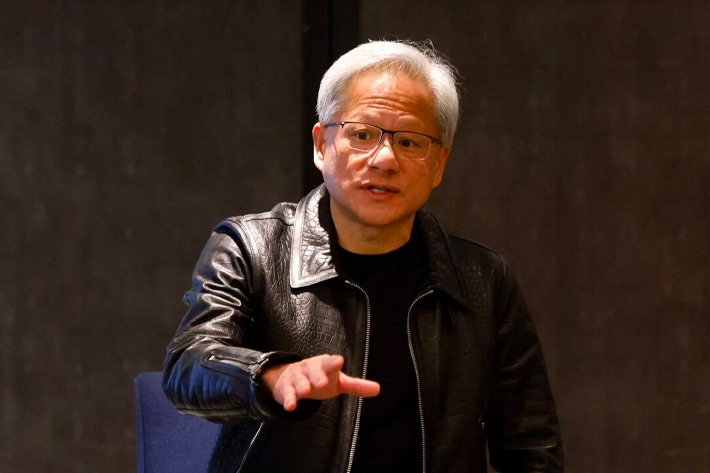

NVIDIA’s $5 billion financial investment in Intel revealed a rise in shares of united state chipmakers on Thursday. However the effect on Eastern chip suppliers is not yet completely comprehended.

Experts claim the step is most likely to raise competitors in the market in the future, yet if Intel rebirth brings us to examination of international chip manufacturers, it can profit TMSC (the top chipmaker in Asia) and others.

Nvidia Currently, currently one of the most beneficial business on the planet, revealed its supply financial investment on Thursday, which will certainly make it among Intel’s biggest investors, with a risk of around 4%. Both firms have actually consented to collectively create computer and information facility chips.

See additionally: Thais are eager to reduce “grey cash”, gold sees Thai baht

Intel capitalists comfortably invited the offer, which drove a 23% risk current. Experts anticipate the NVIDIA collaboration can assist battling chip manufacturers create a structure in expert system and enhance their production capacities.

For Taiwan’s TSMC, this is the huge bulk of all AI chips that elevate American firms, experts claim.

” If Intel is mosting likely to drop, it just indicates TSMC gains extra market share, which leaves 90% of the concern on the united state semiconductor production market,” claimed Luke Lin, elderly expert at Taiwanese research study company Digitimes.

” Allow rivals make it through in fact be a good idea for TSMC due to the fact that it eases the stress on our business. The united state will certainly have an additional objective (Intel) assistance, which will certainly enable TSMC to relocate at its very own rate.”

TSMC and various other Eastern chip giants, such as South Korea Samsung Electronic Devices It’s making AI chips for consumers’ agreements, constructing billions of bucks in the united state manufacturing facilities as they are under stress from the management of Head of state Donald Trump to make in the united state, or face serious penalty for imported chips.

This might make us even more depending on them and draw in even more focus from the federal government.

Shares of Eastern chipmakers were mostly secure on Friday, with TSMC down 1.6% and Samsung down 1% for a bigger efficiency.

AMD can be struck hardest

The NVIDIA method can place Intel’s next-generation production innovation in a more powerful setting, and it aids recover its destiny after years of turn-around initiatives fell short to pay back.

Intel alerted in July that it might need to leave the chip production organization if it does not draw in outside consumers to construct manufacturing facilities.

While the brand-new contract will certainly not include Intel’s agreement production organization to produce NVIDIA calculating chips, some capitalists anticipate their collaboration might someday turn into a production offer, which can position a danger to TSMC, which presently generates NVIDIA’s front runner cpus.

” Intel will at some point make its factory organization run, yet broaden,” claimed Dan Nystedt, vice head of state of Trioreent, a personal investment company based in Asia.

” Certainly, the united state federal government desires Intel to be the innovative semiconductor maker for nationwide safety once again,” he claimed.

Samsung Stocks expert Moon Joon-ho claimed the collaboration is “definitely problem for Intel’s rivals” as the offer elevates the possibility of Intel’s competition and the opportunity that NVIDIA will certainly offer to Intel with NVIDIA’s contracting out chip production market.

Nevertheless, one of the most straight issue for TSMC is most likely the loss of organization being participated in AMD Some experts claim taking on Intel and Nvidia to offer chips for information facilities.

” The greatest sufferer will certainly be AMD … For NVIDIA, AMD is a rival, so it’s in fact battling AMD,” Lin claimed. He included that TSMC’s Web server CPU orders AMD’s CPU orders can go down as a result of this.

TSMC and Samsung decreased to comment.

An AMD representative claimed previously that the business will certainly remain to drive market share development via its AI-Forward technique.

The advancement of the chip production landscape is much from clear.

” We need to see exactly how it functions. Simply spending cash does not make the business more powerful,” claimed Han Hanhan, supervisor southern Oriental Fables Sector Organization.

” Intel requires to overtake TSMC in regards to making capacities. Eventually, whether it’s created by Nvidia, it still needs to go to TSMC, or ideally, in the future, Samsung Factory.”

- Jim Pollard’s extra editor Reuters