Public outrage over the rate battle in a few of China’s biggest fields has actually increased hopes that Beijing might ultimately take straight activity to minimize the nation’s excess commercial ability.

this Head of state Xi Jinping’s statements are a lot more challenging Jinping, its financial plan has actually constantly been Severe objection mentioned the instructions of activities that will certainly attempt to test the overcompetitiveness of the market, and although it might suppress financial development, it still attempts to suppress the deflationary stress endured over the previous couple of years.

The Communist Celebration leaders assured to enhance guidance of energetic rate cuts this month, and the state media run The hardest caution with the explained kind of commercial competitors that damages the economic situation.

See additionally: China’s XI trouble hardly ever cautions EVS, AI – feet

These signals replied to Beijing’s Supply side reform 10 years earlier, in order to minimize steel, concrete, glass and coal manufacturing, this was important to finishing a 54-month decrease in manufacturing facility door rates.

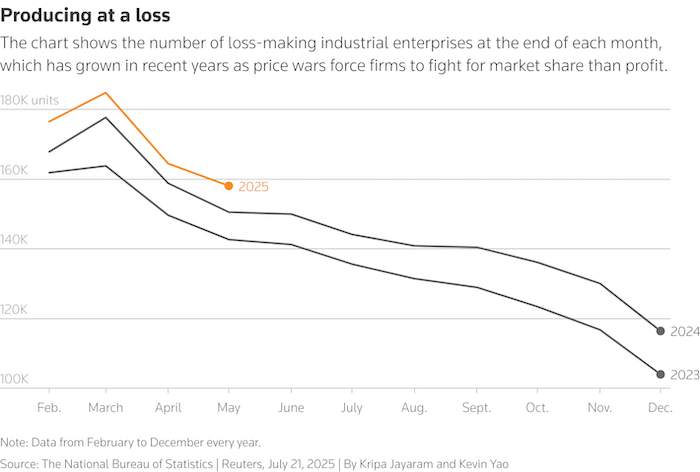

This time around, the battle versus depreciation will certainly be much more intricate and bring threats to work and development, financial experts state. this Profession battle with the USA At the very same time, the rate battle is increasing and pressing manufacturing facility earnings.

Obstacles that Beijing has actually not dealt with in the last years consist of high personal possession, rewards at the neighborhood and nationwide degrees, and minimal stimulation choices in various other private sectors to soak up work losses as a result of any type of ability decrease.

Beijing concerns work as the trick to social security. Merchants and also state divisions are Personnel have actually been given up Wage cuts, while young people joblessness is formally 14.5%, although the actual number might be a lot greater.

Financial development has actually decreased

” This round of supply-side reforms is far more challenging than the reforms in 2015,” claimed Hailin Shi, a business economics teacher at Monash College in Melbourne.

” The opportunity of failing is high, and if it does stop working, it will certainly imply that China’s total financial development price will certainly decrease.”

Financial experts anticipate any type of initiative Beijing has actually made to minimize manufacturing ability will certainly be accomplished in little mindful actions, with authorities keen to accomplish regarding 5% financial development this year, although residential and worldwide think its main development numbers run out touch with truth. As a result, they will certainly pay very close attention to the overflow result.

The event’s decision-making body’s Politburo is anticipated to launch even more market standards at the conference at the end of this month, although the meeting event hardly ever supplies an in-depth execution roadmap.

Experts anticipate Beijing will certainly initially take the premium market with what it when called the “brand-new 3” development chauffeur, yet which mention media is currently choosing to eliminate the rate battle: cars and truck,,,,, Battery and Photovoltaic panel

Their growth increased in the 2020s, with China rerouting sources from the crisis-crisis realty field to innovative production to make the globe’s No-2 economic situation expand greater.

However China’s commercial facility is one-third of the international production market and looks puffy.

