India’s $1.4 billion tax obligation need is taking a concentrate on the nationwide plan of business to international business, which is international organizations are taking note of the growth of the globe’s fastest-growing significant economic climates.

It’s a Japanese business Strive to decrease their reliance on China or international airline company business Intend to do away with the Western supply chain situation India is promptly ending up being a significant location for its organization.

Yet the nation’s quarrel with German automobile titan Volkswagen, in the middle of a document $1.4 billion tax obligation need, was likewise the emphasis of this month, after the car manufacturer filed a claim against authorities for a “difficult” quantity.

Likewise on AF: Taiwan, White Home concentrates on Intel’s prospective TSMC shares

Legal representatives for the business’s Indian department on Monday Inform the neighborhood court If Volkswagen India is to pay all called for tax obligations and penalties (overall $2.8 billion), the business uses 6,000 in your area and might not have the ability to endure in India.

” This refers life and fatality,” Volkswagen Indian legal representative Arvind Datar claimed in the Mumbai Court of Indian Financial Funding.

What is the Volkswagen situation?

Indian tax obligation authorities state significant need is the outcome of Volkswagen’s tax obligation evasion in 12 years, throughout which car manufacturers divided imports of some Volkswagen, Skoda and Audi vehicles right into lots of different components to spend for reduced obligations.

They declared that Volkswagen imported “virtually the whole vehicle” without setting up, which need to bring in a tax obligation of 30-35% for CKD, or a “full knockdown” system, yet by incorrectly believing it’s “solitary component” Forthcoming tax obligations. In different items, just 5-15% tax obligation is called for.

At The Same Time, in a suit versus authorities, Volkswagen India claimed it had actually educated the Indian federal government of its “partly import-by-one” design and obtained explanation in 2011.

Tax obligation notifications “totally oppose the placement held by the federal government … (and) placement of unsafe ideas and count on basis, international financiers want to act and guarantee at work and guarantee basis”, court declaring standing on January 29.

What are the tax obligation problems in India?

In the very affordable auto market, Volkswagen is not the only one in encountering tax obligation analysis. Car manufacturers such as Maruti Suzuki, Hyundai, Honda and Toyota encounter conflicts over profits tax obligations, customizeds and various other repayments, Reuters evaluation programs

Lengthy tax obligation examinations right into the nation have actually likewise stood out, which usually stimulated years of lawsuits.

In an engaging case, telecommunications business Vodafone won a retrospective Indian tax obligation need of $20 billion after greater than a years of lawful fight with New Delhi, consisting of the Hague International Mediation.

” This scenario can stop international business from making big financial investments in India,” Ameya Dadhich, tax obligation companion at international law office DLA Piper, informed Reuters.

Federal government information reveals that in November 2024, overall defaults for solution tax obligation, customizeds and excise tax obligation were almost $53 billion, with 70% of the challenged claims.

In the classification of import tolls or customizeds conflicts alone, India’s tax obligation demands got to US$ 4.5 billion by March 2024, with one-third of them calling for greater than 5 years.

Against the Indian authorities and the masses Slam authorities To invest years evaluating freight documents, their “passivity and hold-up” go back to 2012.

Volkswagen claimed it might test the relocation or review its import technique if New Delhi finished its remarks previously, yet tax obligation notifications will certainly currently be “at high-risk on the basis of confidence and count on” that international financiers are anxious for.

Why is this essential?

The general public shared interest in the expanding promote demonstrations versus international financiers by Head of state Narendra Modi and assured to streamline laws and get rid of governmental obstacles.

Modi wishes to transform India right into a production center, yet lots of electronic devices and auto business depend on components for premium vehicles or smart devices that utilize components that usually influence examinations.

India’s often slammed toll plan has actually likewise been taken another look at after united state Head of state Donald Trump’s danger of reciprocity tax obligations, that called the nation a “large abuser” in profession.

Recently, Modi flew to Washington with a guarantee of reduced tolls and a much better profession offer to stay clear of reciprocatory tolls.

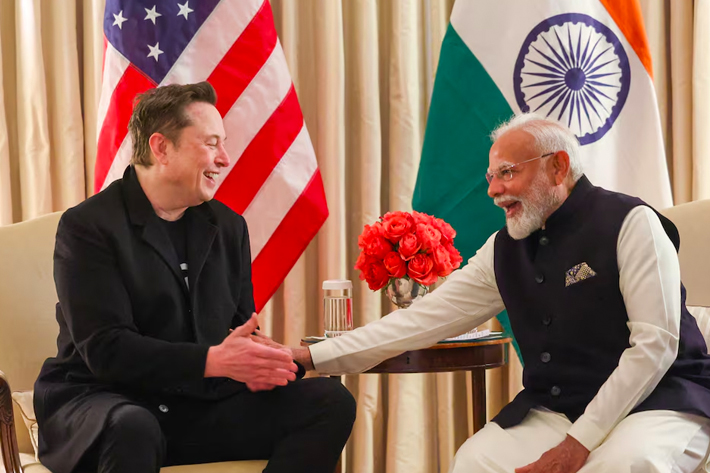

He likewise satisfied Trump’s close assistant Elon Musk, after that Musk’s electrical vehicle business Tesla Beginning working with elderly team in India Today.

Tesla has actually intended to get in India for several years, consisting of the facility of a neighborhood factory. Yet it has retroactively retroactive these strategies whenever after conjuring up high Indian tolls. