The Reserve Bank of India has proposed that BRICS countries link their official digital currencies to make cross-border trade and travel payments easier.

Sources who spoke to Reuters said the move could unsettle Washington and is seen as a way to reduce reliance on the U.S. dollar as geopolitical tensions rise.

The Reserve Bank of India (RBI) has recommended to the government a Central Bank Digital Currency (CBDC)Sources said that this issue will be included in the agenda of the 2026 BRICS summit. They requested anonymity because they were not authorized to speak publicly.

See also: Trump rattles markets with tariff threat to EU over Greenland

India will host the summit later this year. If the proposal is accepted, it would be the first proposal to link a BRICS digital currency. The BRICS organization includes Brazil, Russia, India, China and South Africa.

The move is likely to anger the United States, which has warned against any moves away from the dollar. Donald Trump threatens before taking office for second term Impose 100% tariffs on any BRICS country that tries to circumvent the dollar.

U.S. President Trump has previously described the BRICS alliance as “anti-American” and threatened to impose tariffs on its members.

The Reserve Bank of India, India’s central government and the central banks of China, Brazil and Russia did not respond to emails seeking comment. The South African Reserve Bank declined to comment.

The RBI’s proposal to connect CBDCs from BRICS countries for cross-border trade finance and tourism has not been reported before.

Promote better cross-border payment systems

The RBI’s proposal builds on the 2025 Declaration at the BRICS Summit in Rio de Janeiro, which promoted interoperability among member countries’ payment systems to make cross-border transactions more efficient.

The Reserve Bank of India has publicly expressed interest in linking India’s digital rupee with other countries’ CBDCs to speed up cross-border transactions and enhance the global use of its currency.

However, it said its efforts to promote the global use of the rupee were not intended to promote de-dollarization.

While BRICS has yet to fully roll out digital currencies, all five major members are running pilot projects.

India’s digital currency — called e-rupee It has attracted a total of 7 million retail users since its launch in December 2022, and China has pledged to promote the international use of the digital yuan.

The Reserve Bank of India is encouraging the adoption of e-rupee by supporting offline payments, providing programmability for government subsidy transfers and allowing fintech companies to offer digital currency wallets.

One source said that for the BRICS digital currency link to be successful, elements such as interoperable technology, governance rules and ways to address imbalances in trade volumes will be the subject of discussions.

Sources warned that members’ hesitancy to adopt technology platforms from other countries could delay work on the proposal, with progress requiring technical and regulatory consensus.

One idea being explored to manage potential trade imbalances is to use bilateral foreign exchange swap arrangements between central banks, two sources said.

Russia and India have previously tried to conduct more trade in their own currencies but have run into roadblocks. Russia has accumulated large Indian rupee balances, but their use has been limited, prompting the Reserve Bank of India to allow such balances to be invested in local bonds.

A second source said weekly or monthly trade settlement via swaps was proposed.

BRIC countries expand

Established in 2009 by Brazil, Russia, India and China, the BRICS later included South Africa and was further expanded to include new members such as the United Arab Emirates, Iran and Indonesia.

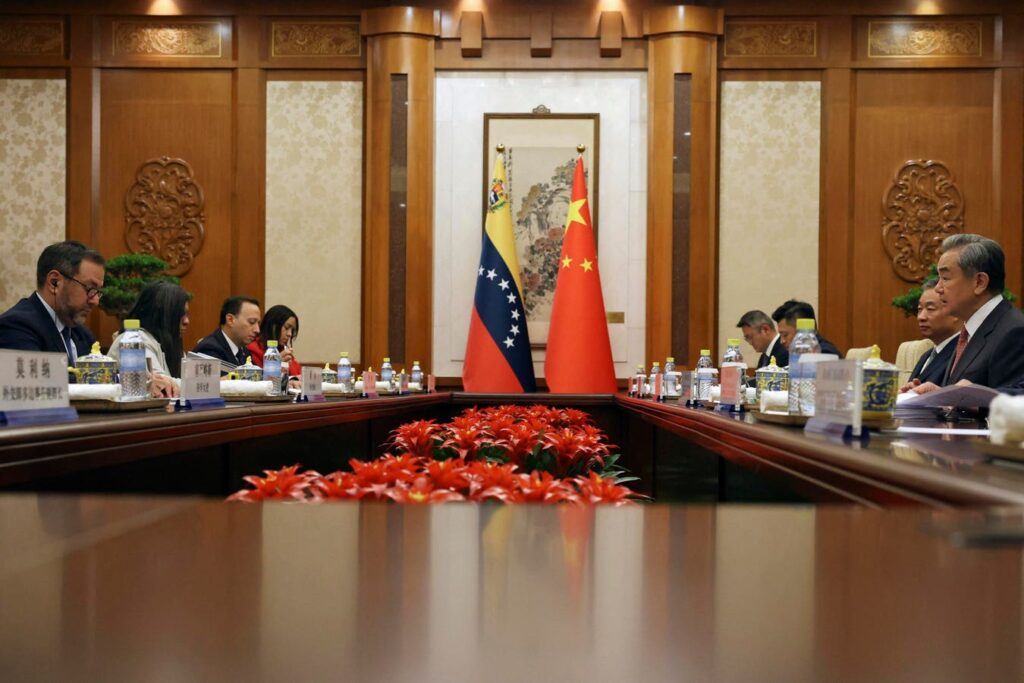

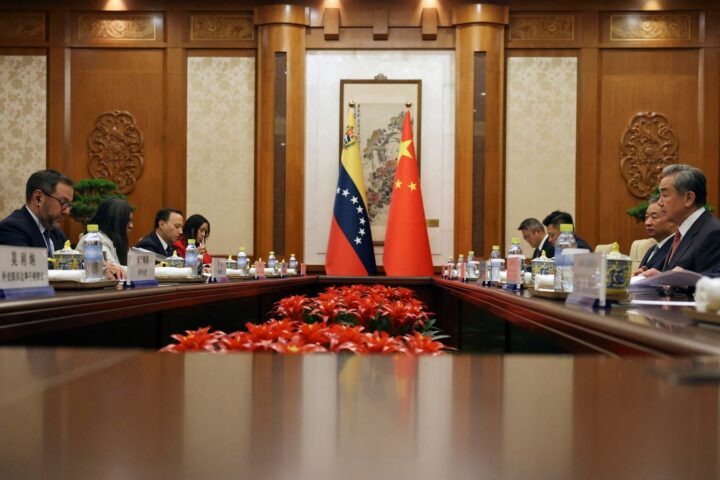

The group is back in the spotlight as Trump renews trade war rhetoric and tariff threats, including warnings against countries aligned with the BRICS. At the same time, India is getting closer to Russia and China as it faces trade friction with the United States.

Past efforts to transform the BRICS into a major economic counterweight have encountered obstacles, including the ambition to create a common BRICS currency, an idea proposed by Brazil but subsequently rejected.

While rising stablecoin adoption has dampened global interest in CBDCs, India continues to position its e-rupee as a safer, more regulated alternative.

T Rabi Sankar, deputy governor of the Reserve Bank of India, said last month that CBDC “does not pose many of the risks associated with stablecoins.”

“In addition to facilitating illegal payments and circumventing controls, stablecoins raise serious concerns about monetary stability, fiscal policy, bank intermediation and system resilience,” Sankar said.

India is concerned that widespread use of stablecoins could fragment national payments and weaken its digital payments ecosystem, Reuters reported in September.

- Reuters Additional input and editing by Jim Pollard