The success of China’s electrical automobile manufacturers, that arrested half the nation’s residential market in simply a couple of years, produced troubles for conventional cars and trucks powered by gas.

The reasonably fast appeal of EVs knocked once-dominant international car manufacturers off their stands, however likewise produced a listing of losers in the house.

Numerous Chinese heritage car manufacturers likewise saw their sales collapse– and reacted by swamping the globe with fossil-fuel automobiles they could not cost home.

ADDITIONALLY SEE: China Launches First Great Deal Of Simpler Rare Planet Export Licences

While Western policymakers have actually concentrated on the hazard of China’s greatly subsidized EVs, shielding their markets with tolls, United States and European car manufacturers encounter higher competitors from China’s gas-guzzlers in nations from Poland to South Africa to Uruguay.

6m gas cars and trucks delivered this year?

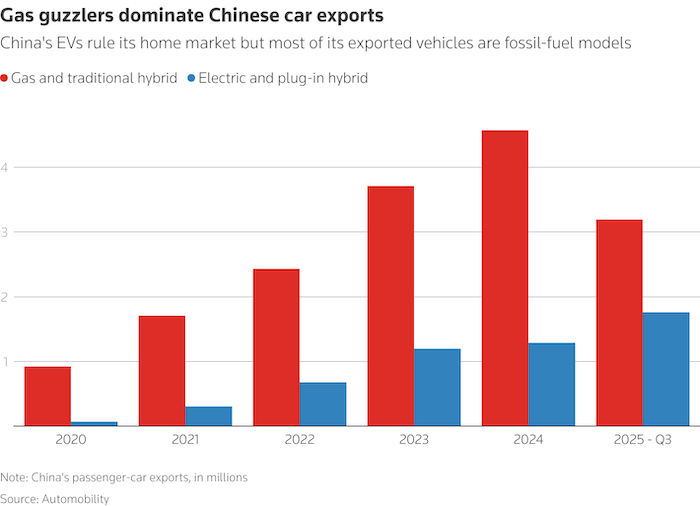

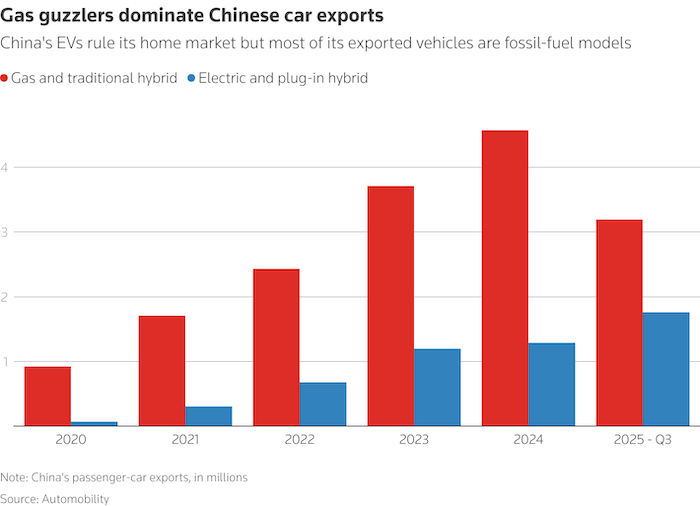

Fossil-fuel automobiles have actually made up 76% of Chinese automobile exports given that 2020, and complete yearly deliveries leapt from 1 million to likely greater than 6.5 million this year, according to information from China-based working as a consultant Automobility.

The boom in gasoline-powered exports is driven by the very same EV aids and plans that damaged the China companies of car manufacturers consisting of Volkswagen, GM and Nissan by financing ratings of Chinese EV manufacturers and stiring up a destructive cost battle

The sensation highlights the significant effects of China’s commercial plan, as international rivals battle to keep up with government-backed companies chasing after Beijing’s objectives to control crucial industries across the country and internationally.

China’s gasoline-vehicle exports alone– not consisting of EVs and plug-in crossbreeds– sufficed in 2015 to make it the globe’s biggest auto-exporting country by quantity, sector and federal government information reveal.

