Financiers aspire to purchase Iluka Resources, the firm that creates Australia’s second-largest unusual planet job, in spite of initial manufacturing being pressed right into the mid-2O27 duration and some financial investment financial institutions are bothered with “unusual planet mania”.

Iluka’s shares have actually increased 120% to an 18-month high of $7.45 over the previous 6 months, also as its standard titanium minerals and titanium and zirconia companies have actually been valued down.

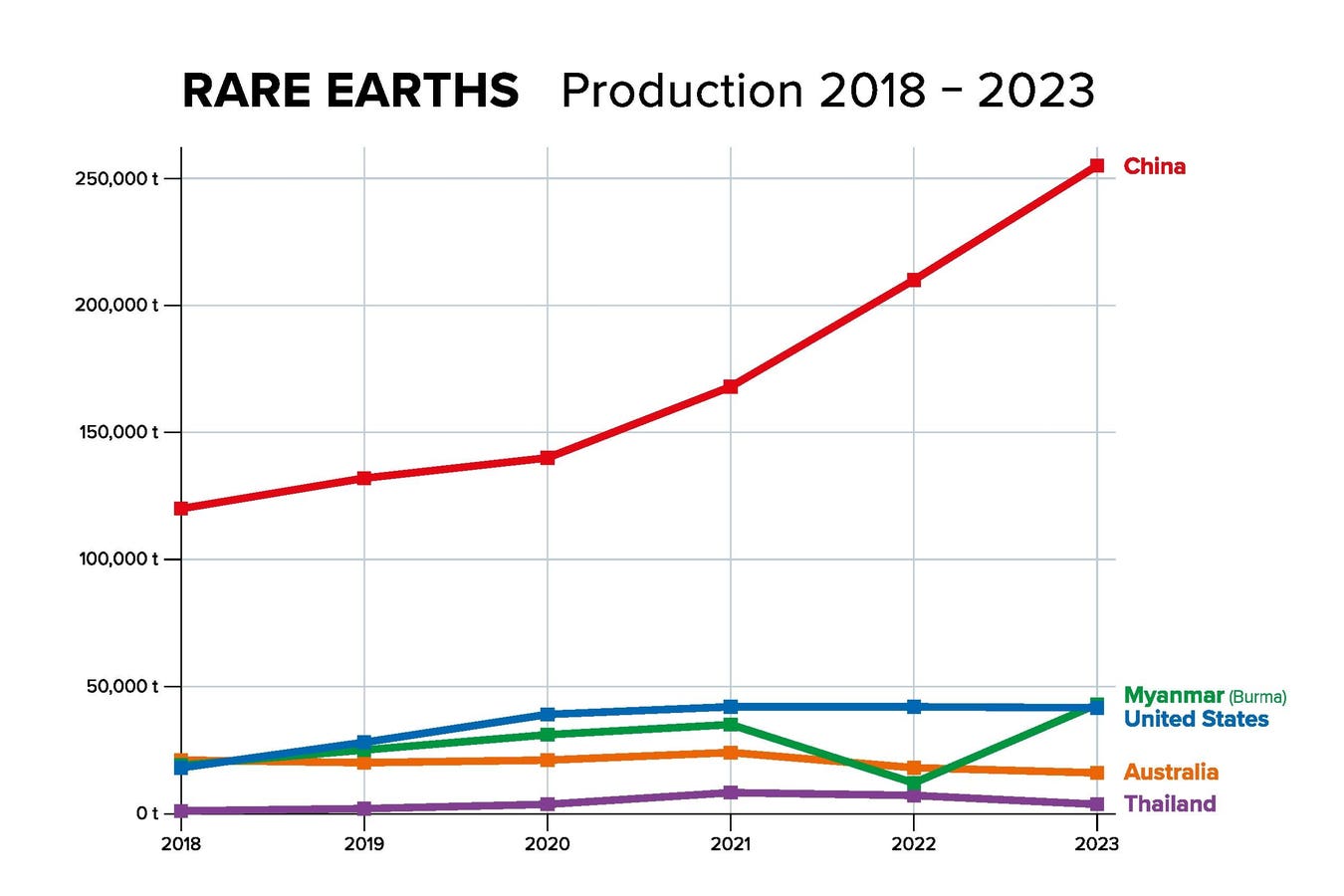

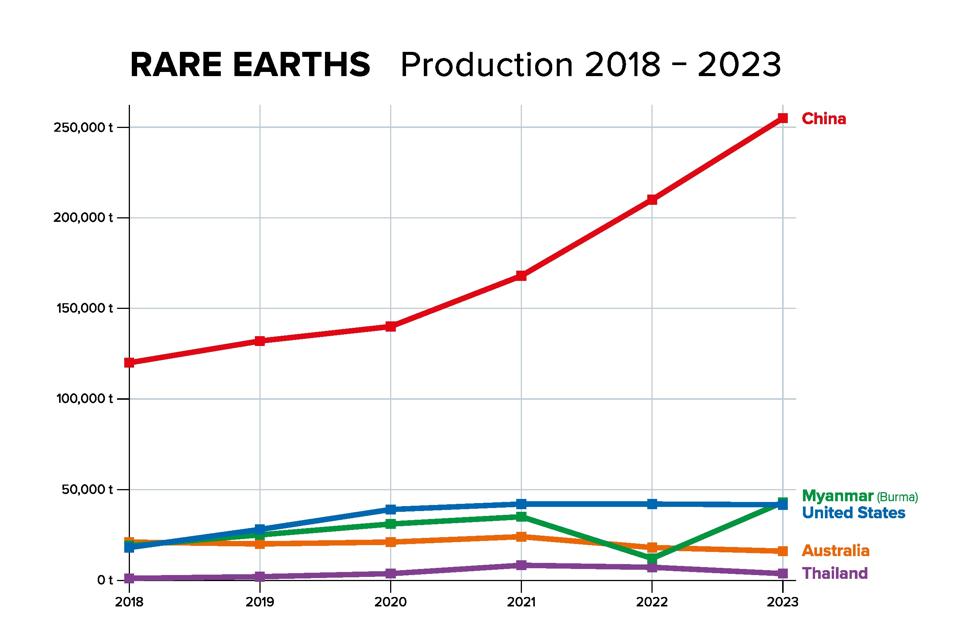

From 2018 to 2023, unusual planets will certainly be created. China is without a doubt the biggest manufacturer, complied with by Myanmar, the USA, Australia and Thailand.

Getty

Iluka is among Australia’s earliest mining business and is popular as a distributor of Ilmenite and Ilmenite and Mutile, made use of to make paint, zircon (zircon) made use of as polish for porcelains such as restroom and cooking area floor tiles.

However it is likewise consisted of in ores extracted in Iluka in several places in Australia, a gently contaminated mineral called monozolite which contains high-value unusual planets.

Over the previous thirty years, Iluka has actually kept its pillar since it is thought that day the mineral will certainly be found, which is currently occurring, countering the decrease sought after for the Ilmante and rutile.

From one of the most popular manufacturer of zircon and Ilmit to unusual planet vendors to competing Lynas Rare Earths, Australia’s widely known steel vendors such as Newin Island, praseodymium and Nysprosium, this is a charitable financing for the approximated manufacturing facility via charitable Australian federal government funds, therefore aiding to construct a $1.2 billion manufacturing facility.

Need for industrial and armed forces uses unusual planets and need for export controls has actually increased dramatically. Neon lights make up 55% given that April.

