Manila— The Bangko Sentral ng Pilipinas (BSP) is commonly anticipated to reduce its plan price, which overviews financial institutions’ very own prime rate, by an additional 25 basis indicate 4.5% at its last conference of this troubled year on December 11, an action that policymakers busily really hope will certainly assist place the slow-moving Philippine economic situation back on a course to solid development.

Remember that the nation’s financial development was all of a sudden weak in the 3rd quarter of this year, at just 4%. Economic Expert Reinielle Matt Erece of Oikonomia Advisory & Research study Inc. claimed it was the slowest in 4 years and well listed below the marketplace agreement of 5.2%, so it required “a hostile press from policymakers.”

Standard knowledge holds that by decreasing reserve bank standards to affect financial institutions to decrease their very own prime rate, people and companies will certainly be drawn in to obtain cash to acquire expensive things, purchase property, begin an organization, or broaden or construct their very own company, every one of which will certainly improve financial task.

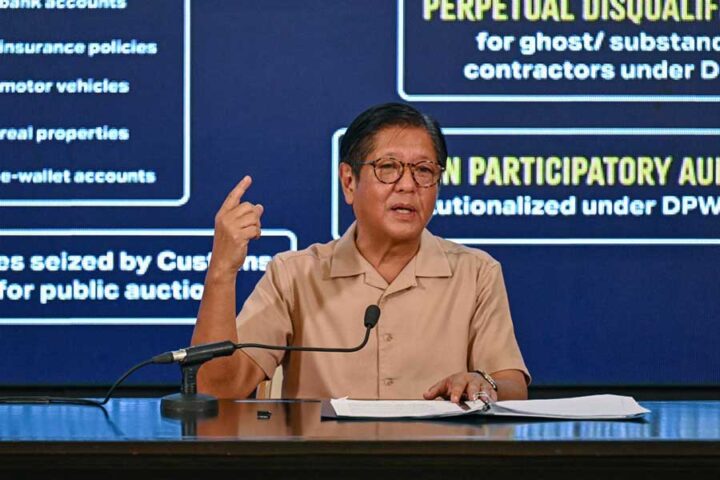

Nonetheless, issues are expanding that the reliable formula will certainly not be as reliable this moment about, as the broadening flooding control rumor has actually been influencing company and customer self-confidence and brought public jobs to a close to dead stop given that it was exposed by Head of state Marcos last July.

rather worried

The Philippine Data Authority’s third-quarter gdp (GDP) development record was clear at a glimpse: the sharp stagnation was primarily as a result of a sharp tightening in public jobs building. According to the most up to date information from the Division of Budget Plan and Monitoring, federal government capital investment dropped greatly by 10% year-on-year to 112.9 billion pesos. Of this quantity, P84.9 billion was designated to vital framework tasks, a decline of almost 22%.

The dive is a straight outcome of a corruption examination right into the Division of Public Functions and Freeways’ flooding control task and extreme analysis of task application, which has actually reduced specialists, also reputable ones, out of worry that they will not be paid promptly, if whatsoever.

High degrees of worry regarding the degree of corruption and the influence of succeeding solid hurricanes have actually additionally brought about slow-moving house intake, creating development in this financial engine to reduce to 4.1%, the most affordable degree in 4 years.

The stagnation in house costs development is especially uneasy as rate boosts for fundamental products, specifically rice, have actually been marginal and reduced loaning expenses ought to have improved Filipinos’ costs power.

Secret chauffeurs of financial stagnation

These elements have actually brought about continual descending alterations of GDP development for the complete year of 2025. The Philippine financial development price in 2025 is presently anticipated to be listed below 5%, which is less than the 5.5% to 6.5% target established by the Marcos federal government. The Marcos federal government currently has no selection however to re-examine these numbers and confess that the target will certainly not be attained.

If the expanding agreement appears, the Marcos federal government will certainly miss its development target for the 3rd successive year. In 2015, the economic situation expanded by 5.6%, missing out on the modified target of 6% to 6.5%. This year, economic experts anticipate development to reduce even more to listed below 5% as a result of weak framework and house costs.

For instance, as a result of weak financial development in the 3rd quarter, S&P Global Scores decreased its GDP development projection for the Philippines this year to 4.8% from the previous 5.6%.

” Financial investment, specifically public market financial investment, has actually been the major chauffeur of the financial stagnation. This has actually additionally influenced customer self-confidence,” claimed Vincent Conti, elderly primary economic expert at Criterion & Poor’s. Moody’s economic experts included: “Self-confidence in the financial expectation is plainly drunk when families and companies all end up being careful.”

dilemma of self-confidence

It’s clear that extensive corruption has actually cast a lengthy darkness over framework tasks and is taking a hefty toll on the economic situation, and additional cuts, while welcome, might not include sufficient of a shock.

As Jesus Felipe, Mariel Monica Sauler, Gerome Vedeja and Clarence Gabriel Fernandez of the De La Salle College College of Business economics created in an October record, “Monetary plan will certainly do little to invigorate the Philippine economic situation. The Philippine reserve bank can not and will certainly not reduce rate of interest to escape corruption examinations.”

Federal governments have to do even more to relax political unpredictability and improve financial development. The Independent Compensation for Framework and the Workplace of the Ombudsman have to supply reputable prosecutions of the masterminds and partners of large flooding corruption, not simply for residential target markets however additionally for global financiers.

If the Marcos federal government desires the Philippines to go back to the track of financial development, it must squander no time at all in settling this dilemma of self-confidence.