This account of Chinese car manufacturers’ worldwide growth is based upon a Reuters testimonial of auto-sales information in loads of nations and meetings with greater than 30 individuals, consisting of execs from 11 Chinese and 2 Western car manufacturers, circulation supervisors for Chinese brand names and sector scientists.

Flooding of cars and trucks right into second rate markets

The increase of Chinese gas cars and trucks right into arising and second-tier markets mirrors a crash in between Beijing’s present EV press and older plans that developed China’s residential gasoline-vehicle sector by leveraging international car manufacturers’ modern technology.

Amongst the largest merchants are state-owned heritage titans, consisting of SAIC, BAIC, Dongfeng and Changan, which traditionally depended on joint endeavors with international carmakers commercial and design knowledge. These collaborations began in the 1980s as shotgun marital relationships compelled by Beijing as the cost of international gamers’ accessibility to China.

Much more just recently, with the surge of ingenious independently had Chinese EV manufacturers, led by BYD, these joint endeavors’ sales have actually dived. SAIC-GM’s yearly China sales, as an example, dropped from greater than 1.4 million automobiles to 435,000 in between 2020 and 2024, SAIC information reveal.

Currently these state-owned gamers are acquiring sales in export markets that were when the domain names of the very same international car manufacturers that are their companions in China. SAIC’s exports– primarily of its very own brand names, without GM– skyrocketed from almost 400,000 each year in 2020 to greater than a million in 2015.

Dongfeng’s exports of almost 250,000 automobiles in 2015, up practically four-fold in 5 years, verified crucial as sales of its China collaborations with Honda and Nissan went into a “down spiral,” Jelte Vernooij, Dongfeng’s Central Europe supervisor, stated.

Dongfeng’s yearly worldwide sales have actually dropped by a million automobiles given that 2020, to much less than 2 million, business filings reveal. Yet Vernooij isn’t fretted about Dongfeng’s future– due to the fact that it has Beijing’s support.

” The truth that we’re state-owned is essential,” he stated. “There’s no doubt that we will certainly endure.”

There’s likewise no doubt that, in the meantime, gas cars and trucks are marketing much better in second-tier markets, such as Eastern Europe, Latin America and Africa, with limited EV-charging facilities. Longer term, Beijing intends to control EVs and plug-in crossbreeds internationally. Yet during, numerous Chinese car manufacturers are developing overseas brand names by providing consumers whatever they desire.

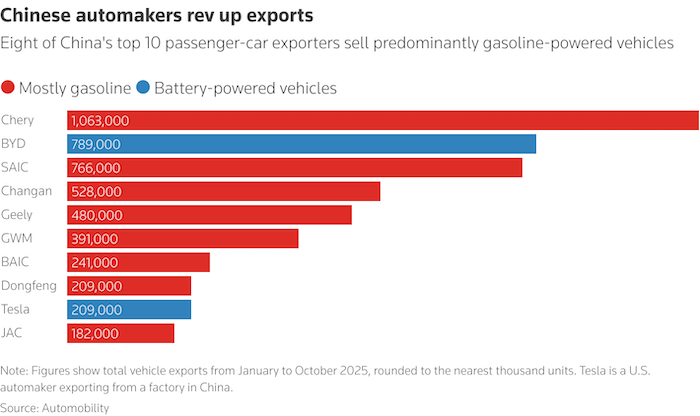

Chery leading merchant

China’s leading automobile merchant is Chery, whose worldwide sales soared from 730,000 automobiles to 2.6 million in between 2020 and 2024. Chery, which has both state and exclusive proprietors, expanded yearly exports over the duration by regarding a million systems– depending primarily on the gasoline-powered automobiles that make up four-fifths of its sales.

China’s leading 10 merchants consist of 5 various other state-owned car manufacturers and 2 exclusive ones, Geely and Great Wall Surface Electric motor, that likewise offer extra gas automobiles than EVs.

Just 2 of China’s leading 10 automobile merchants concentrate specifically on battery-powered automobiles. Among them is United States electric-car leader Tesla. The various other is BYD, which markets just EVs and plug-in crossbreeds. BYD’s press abroad this year has actually made it China’s second-biggest merchant and slanted the country’s exports towards plug-in cars and trucks. Still, China’s gasoline-vehicle exports get on speed to surpass 4.3 million and represent almost two-thirds of this year’s overall.

Abroad supervisors for Chery, Dongfeng and an additional state-owned car manufacturer, FAW, informed Reuters China’s competitive vehicle market has actually made exports necessary to Chinese car manufacturers’ development and revenues. Giles Taylor, worldwide vice head of state for layout at FAW, thinks some residential opponents are one item failing far from going under.

” China’s so overpopulated with vehicle firms,” he stated. “It’s best on the side of dog-eat-dog.”

A lot of brand names have actually concentrated on gasoline-car exports, the supervisors stated, just due to the fact that they’re most convenient to offer in many areas. “We can adjust our offering for every single market,” Nic Thomas, Changan’s European advertising supervisor, stated.

Various other leading merchants SAIC, BAIC, Geely and Great Wall Surface Electric Motor and the federal government’s financial organizer, the National Growth and Reform Compensation, did not comment for this record.

‘ Excess ability focused on remainder of the globe’

Worldwide car manufacturers’ execs have actually extensively recognized that climbing Chinese opponents posture a severe affordable hazard, however primarily in the context of their ingenious and budget friendly EVs instead of gas designs. Spokespeople for Toyota, Ford, Nissan and Hyundai did not discuss China’s export rise.

Some heritage gamers claim they await the battle. Alexander Seitz, Volkswagen’s South America principal, stated he had “no worry of the Chinese.”

” I appreciate them as a rival,” he stated. “They rate to sign up with the event.”

In action to Chinese competitors, Volkswagen is wanting to export cars and trucks constructed in China to even more abroad markets.

A GM speaker indicated chief executive officer Mary Barra’s October statements that the business intends to take on Chinese opponents “with the best modern technology, at the best price.”

Chinese car manufacturers’ thrill to export gas cars and trucks can be mapped to federal government plans that produced an excess of manufacturing facility ability to construct them.

China’s quick EV development idled production line with the ability of generating approximately 20 million gasoline-powered cars and trucks each year, quotes Automobility Chief Executive Officer Expense Russo. Such ineffective expenses elevates prices, pressing car manufacturers to repurpose ability for exports.

” That excess ability is being intended back at the remainder of the globe,” Russo stated.

Might get 30% of worldwide market

Working As A Consultant AlixPartners anticipates Chinese car manufacturers’ yearly sales outside China will certainly expand by 4 million automobiles by 2030, taking big market shares in South America, the Center East, Africa and Southeast Asia. Consisting of anticipated development in China, the globe’s biggest vehicle market, Chinese car manufacturers are anticipated to manage 30% of the worldwide automobile sector in 5 years.

” That development will certainly come with the expenditure of every person else,” stated Stephen Dyer, joint head of AlixPartners in China.

Beijing’s plans over a years urged car manufacturers to construct brand-new EV plants instead of transform existing gasoline-vehicle manufacturing facilities. City governments sustained the manufacturing facility boom with aids as they completed to tempt EV manufacturers, in solution of Beijing’s financial objectives. Car manufacturers obtained affordable EV manufacturing facilities funded by cities and districts anxious to show growth.

” City governments also prepare the land and construct the manufacturing facilities, permitting firms to ‘relocate with simply a luggage,'” stated Liang Linhe, chairman of Sany Heavy Vehicle, amongst China’s biggest vehicle manufacturers.

The outcome: large overcapacity At a March EV meeting, Su Bo, China’s previous vice priest of sector, advised regulatory authorities to advertise the conversion of gasoline-car manufacturing facilities to construct battery-powered designs. He approximated China’s sector had actually developed ability for 20 million EVs and plug-in crossbreeds each year however continued to be burdened sufficient manufacturing facilities for 30 million gas automobiles– even more than its residential market requirements.

Decreasing gasoline-car sales, he stated, are “leaving considerable ability underutilized and diving the field right into a vital survival dilemma.”

