Australia and China are obtaining closer to a repeat of their 2020 profession battle as a twin mining conflict bursts out over iron ore exports and unusual planet financial investment.

The untaught Brownish Hills unusual planet down payments in north Western Australia are a property desired by both Chinese capitalists and the United States federal government.

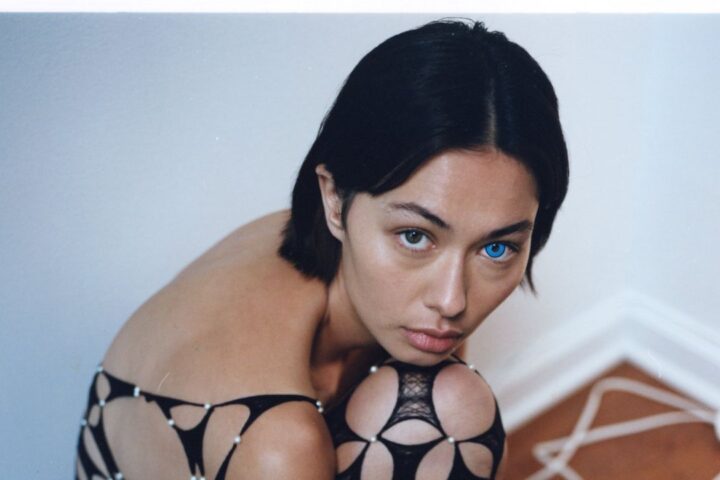

Terbium and dysprosium at facility of brand-new unusual planets altercation

Getty

Browns Variety, which is abundant in the supposed hefty unusual planets dysprosium and terbium made use of in sophisticated tools systems, is had by Northern Minerals, a little business detailed on the Australian Stocks Exchange (ASX).

The united state federal government’s Export-Import Financial institution is taking into consideration a $250 million car loan to partly money continuous job to start progression on the Browns Variety mining strategy.

However the offer was altered by China’s deceptive financial investment in North Mining, causing a flurry of company task recently, consisting of the business’s demand to Australia’s company regulatory authority to delay its yearly conference set up for later on today.

The business claimed in a declaration to the Australian Stocks Exchange that it was worried that Chinese capitalists purchased to offer shares in the Australian business had actually gone against Australian federal government orders by keeping reliable control of a a great deal of shares.

China’s rate of interest in north mining triggered Australian Treasurer Jim Chalmers to interfere under international financial investment legislations.

The business claimed it wished to hold off the conference to make sure complete openness “relative to possible financial backing from Australian and abroad federal government companies pertaining to the Brownish Variety growth”.

iron ore coincidence

On The Other Hand, North Minerals gotten in touch with the federal government to aid determine Chinese capitalists in its shares and whether they are connected to people and business formerly purchased to offer, as a long-running conflict over iron ore costs took a brand-new spin amidst records China had actually outlawed a particular sort of iron ore.

In the beginning look, the unusual planet financial investment problem and the iron ore restriction might appear unassociated, however with China being the common measure, what occurs at Northern Minerals has the possible to trigger a feedback from the fairly brand-new China Mineral Resources Team (CMRG).

The CMRG was developed by the Chinese federal government to supervise and work with all mineral profession and there is no question that the CMRG will certainly be completely familiar with what is taking place at Northern Minerals, particularly provided the political level of sensitivity of unusual planets.

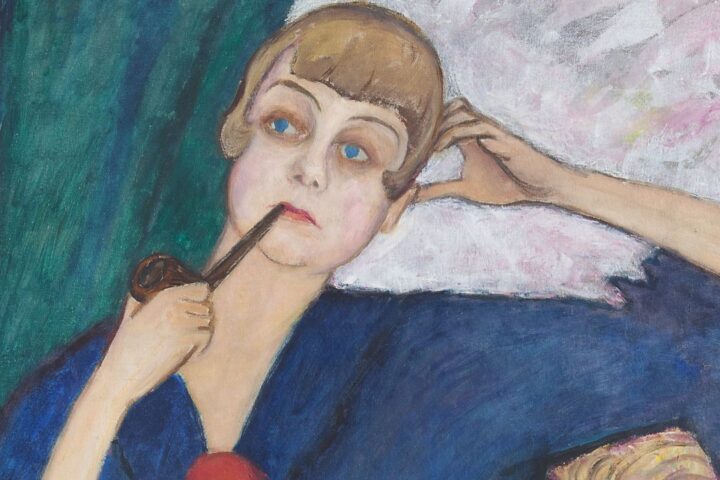

BHP’s iron ore is being delivered by rail to Port Hedland for export. Picture by Fairfax Media by means of Getty Images/Fairfax Media by means of Getty Images by means of Getty Images)

Fairfax Media (Getty Pictures)

According to the Australian Financial Testimonial, Chinese steel mills have actually been advised by CMRG not to acquire a low-grade ore called Jingbao powder from Australia’s biggest extracting business BHP Billiton.

If appropriate, the Jingbao order would certainly be BHP’s 2nd iron ore item to be re-listed, complying with a comparable order previously this year by Chinese steel mills not to purchase Jinbebar penalties.

The Jingbao and Kimbulba products are both second to BHP’s general iron ore exports, however the message is clear that China desires BHP and various other iron ore merchants to reduce costs to help the nation’s steel market, beginning by calling for all iron ore to be sold yuan instead of bucks.

The iron ore conflict has yet to impact market value for products based upon top-quality ore. The last priced estimate rate on the Singapore Exchange was $104.25 per heap, compared to a month earlier.