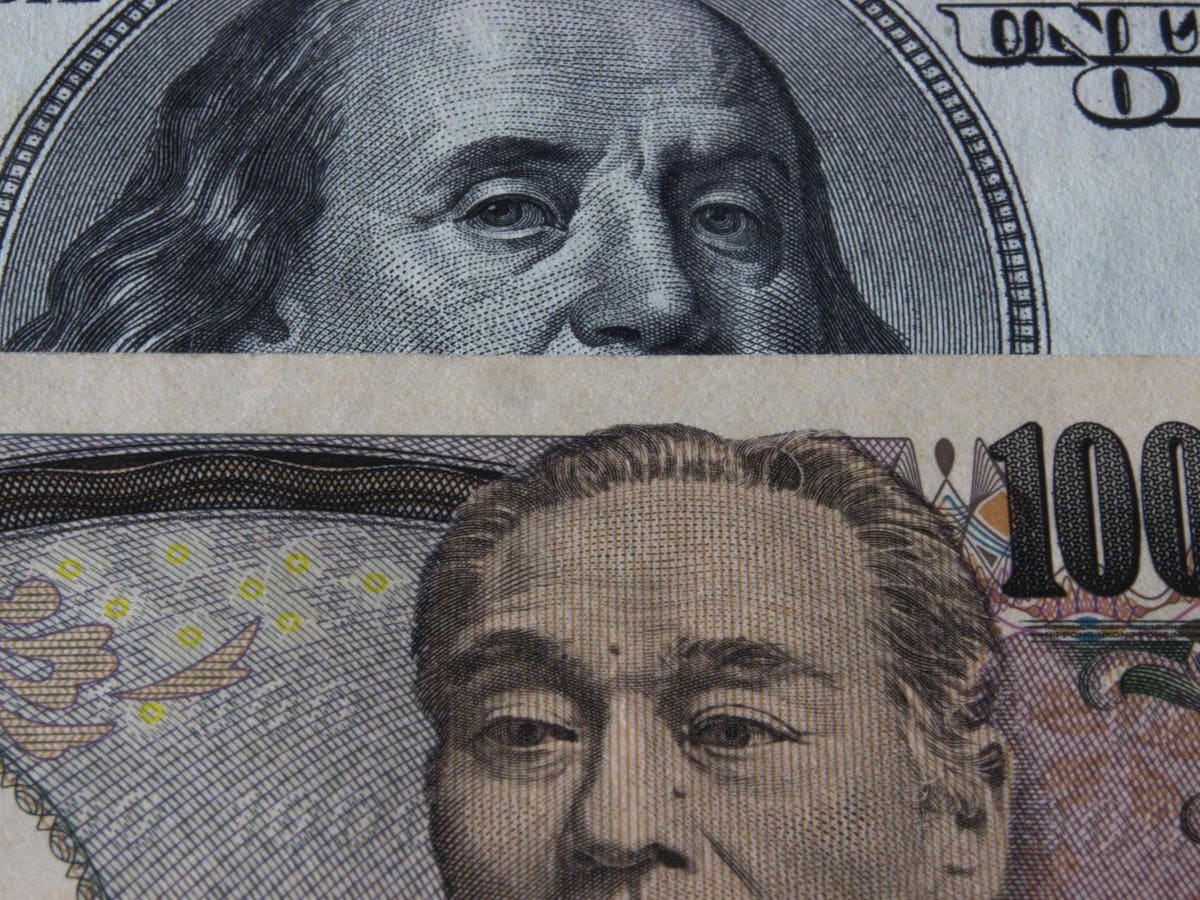

If you are seeking an additional reason Japan Financial institution will not trek proportion anytime quickly, the $338 trillion number is absolutely in accordance with the costs.

This is the financial debt degree that the international economic climate has actually gotten to in the 2nd fifty percent of 2025. This wants a rise of $21 trillion in 6 months of the year. It is not a surprise that Japan is just one of the nations where the International Money Flag Institute is “a location where the marketplace is worried concerning the growing of monetary stress.”

Japan is currently the biggest financial debt problem amongst industrialized nations, making up concerning 260% of GDP. Additionally, the return on Japanese federal government bonds (JGBs), which have actually been around for two decades, is close to the greatest given that 1999.

Certainly, this is the year that the Financial institution of Japan reduced its standard to no, and it is the very first team of 7 economic climates. For a nation with massive financial debt, the return of 20-year rates of interest to their 1999 degrees is a genuine trouble.

Points will certainly likely become worse. On October 4, the Liberal Democrats will certainly pick the brand-new head of state after Shigeru Ishiba surrenders. Nonetheless, the only method for the least industrialized nations to preserve their power is to accept pro-tax resistance events.

The ghost of reduced tax obligations is deeply worried concerning the “Bond Cautious One”. In current weeks, they have actually sent out Japanese incomes for 26 years, making international headings for all the incorrect factors. The issue is that the largest financial debt problem amongst industrialized nations will certainly end up being also better.

Certainly, this is a worldwide concern. Financiers have actually been wagering in current weeks that the UK or France might require bailout from the worldwide financial funds as loaning expenses go out of control. At the exact same time, the united state public debt surpassed $37 trillion.

Japan is an instance of a created economic climate, shedding the story without stimulation. Think about a professional athlete whose efficiency is just credited to steroids and various other temporary boosters. Inevitably, these improvements will certainly shed their performance and call for progressively bigger dosages.

Currently China exists. Asia’s biggest economic climate is discovering that the common monetary and money episodes did not get to a 5% development price in 2025, so it is hard to preserve.

As for Japan is worried, any kind of 2% or 3% gain of GDP needs an asterisk. That’s due to the fact that development is not natural or obtained. It is the item of financially equal blood doping. The reality is that the development of top-level economic climates is as essential as rate.

BOJ initially decreased the price to no 2 years later on, and it took the lead in measurable easing. Although exports have actually been found after the USA, the UK, the euro area and various other leading economic climates have actually been pursued a while, particularly after the 2008 Lehman Brothers dilemma.

It’s not that Japan has actually remained in a 25-year circumstance. One factor is Japan’s payment to the earlier pointed out $338 trillion in international financial debt. Boj takes out of the bond market every action, a financial debt investor presses back.

By 2018, BOJ’s annual report was bigger than Japan’s yearly return of US$ 4.2 trillion. This is the very first in the leading 10 economic climates. It discusses why Head of state Kazuo Ueda, Boj, shelved Tokyo’s tightening up cycle.

It ends up that the elevation of 0.5% is as high as that of Japanese firms and agrees to allow temporary rates of interest vanish. The previous BOJ group accomplished existing degrees in 2007, just decreasing it to no.

Is UEDA relocating in the direction of a comparable destiny? Just time will certainly confirm it. Yet the massive buildup of financial debt and financial debt in Japan and anywhere else is increasing rates of interest to the reserve bank in a smaller sized and smaller sized latitude.