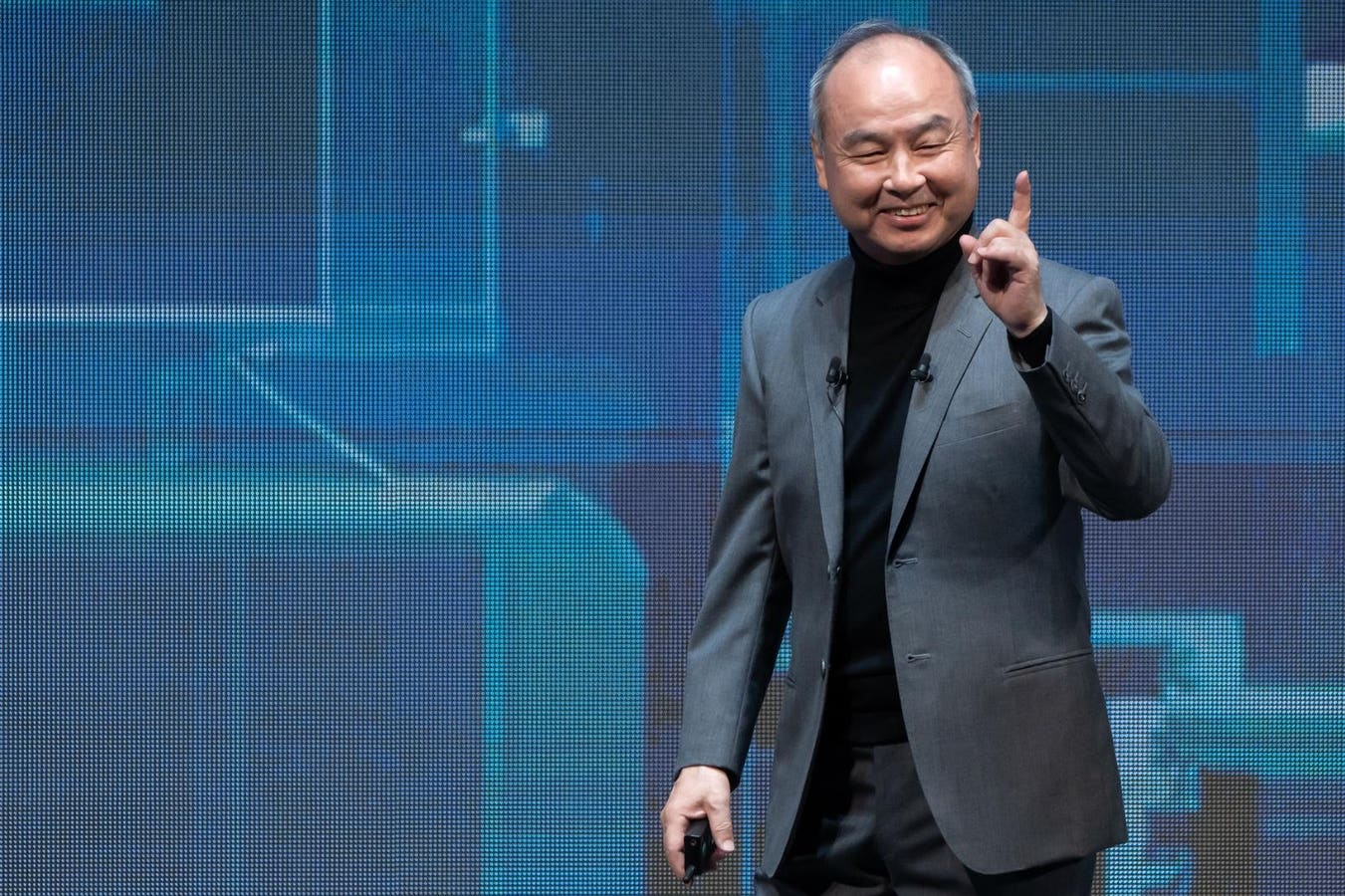

SoftBank Team chief executive officer Masayoshi’s child talked at SoftBank Globe in Tokyo in October 2023.

Professional photographer: tomohiro ohsumi/getty Photos

SoftBank accepts obtain $2 billion in shares as Japanese empires remain to strengthen their financial investment in the united state, according to a joint declaration from both firms launched on Tuesday.

The offer gets the normal closing and will certainly enable SoftBank to obtain Intel ordinary shares for $23 each, the declaration stated. That rate is a little less than the chipmaker’s closing rate of $23.70 on Monday. Supplies rose 5.3% in after-hours trading after the statement.

” Masa [SoftBank founder Masayoshi Son] I have actually functioned carefully for years and I thank him for his self-confidence in this financial investment. Intel chief executive officer Lip-bu Tan stated in a declaration.

Simply 2 weeks earlier, united state Head of state Donald Trump asked Tan to surrender right away since he was worried concerning his earlier partnership with China. The Trump management was later on commonly reported to have talks with Intel as the White Residence discussed for the united state federal government to obtain shares in the firm.

SoftBank is trying to find financial investment possibilities associated with semiconductors and expert system as his child is progressively concentrating on AI.

It has actually bought Chatgpt Developer Openai and is dealing with the last to carry out a $500 billion Stargate AI framework job in the USA, ending up being a financier beloved. This year, its detailed supplies have actually been detailed almost 80%, making their child the void in Japan 4 years later on.

The 68-year-old mogul has a total assets of $56 billion, mostly based upon SoftBank shares, which is viewed as a winning financial investment technique. Capitalists go back to “believe Mr. Child is a financial investment wizard,” Deutsche Financial institution expert Peter Milliken composed in a research study note released last Friday.

Capitalists have actually long delighted in price cuts on SoftBank supplies because of worries concerning the hostile and high-risk financial investment design thought about to be their child. Milliken thinks the price cut is no more practical, with his rate target of 20,000 yen ($ 135.3) per SoftBank, showing a 21.5% rise from Tuesday’s rate.