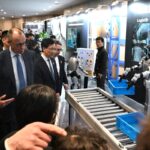

Lithium prices soared on Monday after China announced it would cancel the value-added tax export rebate.

Investors are now betting the move will boost export demand in the early going.

Reuters said that the most active lithium carbonate contract on the Guangzhou Futures Exchange closed at the daily limit, soaring 9% to 156,060 yuan per ton, the highest level since November 2023.

Also read: Mertz says EU-India free trade deal could be signed this month

Investors and analysts expect exporters to speed up overseas shipments ahead of tax rebates.

China’s Ministry of Finance said on Friday that the export tax rebate for battery products will be reduced from 9% to 6% starting in April, and will be completely eliminated from January 1, 2027.

The policy is expected to boost battery production in the short term while underscoring Beijing’s long-term efforts to curb excessive inward competition. [excessive price-cutting]said an analyst at Chinese brokerage Orient Securities.

While the rebate applies to battery exports, not lithium carbonate itself, analysts say the rush to ship batteries ahead of the deadline will boost near-term battery production, boosting demand for lithium.

Lithium prices in China have been rising since mid-2025, surging 167% from last year’s lows, driven by Beijing’s pledge to crack down on manufacturing overcapacity.

The shutdown of battery giant CATL’s Jianxiawo mine and the prospect of strong demand for energy storage systems have also pushed up prices.

- Reuters Additional editing by Jim Pollard