Also as financial investment financial institution experts continue to be on the price of Iluka’s building of its brand-new unusual planet handling plant in Eneaabba, Australia’s west coastline, and unpredictability concerning the future rate of products, capitalists accepted the unusual planet tale.

Uncommon Planet Mania

Financial institution experts made mindful favorable discuss the ENEABBA program go to recently and cost the very least on Iluka since the Rare Planet Mania supply rate is as well much and as well quick, and the reliable impact is contrasted to be afraid of errors or FOMO, which is driven high gold.

Shop broker agent Ord Minnett informed customers that in spite of its self-confidence in Iluka’s technical success at Eneaabba, the supply rate rally is not likely to be preserved.

At existing degrees, Iluka supply rate is stated to suggest that one of the most usual unusual planet trading rate surpasses over $110 per kg (a blend of Xinji Island and praseodymium, referred to as NDPR). $110/kg is the rate of unusual land paid by the united state federal government from chain of mountains mines in The golden state.

Information of table of elements of components current components.

Getty

Various other count on website brows through were a lot more energetic, yet were bothered with the anticipated college graduation from building to manufacturing.

Morgan Stanley stated it is anticipated that by mid-2027, NDPR’s initial job will certainly be anticipated to be anticipated by the end of 2027 (such as shanty towns and terbium) and will certainly not have “mild hold-ups in our assumptions” up until completion of 2027.

Surprisingly, Morgan Stanley’s score (or purchase) for Iluka is $6.40, below the supply’s last sales of $1.16.

Barrenjoey likewise had a $7.60 obese score and rate target for informing clients after his real-time go to, since the job is still under budget plan in spite of losing time via layout modifications.