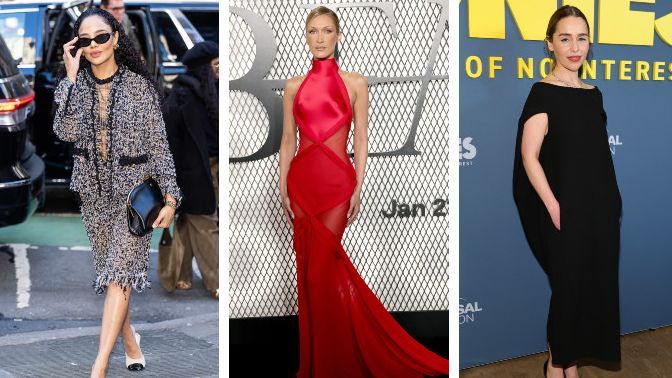

Alan Track, owner of Harvest Resources.

( Note: This is based upon a content translation of the cover account of Alan Track, owner of Beijing Head office Harvest Resources, in Forbes China Publication in December.)

China’s biggest dining establishment chain is not too called McDonald’s and KFC. Nonetheless, among the nation’s most effective investor thinks that their worldwide energy will certainly boost gradually, suggesting a crucial fad for capitalists looking for development throughout a time of financial unpredictability.

In a most current meeting with Forbes China, Alan Track, starting companion of Harvest Resources, like Chinese, in meetings with European globe, like Laos and Babi food, the business we buy – like Laos and Babi foods, can all be McDonald’s and Starbucks of the East.

He included: “The globe is encountering the opportunity of intake downgrade, and China is no exemption. We will very closely line up with the growth patterns of China and worldwide economic situations, and pay even more focus to creating worldwide commitment and development.

Track holds a PhD in organization from the College of Minnesota and started Harvest Resources in 2007 with a concentrate on customer retail organization. He is a sector advisor to the Chinese Elite Institution of Business Economics and Administration, and he is likewise a participant of the New york city College Global Board. Track signed up with the money sector in 1995, operating at Everbright Stocks and Huatai Stocks early in his job.

Considering that its creation, Harvest has actually been concentrating on worth investing. Track claimed various other essential success variables consist of being the single exterior investor and bringing sufficient resources to affect the business’s organization.

His fundamental idea in his approach is that China’s expanding “customer culture” will certainly be a vital motorist of costs, therefore enhancing the nation’s total lifestyle. By concentrating on fundamentals such as apparel, food, real estate, transport, medical care, education and learning and amusement, Track claimed he wishes to satisfy the core and regular demands of 80% of Chinese customers.

As incomes increase, Track created in a short article in 2015 that intake “is no more simply a greater cost, yet a better.” “Considering that the last century, business from the USA and Unilever from the UK have actually expanded the globe by giving top notch, budget friendly items. Likewise, a growing number of business will certainly arise in China.”

Up until now, this is the winning approach for the tune. Harvest currently handles greater than $4 billion in possessions. Among his most effective financial investments was gaining greater than $1 billion in return from the 350 million yuan (concerning $50 million) financial investment in Power Drink Business Eastroc. Considering that its listing on the Hong Kong Stock Market in December, Xiaocaiyuan, a dining establishment chain that has actually obtained financial investment, has actually climbed 25%. In the month, LXJ International, which has 1,400 shops in China and is the biggest Chinese junk food chain in Harvest’s profile, submitted its application for noting on the Hong Kong Stock Market. Track kept in mind that Harvest, which bought 5% of LXJ International in 2018 with a first-round financier, is the only exterior investor.

The cover of Harvest Resources owner Alan Track is the cover of Forbes China.

Looking in advance, the tune thinks that as China changes from a production-oriented culture to a consumption-oriented culture, the share of customer costs in China’s GDP has virtually 20% space for in 2015’s 50% (consisting of public and exclusive intake). He thinks that at the same time, China will certainly create even more worldwide business, consisting of numerous in the Harvest profile.

Track claimed he has actually found out success from the providing sector in the USA and Japan. The 3 significant beef dish chains in Japan – Yoshinoya Holdings, Sukiya and Matsuya battled an intense cost battle in the 1990s, developing the core worth and price framework of Japanese junk food chains.

Track claimed the lessons picked up from their experience have actually impacted organization neighborhoods in China and the USA. In spite of residential leaders in Japan, the company has actually not yet done well with KFC and McDonald’s due to the fact that they are not able to integrate supply chain monitoring performance with organization development. Track thinks that Chinese business might do far better currently.

Content passages from a current meeting with the tune’s cover.

Forbes China: You are the most effective passion on the New Forbes China Midas listing. Just how did you do it?

Track: In the economic sector, most individuals adhere to the ideology of financial investment based upon profile concept. After presenting maths right into money, it came to be a ready wise individuals attempting to benefit from market volatility. Wall surface Road background has actually confirmed that a lot of slim tales will not be great over the previous 100 years. On the other hand, those that demand entrepreneurship generally obtain wonderful incentives.

