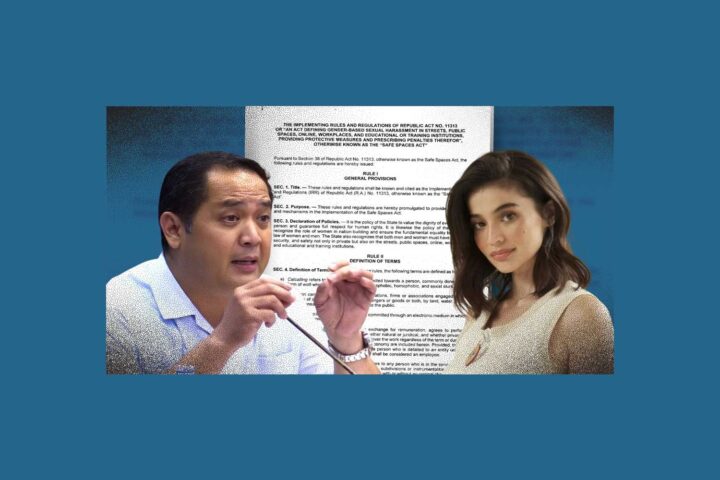

Villar Land Chairman Manuel Villar.

Supplied by View Land

Residential Property Magnate Manual Villar’s front runner Villar Land (previously held for gold MV) came to be a prominent limelight today when the SEC got exposed that the firm’s outside audit auditor Punongbayan & Araullo, an associate of Give Thornton, had actually stated the firm did decline the $130 million evaluation of the firm’s evaluation and did decline the $130 million duty. The order is connected to a SEC examination that was started after Villar Land postponed its yearly audited monetary declarations for 2024.

In an unaudited monetary record launched in March, Villar Land’s internet earnings in 2024 (supplying P3.34 billion postponed tax obligation responsibility) and its internet earnings was almost 1 trillion pesos), up 666% from the previous year’s record of P1.5 billion internet earnings. The firm stated the firm’s enormous revaluation profits was 13,000 pesos, and after the evaluation, the firm reviewed the reasonable market price on 366 hectares of land bought from Villar personal firm in October in 2015 to establish the reasonable market price of pesos 10.2 billion.

Villar Land, together with Villar, its supervisors (consisting of the billionaire’s 3 youngsters Paolo, Mark and Camille) and crucial execs authorized and released a penalty of 12 million pesos prior to the SEC authorized the firm’s unaudited monetary declarations and released the firm’s evaluation, which has actually been validated by the firm’s auditors.

” There is factor to discover that they are accountable for severe or destructive [for] “It is clearly incorrect, incorrect or deceptive to cause the launch of public disclosures,” the SEC stated under its order.

Because the land procurement was introduced in October, Villar Land’s shares have actually battled versus gravity in the stock exchange, making it the nation’s most useful firm with a market cap of as much as 15,000 pesos ($ 26 billion). That goes beyond the evaluation of Sy brother or sisters’ SM financial investment and billionaire Ramon Ang’s San Miguel, both of which radiates a range of companies. The Philippine Stock market put on hold trading of the firm’s shares in Might due to the fact that it fell short to submit audited monetary declarations in 2024.

” Villar Land, its supervisors and elderly monitoring, invites the possibility to describe the inquiries they increased and will certainly reply to the SEC’s orders eventually,” the firm stated in a declaration.

” The costs or strategy is most likely to misdirect financial investments in the general public, buying deals with business or the general market.”

The SEC stated in March disclosures, including its supervisors and execs, Villar Land, “looking for openly understood, considerable reasonable worth gains and raising the firm’s overall possessions as a result of the worth of particular residential properties,” the SEC stated. “Nevertheless, the firm later on reported the exact same rise in incomes and possessions as it is still discontinuation of completion, confirmation, bookkeeping and/or screening its outside auditors for the examination for rationality. The costs or strategy is most likely to misdirect the general public, i.e. capitalists that patronize the firm or market.”

Villar Land began its burial ground service and is understood for its boneyard, with 11% public websites, up from 10% of the minimum demand. The evaluated 366 hectares of land parcel becomes part of a 3,500 hectares of mixed-use estate in Cavite District southern of Manila, and the company intends to turn into a city of the future over the following 3 years.

Filipino billionaire Manuel Villar remains in the high end Villar city household and business territory in the southerly Metropolitan Metropolitan City.

Supplied by View Land

” Certainly, the auditors differ with the revaluation,” stated John Gatmaytan, chairman of Luna Stocks, Manila. “The auditor stood fearlessly on the ground.”

Although the firm stated it had actually “gunlessly suggested” to change the evaluation of the land to pesos 8.6 billion to make it possible for Punongbayan & Araullo to quicken its audit, Villar Land firmly insisted that pesos 1.3 trillion is the reasonable worth of the residential or commercial property. “The firm strongly thinks that the reasonable worth of the residential or commercial property in the City of Villar ought to be mirrored in its monetary declarations,” the firm stated.

SEC Chairman Francis Lim stated in a text that regulatory authorities will certainly take additional activity on the Villar land, which might be required for realities discovered in the continuous examination. “This is the honesty of our stock exchange.”

Along with his property service, Villar is a previous legislator that competed head of state in 2010 with a passion in power, media, retail, dining establishments and hydro business. He is the 3rd wealthiest guy in the Philippines, with a total assets of $11 billion on the listing of 50 abundant individuals released previously this month.