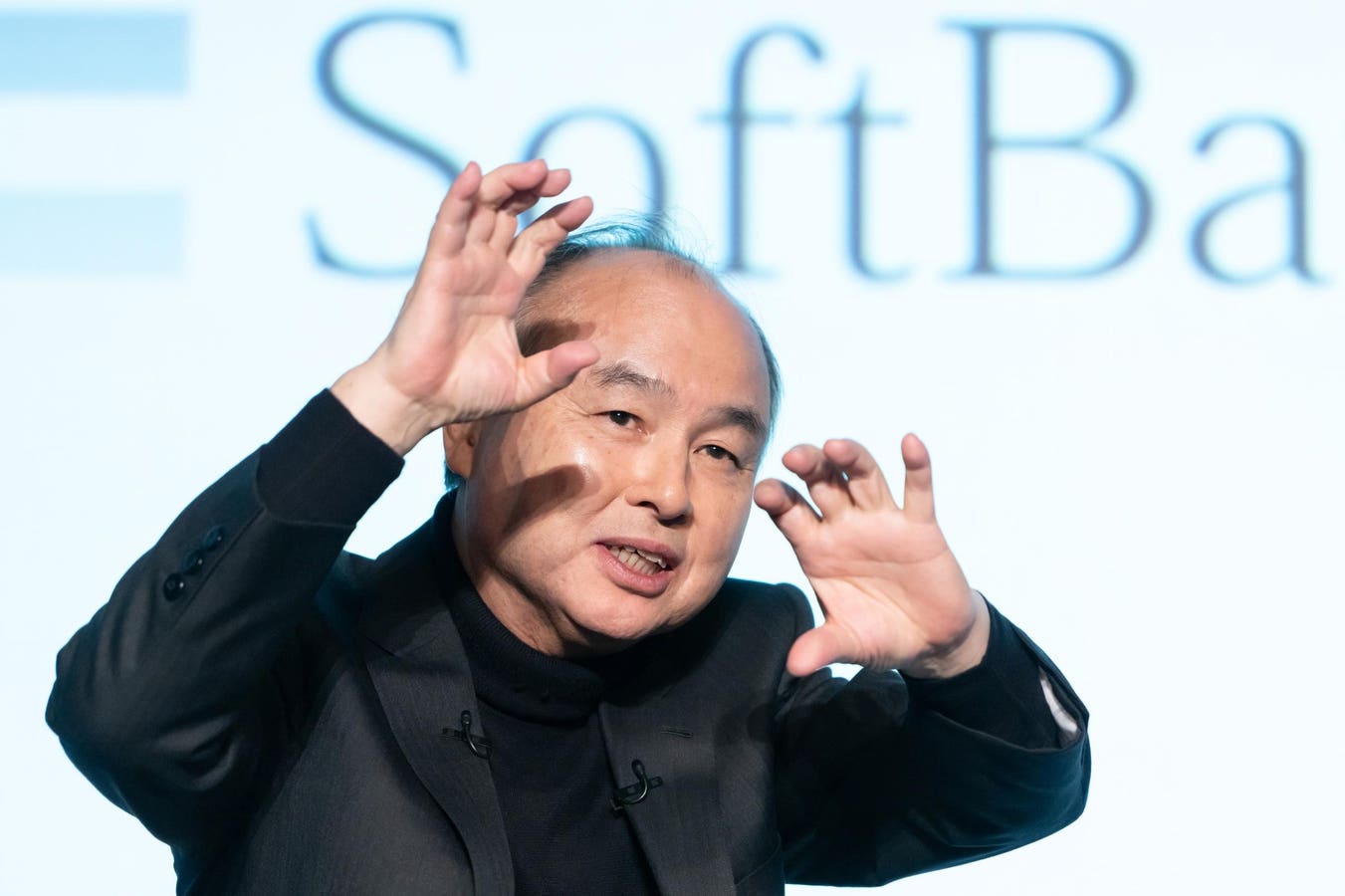

SoftBank chief executive officer Masayoshi’s kid talked at a February conference with Open AI Chief Executive Officer Sam Altman on the occasion to transform organization via AI via AI.

tomohiro ohsumi/getty photo

SoftBank Team owner Masayoshi’s kid took the royal family members back to Japan’s most affluent male after 4 years of space, with his Tokyo-listed financial investment team supply moring than 60% this year because of positive outlook regarding capitalists’ potential customers for AI.