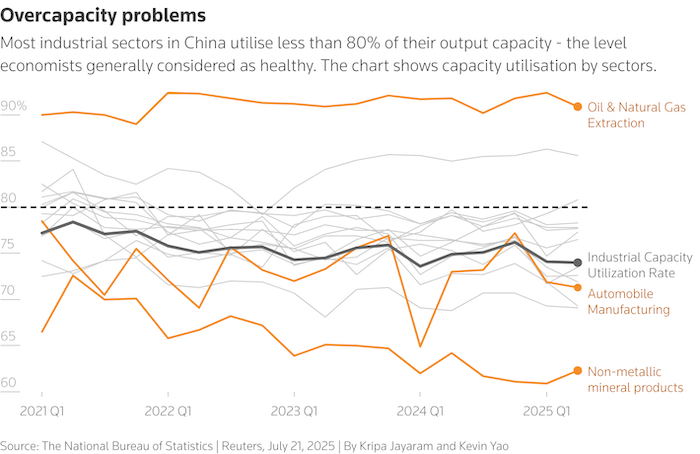

The majority of sectors have “healthy and balanced” degrees of ability usage listed below 80%, which is credited to weak residential need and a choice for manufacturers over customers in an investment-driven development design.

united state and EU authorities have actually continuously whined that the design is swamping international markets with economical Chinese-made products and threatening their residential sectors.

An international chemical firm supervisor called Jiang asked some to review the market anonymously, claiming that her market has an overcapacity that was evident as very early as 2023, yet the firm is still increasing.

” If the cash is economical and plentiful, any type of firm assumes it will not declare bankruptcy and can squash the rivals to fatality,” Jiang claimed.

Decrease the market that is currently “as well huge”

For all the nationwide assistance the maker obtains, the majority of which is independently possessed, unlike the raw product manufacturers in Beijing in the last years, mostly with uncomplicated management orders.

Currently, decreasing ability needs a reduced foreseeable aesthetic aid, economical land supply, special fundings or tax obligation refunds, and after that allow the marketplace select victors and losers.

Nonetheless, neighborhood authorities that have to apply this objective have the contrary rewards: to create market champs, therefore drawing in supply chain financial investment and work in their areas.

” City governments are motivating firms to buy these brand-new fields in order to alter the neighborhood economic situation,” the plan advisor claimed on confidential.

” There is absolutely nothing basically a blunder in makeover and updating, yet the trouble is that every person is targeting the very same division,” the expert claimed. The expert included that the united state profession battle has actually subjected “as well huge” sectors.

Yan SE, replacement supervisor of the Institute of Economic Plan at Peking College, claimed city government resistance will certainly transform the “essential and needed” ability decrease right into a lasting progressive procedure that will certainly not get rid of the stress of shrinking by itself.

Yan claimed at a conference recently that promoting need would certainly be much better.

Task will certainly be shed

Producer rates drop June 33.

Financial experts state China encounters an agonizing compromise in between much deeper rate decreases and much shorter rate decreases, which postpones the work strike as outcome cuts cause joblessness and ability losses and downgrades expand much longer.

Macquarie approximates that reforms in the last years have actually reduced 10s of numerous tasks. However an approximated RMB 10 trillion ($ 1.4 trillion) approximated by Morgan Stanley, an enthusiastic job intends to redevelop shanty communities throughout China, supplying brand-new tasks for displaced employees.

Currently, there is a lot less production. Monash College, Monash College, claimed that regardless of this, tasks are still shed, and there is “no chance” various other fields of the economic situation are additionally encountering weak customer need, which might soak up shock.

In the middle of an additional resemble of the previous years, elderly conversations on metropolitan restoration have actually re-emerged recently. Nonetheless, any type of brand-new financial investment in the area might be as well little to make up for shed commercial tasks and tasks.

” I do not assume we can absorb the loss of job from realty from supply side reforms any longer,” claimed John Lam, head of UBS’s Greater China realty study.

” It made use of to be made use of in the past, and it created way too much ability in our market,” he claimed. “The authorities “appear not to enter that instructions, I assume that’s right.”

- Jim Pollard’s Additional Input and Modifying by Reuters