A worldwide assets grow that has actually sent out copper, silver and gold rates to videotape highs is improving fundamental resources such as iron ore, which is anticipated to climb as opposed to drop as commonly anticipated previously this year.

The unforeseen upturn has likewise urged mining titan Rio Tinto to advance with strategies to construct an enormous brand-new mine in Western Australia with its joint endeavor companion Japanese trading home Mitsui & Co. and exclusive financier Angela Bennett.

The choice revealed earlier today to perform a $191 million usefulness research for the Rhodes Ridge mine is a crucial action in the preparation procedure, with building anticipated to start in 2029 and initial ore extracted in the very early 2030s.

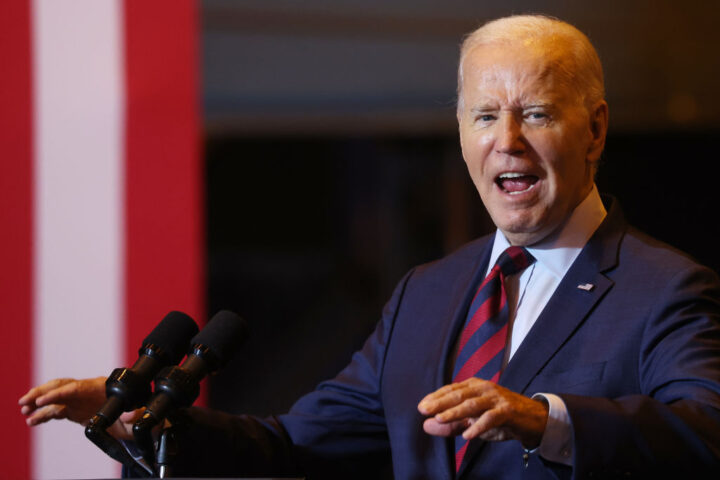

Rio Tinto’s iron ore mine lies in the Pilbara area of Western Australia. Image Christian Sproug/AFP through Getty Images)

AFP through Getty Photos

The brand-new mine will certainly be just one of the biggest worldwide, with a preliminary target of generating 40 to 50 million lots of state-of-the-art iron ore annually, and the possible to turn into a task with a yearly manufacturing of 100 million heaps.

Probably much more notably, Lod Ridge is an instance of the expanding competitors amongst Oriental nations for trusted products of minerals and steels.

When it comes to Rio Tinto, solid need for iron ore has actually permitted it to become part of joint endeavors with Chinese firms at the New Simandou mine in the African nation of Guinea, in addition to with Japanese companions in Australia.

Underpinning both organizations are iron ore rates that continue to be over $100 a heap, regardless of duplicated projections of being up to $75 a heap, and growing political and polite distinctions in between East and West that motivate the advancement of brand-new independent supply chains.

Sydney-based financier Barrenjoey recently repeated its previous projection for iron ore rates of $100/ton following year, yet a little increased its cost projection for 2027 by $3/ton, from $95/ton to $98/ton.

after simandou

The better overview is partially because of a more powerful worldwide economic climate and the marketplace’s capability to soak up Simandou ore, which will certainly not get to nameplate ability till 2028, after which a home window of chance will certainly start to open up for brand-new mines such as Rhodes Ridge.

Japan’s straight rate of interest in Rhodes Ridge, while not openly advertised as a method to safeguard future products of iron ore from non-Chinese resources, complies with a spots bargain previously this year in between Mitsui & Co. and the successors to the late Peter Wright’s estate.

Mitsui & Co. obtained a 40% risk in the mine from Wright’s sibling, Angela Bennett, and her 2 youngsters, Leonie Baldock and Alexandra Burt, for an in advance repayment of $5.2 billion, sealing their position on the listing of Australia’s wealthiest individuals.

Although Baldock and Burt have actually marketed their whole rate of interest in Rhodes Ridge to Mitsui & Co., Bennett preserves a 10% risk. Rio Tinto has 50% of the shares and has monitoring control.

High quality (iron web content over 63%) Australian iron ore.

Getty

In today’s usefulness research news, Rio Tinto claimed that along with introducing the research, the joint endeavor will certainly spend $146 million over the following 3 years in iron ore expedition in the area.

The initial ore from Lord’s Ridge, approximated to consist of 6.8 million tonnes, is anticipated ahead from the north end of the down payment, which is closest to existing rail, port and power facilities.

If at some point increased to 100 million tonnes per year, Rhodes Ridge would certainly be comparable in dimension to Simandou, which was as soon as viewed as a hazard to the Australian iron ore sector yet is currently viewed as a prompt enhancement to worldwide products.