This story appears in the December 2024 issue of Forbes Asia. Subscribe to Forbes Asia

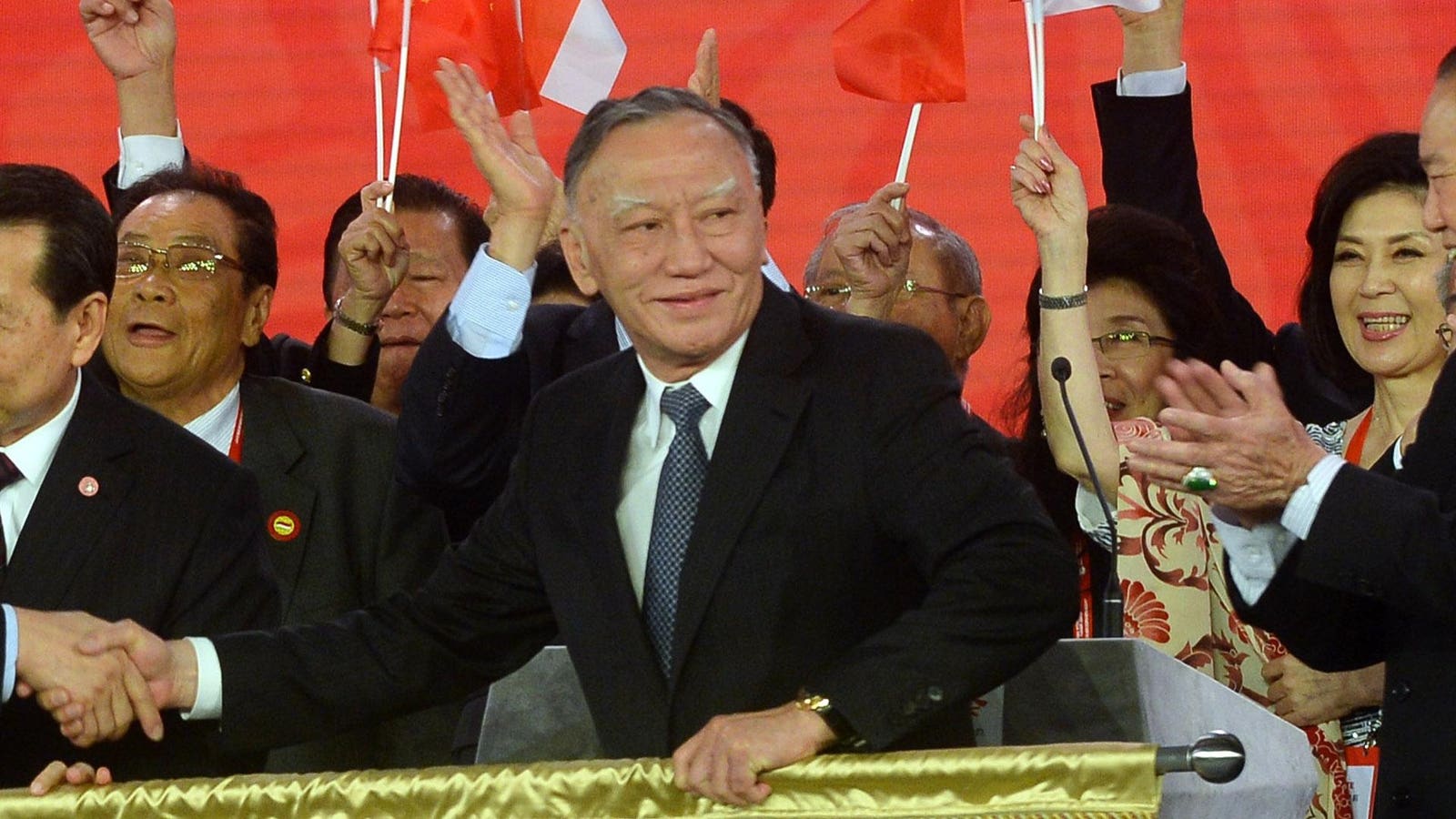

Kiki Barki.

Jin Liangkuai/Newscom

This story is part of Forbes' coverage of Indonesia's richest 2024. See full list here.

Kiki Barki, whose coal ore fortune made him a billionaire, is diverting his Harum Energy into nickel for use in electric vehicles. Global electric car sales, led by China, boomed in the first ten months of the year and grew 24%, according to London research firm Rho Motion.

SS

Nickel will contribute just 11% of Harum's $926 million in 2023 revenue, but that could grow to more than 80% over the next three years, according to an October report from financial services firm Nomura. The company's nickel expansion has hit pace this year with a series of deals. In January, it increased its stake in Indonesian nickel smelter West Metal Industries to nearly 81% for $215 million. In April, its subsidiary Tanito Harum Nickel (THN) paid $206 million for 51% of Blue Sparking Energy, which is building a refining facility to produce 67,000 tonnes of nickel per year by 2026.

To help accelerate nickel's play, Harum in September formed a partnership with Chinese metals billionaire Xiang Guangda's Eternal Tsingshan Group, which acquired 49% of its nickel units under THN for $412 million. The Nomura report noted that joining forces with Tsingshan will also unlock future asset opportunities.