We have actually been devoted to being the major motorist of business development over the previous 20 years. We are not restricted to making suggestions on the board; our (concepts) prolong deeply to the daily procedures of the business, consisting of brand name structure, network development, advertising and marketing, understandings right into customer patterns, electronic improvement and the facility of organization knowledge systems. We are not speculators looking for temporary arbitrage. In the trip of life, circulation (totally submersed in jobs) is important, and the significance of success is greater than cash.

I utilize the adhering to as an allegory for my job: I bring a team of professional athletes to the business’s Olympics. I would certainly be really happy if I can assist much more Chinese business end up being champs.

I count on Peter Drucker’s monitoring scientific research. For instance, I have actually purchased numerous dining establishments, quickly expanding customer excellent business, food and drink companies, cosmetics, and particularly junk food foods. Lots of people frequently ask why Chinese food can not globalize and produce first-rate brand names. I think the factors are non-standard. The variety and intricacy of Chinese food makes it tough to systematize; it calls for considerable training for cooks and tailored speeches.

Pedestrians went through McDonald’s dining establishment in Shanghai in 2023. … [+]

With numerous varied worldwide foods, why can just the USA grow one of the most open business and brand names? The USA has actually 61 noted dining establishment business, and the globe’s biggest commercial dining establishment brand names are done in the USA – McDonald’s, KFC, Starbucks and Chipotle. If you research this sensation seriously, you will certainly locate that Americans count on supply chain and monitoring scientific research. The globalization, automation, standardization and innovation of its items are the ace in the holes of success in the USA’ junk food sector.

The business we buy (such as LXJ International, Xiaocaiyuan and Babi Food) can all end up being McDonald’s and Starbucks of the East. Chinese individuals can produce their very own brand names and be worthy of a much better life. Chinese business owners will certainly likewise end up being proprietors of impressive brand names like the West.

Charlie Munger as soon as claimed that life has numerous chances, yet there are couple of architectural frameworks. If you capture them, you will certainly be a large victor. Individuals that maintain trading can not have an ideal life.

Forbes China: Does the harvest itself exceed China in China?

Track: When the economic climate creates to a specific degree, it will certainly have a specific level of financial overflow. Resources, brand names and business owners encounter difficulties of travelling and joining worldwide competitors. I assume this is an excellent sensation. Gaining resources is no exemption. We are presently in a critical point of worldwide development. We are an organization that deeply takes part in intake, has actually accomplished considerable outcomes, and will certainly join worldwide durable goods organization competitors. Up until now, we have actually established business in the USA, Japan, Singapore and Hong Kong.

Nonetheless, customer financial investment is various from various other sorts of financial investments. According to Maslow’s power structure of demands, ethnic societies and racial histories differ, yet the fundamental reasoning of intake is basically comparable. Individuals’s fundamental intake demands correspond.

As A Result, there prevail factors in customer society, customer world and the intake demands of various markets, social and ethnic teams. In the future, we will certainly concentrate on the mass durable goods market – generally necessary high-frequency services and products.

At the very same time, we will certainly likewise satisfy the day-to-day demands of regular individuals and concentrate on items with outstanding cost-effectiveness. I do not decline elite intake, yet mass intake has actually constantly been the traditional need for customer item growth. We will certainly do what we are proficient at in comprehending to produce worth to culture.

In the past, reform and opening in China implied that international financial investment involved the nation. In the future, reform and opening will certainly indicate that Chinese business owners will certainly travel and end up being a crucial pressure in worldwide competitors. Harvest Resources will most certainly likewise relocate in the direction of globalization, making use of the experience we have actually obtained in the worldwide Chinese market.

Forbes China: What are your prepare for the following year and past?

Track: In the future, China’s economic climate will certainly encounter difficulties. The globe is encountering the opportunity of reduction, and China is no exemption. We will very closely line up with the growth patterns of China and worldwide economic situations, highlighting the growth of top notch customer sectors.

Harvest Resources’s core financial investment concepts presently count on the capital price cut design. Over the following one to 2 years, we will certainly concentrate on constructing brand-new networks in fundamental durable goods locations such as corner store, drinks and cosmetics. These locations are very resistant to market threats and have solid capital problems.

As an economic professional, my objective is to change harvest resources right into harvest sector, not just in China yet internationally. We are currently checking out markets in New york city, London, Paris and Japan. Sector is the reason it genuinely produces worth, has social worth, creates riches spillover impacts and genuinely advertises social progression. This is the concept we follow, real core spirit and the quest of resources harvesting. So from this point of view, we are various from a lot of PE and VC business.

Forbes China: In other words, why does this simplify?

Track: Upstream Sports. Charles Dickens as soon as claimed, “That was the most effective minute, that was the most awful.” However all we need to do is to be among the best individuals of this age.

Review: IMAX China rises, like smash hit NE ZHA 2 climax

Florida’s boy gains IMAX success in China

Eastern Bulls see even more unicorns, IPOs broaden as local development

Derek Li and Squirrel AI purpose to lead the future of AI-driven education and learning