According to Forbes, the 68-year-old huge male is SoftBank chairman and chief executive officer, with a total assets of $50.5 billion, primarily based upon firm shares. According to the real-time billionaire checklist, he currently exceeds his previous top lot of money of $45.4 billion. He is currently richer than Uniqlo’s rapid retail owner Tadashi Yanai, that has a lot of money of $46.8 billion.

The kid yielded the crown to Yanai in 2022 as Softbank’s share cost dropped after its substantial Vision Fund Finances Financial Investment Nitts. Currently, financial investments in AI-related business (specifically Chatgpt Developer Openai) are taken into consideration to place the firm’s development.

” SoftBank supplies public capitalists with a means to contact AI subjects,” Dan Baker, elderly equity expert at Melbourne research study company Morningstar claimed by means of e-mail.

Financiers are piling SoftBank since OpenAI is independently held, avoiding them from acquiring a business that signifies the AI boom. SoftBank and OpenAI have actually developed calculated collaborations, such as the $500 billion Stargate AI facilities job and financial investment arrangement. Softbank is a financier with $40 billion just recently introduced by Openai, concentrating on the $300 billion makers of Chatgpt. It prepares to spend as long as $30 billion in the united state firm, with the staying $10 billion in a collection of concealed co-investors.

As his kid goes after the objective of man-made superintelligence (ASI), or AI, SoftBank makes various other AI-related wagers, which he calls “knowledge a thousand times greater than human knowledge.” SoftBank just recently recommended risk in NVIDIA and gotten numerous countless bucks in shares in Oracle and Taiwan Semiconductor Production Company (TSMC).

On The Other Hand, regarding 90% of Nasdaq-listed chip layout firm Arm Holdings, had by SoftBank, introduced strategies this year to make its very own semiconductors, a significant adjustment in its organization design that markets software application just. It tries to benefit from the raising need for semiconductors that can refine information from different AI solutions much faster.

SoftBank additionally wishes to invest $6.5 billion to acquire American chip layout firm Ampere Computer, which introduced recently that internet earnings was 421.82 billion yen ($ 2.9 billion) in the 3 months finishing in June, while shedding 174.3 billion yen a year earlier, shedding 174.3 billion yen a year earlier, and shedding 12.7 billion yen a year earlier and 12.7 billion yen (by means of $12.7 billion yen. Its earnings expanded 7% year-on-year to 1.8 trillion yen.

Yet over the previous couple of years, SoftBank has actually traded at a considerably reduced cost on its total assets. Financiers are worried regarding the monetary utilize of a business and what is frequently viewed as a favorable financial investment strategy.

The discount rate has actually avoided 50% previously this year to around 40% as individuals start to understand SoftBank’s directions are “appropriate”. He confessed on the phone call that Stargate was slower than anticipated since it took a while to choose a website and elevate funds for the information facility.

Morningstar’s Baker claimed that if SoftBank remains to sink funds right into Celebrity Entrance, financial debt threats might raise. SoftBank presently has a loan-to-value proportion of 17%, which is listed below the firm’s self-imposed ceiling of 25%. This statistics procedures SoftBank’s financial debt to determine the worth of equity holdings in its monetary placement.

SoftBank might offer possessions to money its financial investments in OpenAI and Stargate, a Hong Kong expert at Deutsche Financial institution, composed in a study note on Monday. The firm has actually marketed $4.8 billion in T-Mobile supply in June to money its AI financial investment.

SoftBank might offer extra T-Mobile supplies or supplies for financial investment functions, Baker claimed. Yet he additionally urges that Japanese empires might wish to preserve control of ARM or ensure their shares as security for funding.