As China deals with a downturn in development, technology-driven “clever economic climate” and arising usage fads supply security versus recreation financial task, yet much more targeted federal government plans might still be required to preserve energy.

In the very first fifty percent of this year, Beijing is anticipated to fulfill its 2025 development target of 5%, tape-recording 5.4% and 5.2% development in the very first 2 quarters, yet task shows up to have actually slowed down ever since.

China stresses this August Occasion Record which highlights the downturn in retail and commercial result.

See additionally: Reserve bank of India streamlines international loaning regulations for firms

Nevertheless, there are highlights in the Chinese economic climate – a number of which are recipients of brand-new and continuous federal government plans.

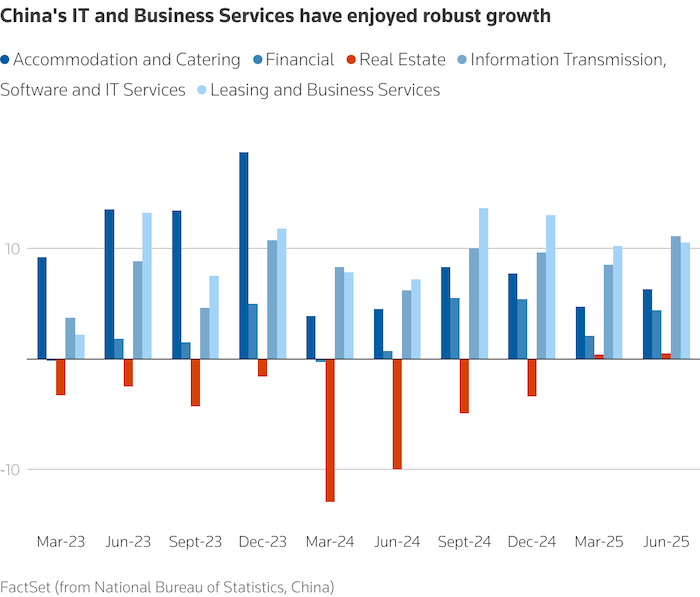

Initially, Beijing’s initiatives to sustain China’s “clever economic climate” such as expert system, semiconductors and various other sophisticated production sectors have actually aided the infotech and organization solutions fields to surpass lots of various other locations considering that very early 2024.

The graph reveals the development of the parts of China’s solution sector GDP from the March 2023 quarter to the June 2025 quarter.

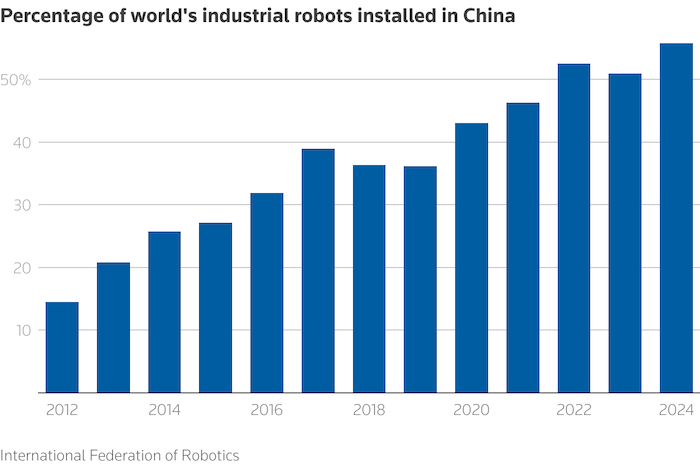

This pattern aims to proceed as China makes significant financial investments in commercial and humanoid robotics that can boost efficiency. Over the previous 3 years, China has actually mounted over half of the globe’s commercial robotics.

The Reuters photo reveals the variety of commercial robotics mounted in China.

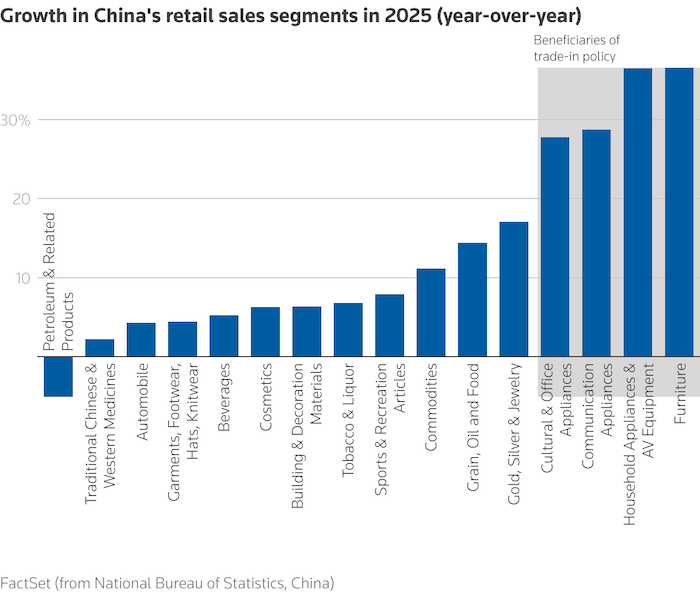

Targeted federal government plans additionally appear to have actually resulted in modest development in retail sales in the very first 8 months of 2025. Family home appliances, furnishings, interactions and workplace devices – the fastest expanding industry in retail – all gain from China Deal Plan Established at the end of 2024.

The graph reveals year-on-year development in different fields of retail sales in China in 2025 (up until August).

Some federal government procedures have actually additionally harmed usage. China’s Needs for anti-communication For federal government authorities repeated in May, there has actually been an adverse influence on the dining establishment, alcohol and event catering fields beginning in June.

