A collapse of trust in government-printed (fiat) currency could push gold prices well beyond the current record price of $5,057 an ounce, as investors feel betrayed.

Renowned gold trader Ross Norman used a human analogy to explain the psychology behind the gold boom, which is the difficulty of rebuilding trust after a marriage breaks down because of one partner’s infidelity.

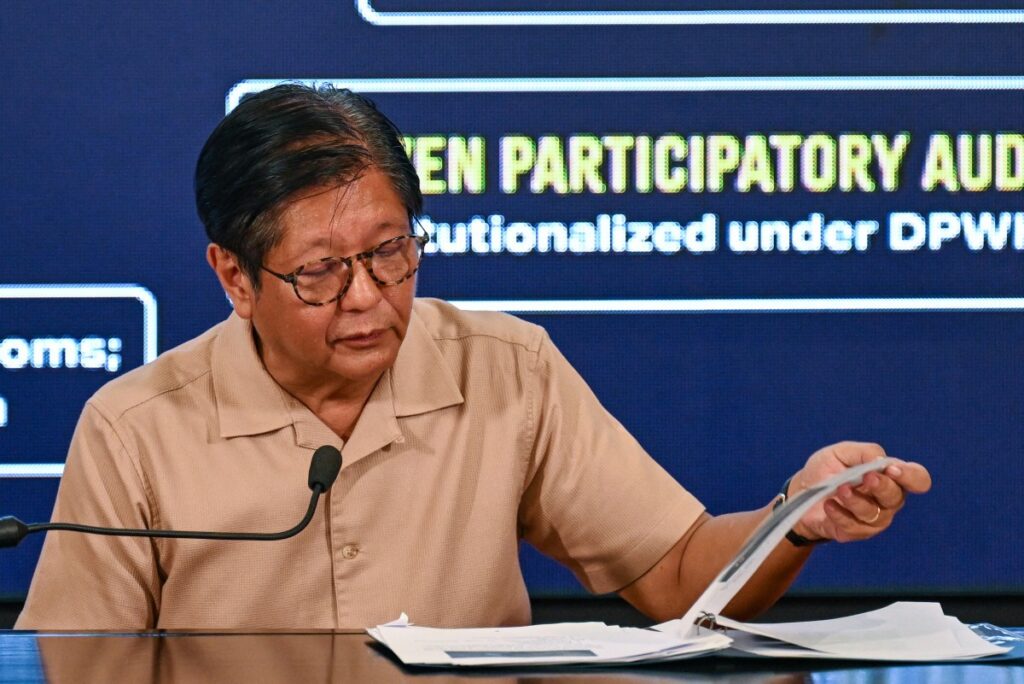

Gold outpaces paper money

Getty

“Imagine you’re married,” London-based Norman wrote in a new report published on his MetalsDaily.com website.

“Your partner was unfaithful and later regretted it. When did you start trusting them again?”

“This is the dilemma asset allocators face today. They feel betrayed by the current system because of declining trust in dollar assets, mounting debt and a lack of political courage to face reality.”

Norman doesn’t offer his own gold price tips, he’s been around too long to fall into this trap.

But he does write with great authority about the signal gold is sending, that gold is fulfilling its timeless role not just as an alternative asset or portfolio diversification tool, but as an asset of last resort, something of real value rather than something someone else promises to pay for.

“Gold prices rising above $5,000 an ounce reflect a severe malaise in global finance that is not yet reflected in equity valuations,” Norman wrote.

Systemic breakdown of trust

“This is not just a matter of geopolitical tension or uncertainty; it is a fundamental breakdown of trust and confidence in the system itself.

“At its core, the gold price is more than just a market indicator. It’s a voting machine. News of political kidnappings, distant rebellions or threats to Arctic resources may cause prices to rise, but the basic story remains the same.

“Gold is recalibrating to a world where trust is eroding and debt is mounting, and of course these two dynamics are closely related.”

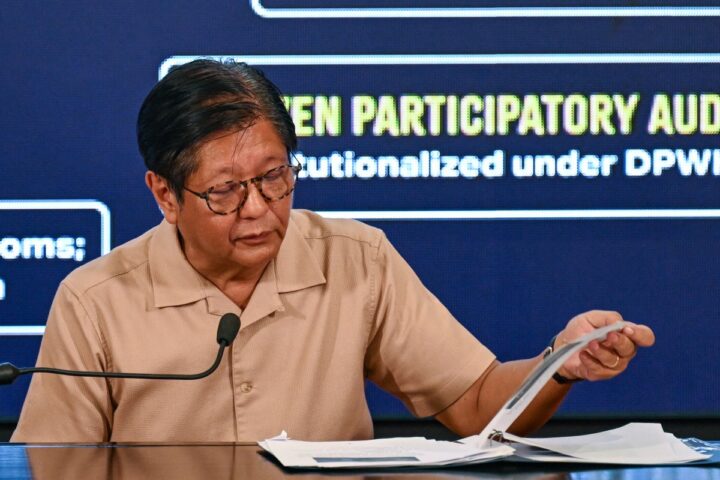

There may still be a long way to go after the golden peak.

Getty

Norman looked for signs that gold prices were nearing a peak, but found none.

Even the oldest adage about taxi drivers and waiters giving share prices is put to the test by telling an anecdote about locals and complete strangers commenting in his country pub asking questions about the price of gold to him and a fellow gold trader.

“Interestingly, the moment people start telling us where they think the market is going is usually the clearest sign that the market is about to top,” he wrote.

“But for now, the barometer hasn’t dropped yet.”

He writes that a big concern for the financial sector is the continued rise in debt, which is not inherently bad but creates real dangers when debt becomes uncontrolled and self-perpetuating, and there is no political will to get out of it.

“In the liberal West, where we regularly vote for leaders who propose austerity policies, we refuse to take our medicine, and the East knows it,” Norman wrote.

debt junkie

“We’ve become obsessed with the latest fiscal stimulus.

“So who’s going to buy these charming IOUs (I Owe You) that the West keeps issuing gilts and gilts to sustain our habit of living beyond our means.”

Norman then raised the question of what might end gold’s rally, drawing on the loss of trust in marriage to draw comparisons as economic alliances and assumptions are called into question.

From this perspective, he writes, gold is the economic equivalent of dating apps Hinge and Tinder, representing the search for alternatives when the status quo is no longer worth maintaining.