Fight for arising markets

As EV start-ups developed manufacturing facilities throughout China, heritage Chinese car manufacturers combed the globe for brand-new gasoline-car markets to maintain their underutilized manufacturing facilities.

On a September day in Warsaw, Poland, brand-new SUVs with chrome “BEIJING” logo designs lined the Plaza car dealership. Under those hoods rested gasoline-powered engines produced by BAIC, the car manufacturer had by Beijing’s local government.

BAIC is amongst 33 Chinese brand names that have actually introduced or introduced Poland sales given that 2023, numerous marketing mostly or specifically gasoline-powered automobiles, business news and GlobalData sales numbers reveal. Jerzy Przadka, BAIC’s Poland supervisor, stated there are numerous lookalike Chinese midsized SUVs that couple of Poles can inform them apart.

Marcin Slomkowski, nation supervisor for GAC and the Geely brand name at supplier Jameel Motors, called the variety of brand-new Chinese rivals in Poland “just insanity,” including that local-market knowledge will certainly be “essential for survival.”

Inchcape, a worldwide automobile supplier, has actually safeguarded a lot of its current agreements from Chinese car manufacturers going into arising markets, stated Inchcape chief executive officer Duncan Tait.

The brand-new worldwide participants consist of older makers having a hard time to fulfill Beijing’s EV-development requireds while protecting gasoline-car revenues. They need to customize exports to what each market can soak up– which in arising economic situations is gas automobiles– instead of press EVs on markets not yet all set for them.

” The design you have with China will not always operate in Costa Rica, Peru, Indonesia or Greece,” Tait stated. “You need to encounter the globe as it is, not just how you desire it to be.”

Also in some wealthier economic situations, fossil-fuel automobiles are a huge component of Chinese brand names’ line-up. Nearly all of the cars and trucks Chery has actually marketed to day in Australia have gas engines. The business just just recently began to present plug-in designs.

China car manufacturers’ engine-type materialism produced brand-new fronts in their market-share fight with international opponents. Numerous car manufacturers traditionally concentrated their design and advertising on the biggest or most affluent vehicle markets– the USA, Europe, China and Japan.

Concentrate on less costly cars and trucks

In the establishing globe, they focused on less costly cars and trucks, commonly with older modern technology. That’s left the similarity VW, GM and Stellantis prone to an assault of budget friendly Chinese exports, commonly with far better safety and security attributes and software application, stated Felipe Munoz, an automobile expert for study company JATO Characteristics.

” Tradition car manufacturers were resting. Currently they’re spending for it,” he stated. “The genuine fight in between Chinese carmakers and the heritage carmakers is not occurring in Europe. It’s not occurring in the USA. It’s occurring in arising markets.”

Antonio Filosa, Chief Executive Officer of Stellantis, was asked at a September capitalist occasion just how the business would certainly react to Chinese rivals. In markets consisting of the Center East and Africa, he stated Stellantis would certainly follow its design in South America, where it has a 24% market share, by concentrating on in your area developed cars and trucks customized to regional preferences. Stellantis did not comment past Filosa’s current statements.

Encountering increasing Chinese competitors, GM and Hyundai introduced in August that they would collectively establish cars and trucks for South America to decrease prices.

Political headwinds in Mexico, Russia

China’s biggest export location is Mexico– annoyingly close for the USA, which has actually basically outlawed Chinese-brand automobiles with profession obstacles intending to secure nationwide and financial safety and security.

South of the United States boundary, where couple of EVs are marketed, Chinese car manufacturers likely will finish the year with sales surpassing 200,000 and a 14% market share, according to GlobalData.

Tradition brand names such as Fiat, Ford and Chevrolet are shedding ground. GlobalData projections Chevrolet’s Mexico sales at 52,231 systems this year, down greater than 24% given that 2023.

Mexico in September stated it would certainly elevate tolls on Chinese cars and trucks from 20% to 50%, a relocation the federal government stated would certainly secure tasks and which experts called an initiative to soothe Washington. United States authorities have actually pushed Mexico to limit profession with China to stop it from utilizing Mexico as a “back entrance” around United States profession obstacles.

