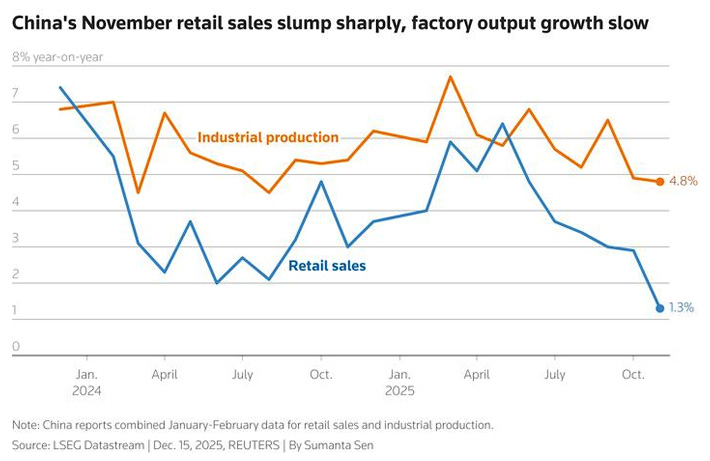

China’s most recent financial information revealed manufacturing facility development was up to a 15-month reduced in November, while retail sales was up to their least expensive degree given that the nation’s difficult controls finished. ” No COVID-19″ plan

The most up to date information launched by the National Bureau of Data on Monday highlighted the immediate requirement for brand-new development chauffeurs heading right into 2026 as a drawn-out real estate situation evaluates on family costs and Beijing’s economic situation. Customer trade-in aid discolor.

With commercial financial investment dealing with the threat of additional depreciation, authorities are relying upon exports to sustain development. Yet that method currently looks progressively unsustainable as trading companions worldwide are outraged by China’s activities. $ 1 trillion profession excess and look for to develop import obstacles.

See likewise: Chinese preacher advises Gulf nations to authorize open market bargain

Information from the National Bureau of Data revealed that commercial result enhanced by 4.8% year-on-year, the most affordable degree given that August 2024, below 4.9% in October.

Retail sales, a sign of usage, climbed 1.3%, the slowest speed given that the globe’s second-largest economic situation finished pandemic constraints in December 2022, and well listed below October’s 2.9% development and assumptions for a 2.8% increase.

” Solid exports have actually restricted the requirement to promote residential need this year, and trade-in aids have actually started to go out,” claimed Xu Tianchen, elderly economic expert at the Financial expert Knowledge System.

” I assume policymakers have actually transformed their focus to 2026 since the development target of around 5% this year appears attainable, so there is little extra reward for additional stimulation.”

The weak information evaluated on Chinese supplies, which have actually likewise been struck by fresh building problems as building designer Vanke shuffles to prevent a financial obligation default.

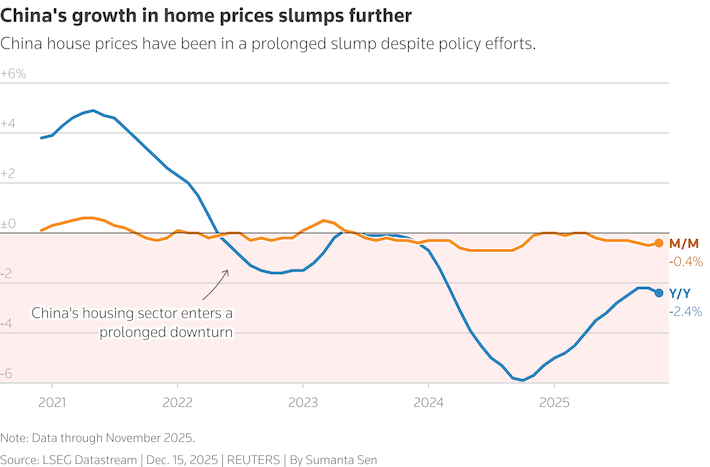

New home rates still dropping

Financial experts state the economic situation has actually passed the phase where better stimulation can give an efficient option.

The International Monetary Fund recently prompted Beijing Speed up architectural reforms and act on the property sector Concerning 70% of Chinese family riches is associated with property.

The International Monetary Fund approximates that fixing the real estate trouble will certainly set you back the matching of 5% of GDP over the following 3 years.

Fu Linghui, representative for China’s General Management of Traditions, informed a press conference after the information was launched that even more actions are required to increase family customer self-confidence.

Costs for brand-new homes in China dropped better in November.

Fu included that dealt with possession financial investment dropped 2.6% year-on-year from January to November, primarily because of a 15.9% decrease in property financial investment throughout the very same duration. Designers are having a hard time to persuade capitalists there are purchasers for their apartment or condos, which continue to be unsold also at reduced rates.

Vanke Among China’s biggest building designers intends to hold a 2nd conference of shareholders today in an initiative to prevent a default after capitalists denied the state financial institution’s strategy to delay payments for a year.

The property sector as soon as represented a quarter of China’s gdp.

Vehicle sales likewise dropped

Yearly car sales dropped 8.5%, the greatest decrease in 10 months, revealing indicators of additional stress and lowering hopes of a year-end rebound in a market that commonly sees solid sales in the last 2 months of the year.

Zhang Zhiwei, primary economic expert of Pindian Property Monitoring, claimed: “The economic situation decreased throughout the board in November, and the weak retail sales are especially notable.” “The current tightening in financial investment and the ongoing decrease in the property market have actually been sent to customer self-confidence.”

Also this year’s five-week Dual Eleven buying celebration stopped working to trigger customer rate of interest.

profession stress

Federal government consultants and experts state China is most likely to strike its existing yearly development target of around 5% following year as it looks for to release a brand-new five-year strategy on a strong structure.

Yet that can be tough, as both the Globe Financial Institution and the International Monetary Fund have actually provided extra traditional overviews on China’s development trajectory.

At a vital financial conference recently describing following year’s plan schedule, China’s leaders promised to keep a “positive” financial plan to promote usage and financial investment, while recognizing the “noticeable” opposition in between solid residential supply and weak need.

Nevertheless, the twin concentrate on usage and financial investment has actually sustained problems that Beijing is not yet all set to desert its production-driven financial version and count extra on family costs.

Globe leaders seem aligning to limit China’s exports.

French Head of state Macron intimidated Beijing with tolls throughout his browse through to China and contacted China to deal with the “unsustainable” international profession discrepancy.

Mexico authorized recently a toll rise of approximately 50% Imports will certainly be made from China and a number of various other Oriental nations following year, intending to increase neighborhood sector.

If exports run out, Chinese manufacturers might have a hard time to discover brand-new residential purchasers.

Huang Zichun, China economic expert at Resources Business economics, claimed: “November information revealed that residential financial task was usually weak, primarily because of the decrease in financial costs.”

” Plan assistance ought to aid drive some healing in the coming months, yet it might not protect against China’s financial development from staying weak total in 2026.”

- Reuters Added modifying by Jim Pollard