Transfer of customer choices

The change in customer choices is one more development chauffeur this year and can additionally remain to progress.

Chinese millennials and Gen-Z are affecting brand-new kinds of home product or services, particularly those that advertise social interaction, integrate custom with modernity, and incorporate consumers with AI and various other electronic modern technologies.

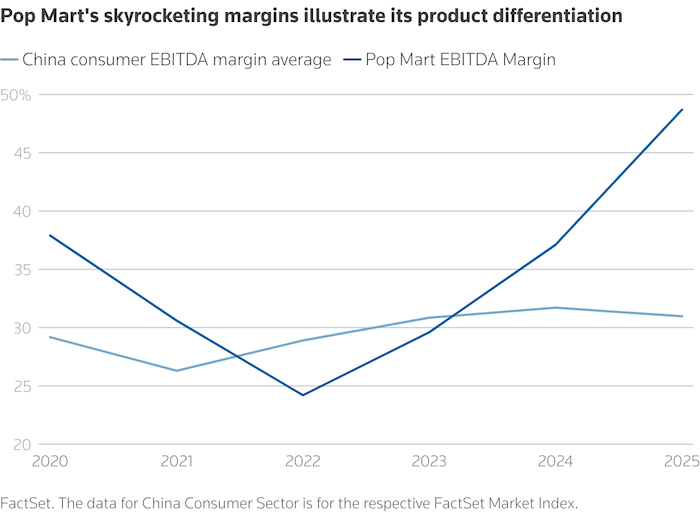

This “brand-new usage” aided drive sales of Popmart’s Labubu dolls, and additionally enhanced the appeal of Tea Residence Chagee’s Chinese opera-style media and Laopu Gold’s precious jewelry, rooted in standard Chinese crafts.

Popmart’s eruptive revenue margins attract attention right here, partially due to the stagnancy of China’s total durable goods sector. This reveals that China’s brand-new kinds of product or services have the possible to weaken its group.

Graph Popular Song Collection

One can additionally claim that Popmart’s success is single and challenging to reproduce on a bigger range. Furthermore, if Labubu goes out, this expensive development might go down swiftly.

At the various other end of the group array, the story of “China’s Aging” is additionally creating brand-new companies, consisting of clever home innovation, senior treatment solutions, economic pension and specialized health care items.

China’s “financial institution economic climate”, approximated to be $1 trillion in 2024, is It is anticipated to expand to $4 trillion by 2035 anticipated by the Info Workplace of the State Council of China.

Although China’s brand-new usage patterns and the “clever economic climate” have had a favorable influence on development this year, this is insufficient to balance out the adverse influence of task in the production, building and construction and residential or commercial property fields.

On the other hand, the resistance from Western exports to China is progressively highlighting, which stresses the requirement to boost residential usage.

This is certainly Federal government concern listing Furthermore, plan manufacturers need to increase their tool kit offered the nation’s solid usage belief, the decreased influence of financial stimulation and monetary assistance area.

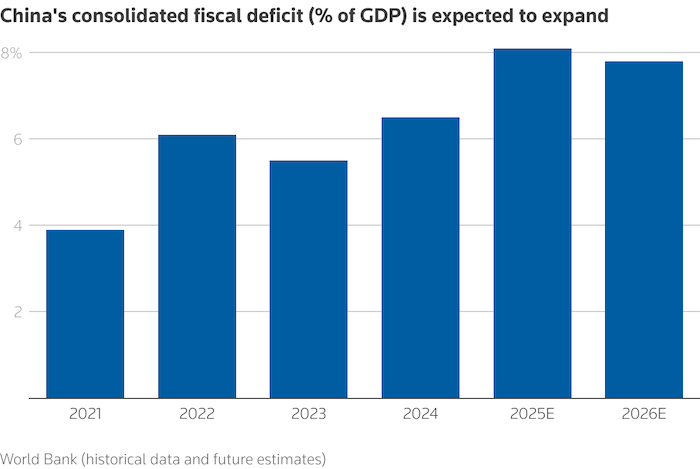

The graph reveals the Globe Financial institution’s quotes and future projections for China’s monetary deficiency, which make up a portion of GDP from 2021 to 2026.

Initially, plan manufacturers appear to recognize that usage belief is not likely to boost unless it is work.

Consequently, Beijing has actually started to Tiny and medium-sized ventures Employment is motivated. It might additionally look for to incentivize firms to boost employees’ abilities with government-mandated insurance aids or with targeted professional training.

Considered That greater than one-third of China’s workforce is immigrant employees, federal government plan manufacturers have idea Kick back the employee’s residence-or home registration-permit demands. This will certainly make sure that government-mandated insurance credentials are not connected to signed up homes, therefore sustaining usage at the reduced end of the revenue array.

Recovering a favorable riches impact might additionally aid. The property industry, which makes up 60% of China’s typical home riches, stays surprised by usage belief.

As the property market might take years to recoup, one more alternative might motivate onshore capitalists to arising passions in Chinese supplies, regulatory authorities seem indirectly sustaining them for the ” Slow Advancing Market”

Real transfer to a lasting, consumption-driven economic climate can be a lengthy and complicated procedure, and risks are plentiful – yet financial investment in leading sectors, advancement in product or services, and dexterous decision-making might stand for a strong structure.

- The factor revealed right here is Manishi Raychaudhuri Owner and Chief Executive Officer of Emmer Resources Allies Ltd, and Head of Equity Study at BNP Paribas Stocks.