Chinese car manufacturers likewise encounter political headwinds in Russia. Mexico this year displaced Russia as China’s leading auto-export market after Moscow increased charges on Chinese imports to $7,500.

Russia increased the levy after China swamped its market with cars and trucks– expanding share from 21% in 2022 to 64%, or regarding 900,000 automobiles– in 2024, according to GlobalData. The charges lowered Chinese exports to Russia dramatically.

The federal governments of Russia and Mexico really did not react to ask for discuss Chinese automobile imports.

Like Russia and Mexico, South Africa has a residential sector to secure, consisting of worldwide car manufacturers with a big production impact. Authorities there have actually urged Chinese car manufacturers to construct manufacturing facilities while likewise endangering tolls to limit affordable imports.

Chinese car manufacturers regulated almost 16% of South Africa’s vehicle market in the very first fifty percent, up from 10% a year previously, according to JATO Characteristics. They marketed almost 30,000 gas automobiles– and simply 11 EVs.

Toyota saw the largest South Africa sales decrease amongst conventional car manufacturers in 2015, dropping practically 15% to 93,805 automobiles, according to GlobalData.

State-owned gigantic Changan is introducing 5 automobiles in South Africa, consisting of two-battery powered designs, however anticipates its hot seller will certainly be a diesel-powered pick-up, or “bakkie,” as they’re recognized in your area.

” The EV market will certainly take even more time,” stated Marinus Venter, that handles the Changan brand name there for supplier Jameel Motors.

South America

The very same holds true in Chile, where there are restricted billing terminals on its 2,600 miles (4,200 kilometres) of hilly seaside surface. Chinese car manufacturers have actually caught practically one-third of the marketplace there, according to the regional car-industry organization. Their development has actually come with the expenditure of heritage brand names consisting of Chevrolet, Nissan and Volkswagen, whose sales dropped by in between 34% and 45% in 2015, according to GlobalData.

Chinese brand names’ technique in Chile extra very closely mirrors a heritage car manufacturer such as Toyota– which markets couple of EVs internationally– than it does China’s largest EV manufacturers.

Like various other state-owned gamers, Dongfeng is getting to deep right into arising markets to improve sales, stated Vernooij, the Dongfeng supervisor in Europe. In Chile, Dongfeng has a wide schedule, from cars to vans to pick-ups and SUVs. “We need to win,” Vernooij stated. “If you intend to resemble Toyota, you can not leave one rock unchecked.”

Generally, Chinese brand names marketed less than 1,000 EVs in Chile in the very first fifty percent however greater than 25,000 internal-combustion automobiles, according to information from JATO Characteristics.

In Uruguay, Dongfeng markets gas-powered pickup that take on Nissan– its long time China joint endeavor companion– by marketing a variation of Nissan’s very own vehicle. The Dongfeng Rich 6 is bit greater than a Nissan Frontier with various outside designing and a somewhat older Nissan V6 engine. A Nissan speaker stated the Rich 6 is based upon the Frontier and was collectively established by the 2 car manufacturers.

One purposeful distinction: The Dongfeng begins at around $21,490 compared to around $30,990 for the Nissan, according to Uruguay suppliers.

In Durazno, Uruguay, 12,000 miles from Dongfeng-Nissan’s China head office, Mariana Betizagasti, 33, just recently purchased an Abundant 6 for the hefty tasks on a livestock ranch– carrying feed, transferring pets– that her old Renault pick-up could not take care of.

The small cost, she stated, secured the bargain: “You can acquire 2 Chinese vehicles for the cost of one conventional brand name in Uruguay.”

Numerous Chinese car manufacturers, nevertheless, offer exports at costs more detailed to similar international rivals’ automobiles– and a lot more than they obtain for the very same designs in China’s competitive market.

Chery’s Jetour brand name intends to hold the line on rates as it increases to every European nation by 2027, stated Jetour International exec vice head of state Yan Jun.

” Now, very few carmakers in China are earning money,” he stated. “We do not intend to obtain associated with anymore cost battles.”

- Reuters with extra editing and enhancing by Jim Pollard