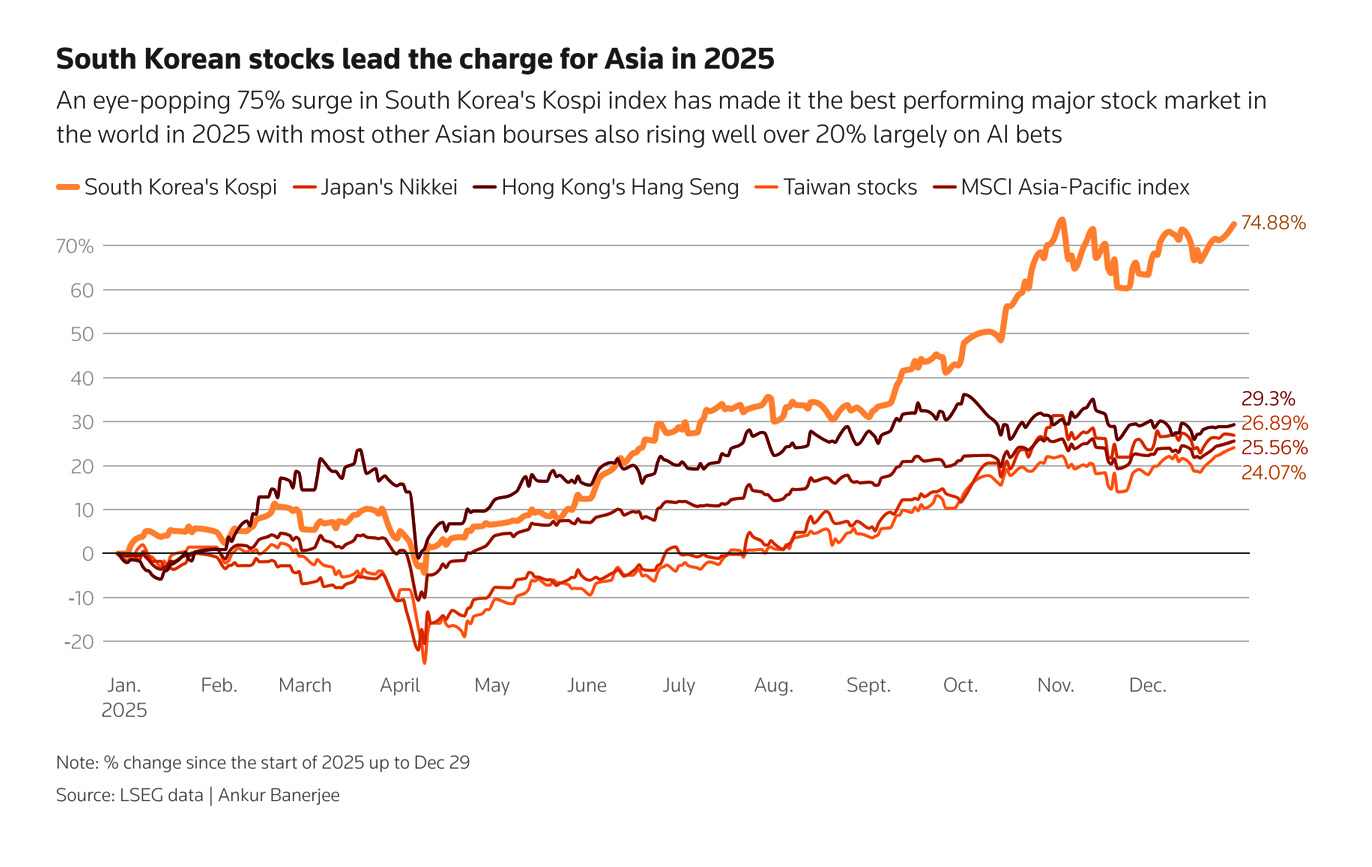

South Korean and Chinese stocks posted their biggest gains in years in 2025 as strong global interest in artificial intelligence overcomes U.S. tariff concerns.

South Korean stocks were the best performers in Asia, posting their biggest annual gains in more than two decades. The benchmark KOSPI index is near record highs this year, up 75.6% for the year, its biggest gain since 1999.

KOSPI also became the world’s best-performing major stock market in 2025, outpacing global equities’ 21% gain and the broader Asian market’s 27% gain.

