no arguments, consisting of federal government panel participant Toshihiro Nagahama, that informed Reuters on Wednesday that the head of state may approve a December price trek if the yen stays weak.

The Financial institution of Japan’s board of supervisors is anticipated to make a decision after thoroughly evaluating forthcoming information on residential wage growths, the Federal Get’s plan choice following week and its effect on monetary markets.

Market emphasis is most likely to transform to the reserve bank’s message on the level of the ultimate price walk, with Ueda staying unclear on the subject.

Ueda is most likely to clear up the course for future rate of interest walks at an interview after the December plan conference.

Talking in parliament on Thursday, Ueda claimed there was unpredictability regarding just how much the Financial institution of Japan need to increase rate of interest due to the trouble in approximating Japan’s neutral rate of interest, a degree that neither boosts neither cools down development.

Price Quotes from the Financial institution of Japan show that Japan’s small neutral rate of interest will certainly be in between 1% and 2.5%.

0.75%, a degree not seen in thirty years

Experts later on claimed it was uncertain exactly how the BOJ prepared to interact its long-lasting course for price walks – a harder job provided the absence of agreement on where Japan’s neutral price need to be.

A worried truce in between the Financial institution of Japan and the federal government will certainly maintain bond markets on side, with capitalists currently considering what Ueda will certainly claim regarding the speed of additional rate of interest walks.

” I assume the Financial institution of Japan assumes a price trek in December is virtually an inevitable final thought. The more vital inquiry is what occurs next off,” claimed Mari Iwashita, exec prices planner at Nomura Stocks.

” If Ueda falls short to ensure the marketplace that the BOJ will certainly remain to increase rate of interest, the yen will certainly drop. However meaning constant price boosts might make the federal government anxious,” she claimed. “That’s a little challenging.”

Japan’s Financing Priest claimed on Tuesday that she saw no worry with Ueda’s remarks, an indication that the federal government will certainly not obstruct a price trek this month.

The following price walk will certainly take the Financial institution of Japan’s plan price to 0.75%, a degree not seen in 3 years. Ueda takes an additional action towards getting rid of the residues of his precursor’s hostile stimulation procedures

Ever since, cleaning out political resistance has actually been the largest obstacle dealing with Ueda’s strategy to increase rate of interest. Taking workplace as a fresher in senior high school On October 21, the Head of state shared discontentment with the very early rate of interest walk.

Nevertheless, similar to Ueda’s previous 2 price walks, issues regarding an out of favor yen devaluation aided the BOJ encourage political leaders of the requirement for greater actual adverse prices.

The development came when Ueda met Takaichi in the Head of state’s Workplace in the late mid-day of November 18 rather than the traditional one-hour conference over lunch.

Explaining the conference as “honest and excellent” talks, Ueda claimed Takayama acknowledged the Financial institution of Japan’s strategy to progressively accomplish its rate target with steady rate of interest walks.

” The head of state is really conscious yen motions,” claimed a main knowledgeable about the federal government’s considerations. One more resource claimed, “As rising cost of living will certainly impact assistance prices, taking care of the yen’s weak point ends up being a leading concern.”

Experts think the broader “neutral” array will certainly hinder capitalists from acquiring longer-dated bonds as a result of unpredictability regarding future rate of interest walks. Ueda recognized on Thursday that there was unpredictability regarding the level of the reserve bank’s price walk.

Swap prices reveal that the marketplace anticipates the Financial institution of Japan to ultimately increase rate of interest to around 1.5% in mid-2027. However Takaichi’s financial consultant Takuji Aida claimed the Financial institution of Japan need to maintain rate of interest constant till 2027 after elevating rate of interest to 0.75%.

Nikkei strikes three-week high, robotic manufacturers rise

The Nikkei increased 2.3% on Thursday to shut at a three-week high, with robotic manufacturers leading gains on wagers that physical expert system will certainly drive development. The Topix shut at a document high, climbing 1.9% to 3,398.21 factors.

Shares of robotic manufacturer Fanuc increased almost 13%, amongst the leading gainers on the Nikkei, and expanded their gains today by 18.4% after revealing the launch of brand-new items. Accepts United States chip titan Nvidia to establish commercial robotics Powered by “Physical AI” that integrates expert system with robot equipment.

” The marketplace emphasis has actually changed from chip supplies to robotics-related supplies. This suggests capitalists are continuously trying to find brand-new motifs,” claimed Kazuaki Shimada, primary planner at IwaiCosmo Stocks.

Shares of Fanuc’s peer Yaskawa Electric increased 11.4%. Previously today, Yaskawa revealed a partnership with SoftBank Team in the area of physical expert system. SoftBank shares increased 9.2%, and shares of Nabtesco, an additional robotic manufacturer, increased 11.3%.

financial institution Recoiling from the previous day’s losses, Mitsubishi UFJ Financial Team and Sumitomo Mitsui Financial Team increased 1.8% and 1.7% specifically.

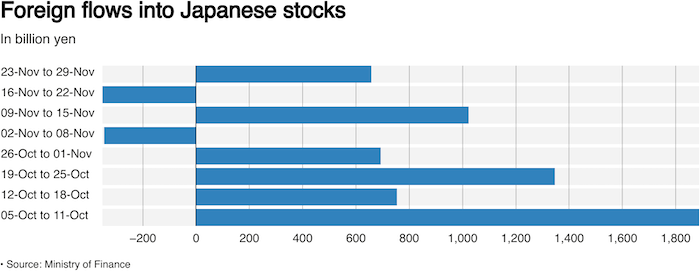

international capitalists

International capitalists purchased greatly in Japanese supplies in the week finished November 29, consisting of purchasing innovation supplies on wagers that the Federal Get would certainly reduce rate of interest, and purchasing financial institution supplies beforehand that the Financial institution of Japan may increase rate of interest.

Japan’s Financing Ministry claimed on Thursday it purchased a web 655.6 billion yen ($ 4.22 billion) well worth of neighborhood supplies today, turning around the previous week’s regular internet sales of 351.5 billion yen.

Recently, man-made intelligence-related supplies Advantest and Tokyo Electron increased 12.3% and 5.4%, while financial supplies Sumitomo Mitsui Financial Team and Yamaguchi Financial Team increased 5.6% and 13.4% specifically.

Japanese supplies have actually brought in regarding 7.22 trillion yen in international funding inflows thus far this quarter as Head of state Sanae Takaichi’s federal government stimulation procedures and solid business incomes enhanced market belief.

According to London Stock Market Team (LSEG) information on 742 huge and medium-sized firms, Japanese firms’ internet earnings are anticipated to climb 15.2% following year, compared to 8.5% this , based upon experts’ typical projection.

On the other hand, immigrants purchased 1.06 trillion yen well worth of Japanese long-lasting bonds in a 4th week of internet acquiring in 5 weeks, also as the return on 30-year Japanese federal government bonds (JGB) increased to a document high up on Thursday.

- Reuters Extra modifying by Jim Pollard