The Book Financial Institution of India (RBI) is a careful and conventional reserve bank, much like its worldwide equivalents. It is unexpected, for that reason, in current months, the RBI has actually been speaking about the internationalization of the rupee, which is the cross-border use money for profession settlement and has actually traded setups with numerous nations.

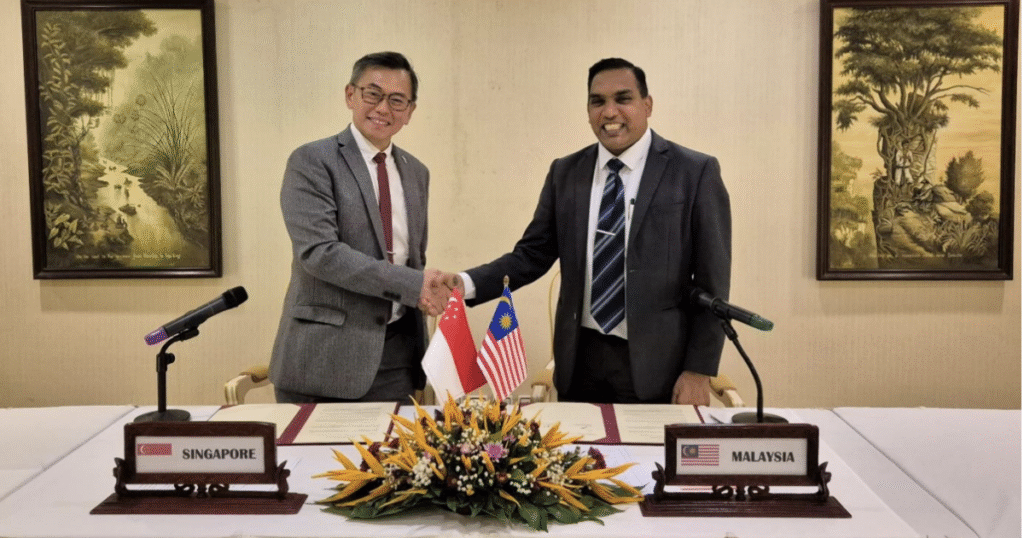

The reserve bank enables Indian financial institutions to offer to neighboring nations and proactively advertise profession billings in nationwide money. The most up to date arrangement with Singapore, Russia and the UAE has actually increased the rupee negotiation and has actually permitted international financial institutions to open up Vostro accounts that will certainly allow international entities to hold accounts of rupee with residential financial institutions.

The steady internationalization of the rupee is underway versus the background of profession volatility and stress with the united state, the biggest trading companion. The Trump management enforced high 50% tolls on India’s exports in current weeks, and the rupee has actually deteriorated in current weeks, which might have a considerable unfavorable effect on the economic climate.

What to provide? Initially, the principle of worldwide rupee is not as improbable as it appears. The obscure historic reality is that the rupee was the main money in the 1950s and 1960s in the UAE, Oman, Kuwait and Qatar for the majority of the moment. It continues to be a legal tender in Bhutan and is commonly approved in Nepal. Making use of the “gulf rupee” is a clear weak nation contrasted to being among the fastest expanding big economic climates worldwide today. It can additionally be stated that there is a distinct “indopheric” financial area within South Asia and additionally far from the Center East and Africa, and making use of money in global purchases will just enhance.

India is not in the very same partnership with its China and Eastern Oriental next-door neighbors, yet exports and imports completed over $1 trillion in 2014, and India is a substantial profession power. Also a specific percent of this sell rupees will certainly profit Indian importers (by lowering forex dangers) and incentivize bad guys to purchase even more Indian items and solutions. This is a manuscript that China has actually released over the previous years to internationalize the RMB, consisting of the facility of a cross-border interbank settlement system (CIPS).

Like China, India is not likely to unwind resources controls and drift the rupee anytime quickly. Nonetheless, the means to differentiate India from China works. RBI Guv Sanjay Malhotra worried that the internationalization of the rupee is not planned to change the United States buck as the globe’s book money, which is a passion that China definitely stays clear of. India additionally provided a proposition versus Russia-China’s proposition to release gold money.

India can copy China in various other means. Like China’s UnionPay, it might additionally broaden the cross-border use its Lu Pay card system, which would certainly enable Indians to take a trip abroad to spend for product or services at a rate of Rs. With time, as the worldwide rupee gains reliability and impact, it can also locate a seat on the International Monetary Fund’s Unique Illustration Civil liberties (SDR) money basket, which presently consists of the renminbi with the United States buck, extra pound, euro, euro and yen. For the extremely mindful RBI, this is most likely to be the last reward.