Also on AF: Meta acquires Chinese-founded artificial intelligence startup, regarded as “the next DeepSeek”

The gains have been driven largely by heavyweight chipmakers, with Samsung Electronics up 125% this year and SK Hynix soaring 274%. Together they account for more than 40% of the benchmark’s market capitalization.

Interest in the two chipmakers is largely due to their dominance in making high-bandwidth memory (HBM) chips, a key component in artificial intelligence accelerators and data centers. Analysts now expect demand for artificial intelligence to remain strong next year.

South Korea’s stock market has also been boosted by recent market reform measures taken by the government.

Since taking office on June 4, President Lee Jae-myung’s administration has been working to narrow the so-called “Korea discount” caused by opaque governance and low dividend payments.

The government has revised the Commercial Code to strengthen protections for minority shareholders and is seeking to upgrade to developed market status, with South Korea currently classified as an emerging market by Morgan Stanley Capital International (MSCI).

Elsewhere, financial group shares rose 71% in 2025 and securities firms doubled on optimism about a government-led stock market boost.

Dasin Securities analyst Lee Kyoung-min, who set a target of 5,300 points for next year, said: “We expect the still undervalued KOSPI to show an upward trend next year as favorable external conditions, the semiconductor upcycle and the government’s policy push make it more attractive.”

Meanwhile, the South Korean won has appreciated 2.3% against the U.S. dollar so far this year, on track to end four consecutive years of declines. The currency had been hovering near a 16-year low until the government stepped up efforts to stabilize the currency last week.

Tech war boosts Chinese stock market

For China, artificial intelligence has also helped the stock market overcome concerns about an economic slowdown.

Hong Kong stocks rose nearly 30% in 2025, their best performance since 2017, while Shanghai posted its best year in six years, thanks to investor excitement about China’s artificial intelligence, particularly Beijing’s efforts to create a self-sufficient tech supply chain.

Hong Kong’s Hang Seng Index soared 28% for the year, while the Shanghai Composite Index had its best year since 2019 with an 18% gain. China’s blue-chip CSI 300 index is also up 18% this year.

Chinese markets have weathered a tumultuous year from the U.S.-China trade war and geopolitical tensions, with share prices buoyed by government stimulus measures. Growing confidence in Chinese technologyand the appreciation of the RMB.

This week, the RMB exchange rate against the U.S. dollar broke through the psychological barrier of 7 yuan for the first time in 2-1/2 years and is on track to achieve its largest annual gain since 2020.

Western Securities predicts that the market upward trend will continue in 2026, supported by the appreciation of the renminbi.

The brokerage said, “The appreciation of the RMB is driving offshore funds back to China and laying a solid foundation for China’s bull market.”

Cathay Haitong Securities also stated in the report that the steady appreciation of the RMB will “provide favorable conditions for loose monetary policy in early 2026” and expects investor risk appetite to increase.

Japan is also leading the way

Meanwhile, Japan’s stock market was Asia’s second-best performing stock market in 2025, with the technology sector once again a key driver of its sharp gains.

Japan’s benchmark Nikkei rose 26% in 2025, its third straight year of gains and its biggest gain since 2023. The Topix rose 22%.

Japanese stocks have performed strongly this year, benefiting from a corporate governance push by the Tokyo Stock Exchange and a recent craze for artificial intelligence investments.

The Nikkei rose again after Takaichi Sanae was elected prime minister with massive fiscal stimulus measures.

“The first half of the year was affected by global economic instability, including rising prices, labor shortages and U.S. tariffs,” Takahiro said at a ceremony at the exchange after the close on Wednesday, the last trading day of the year.

“But in the second half of the year, the resilience of Japanese companies and policy support drove the Nikkei to improve significantly, surpassing the 50,000-point mark for the first time in history.”

One of the Nikkei’s biggest gainers this year is server memory chip supplier Kioxia Holdings. The company’s stock price has soared 540% this year. According to Nikkei Asia.

Booming demand for data centers – designed to train and run artificial intelligence inference – has largely driven gains in Japanese stocks, pushing up the shares of companies including Fujikura, Mitsui Mining and Mitsubishi Heavy Industries.

Another big winner is SoftBank Group led by Masayoshi Son, whose share price soared 93% in 2025. On Tuesday, the company said it had completed OpenAI invests $41 billionIn one of the largest private funding rounds ever, the Japanese company will acquire approximately 11% of the ChatGPT maker.

- Reuters, with additional input from Vishakha Saxena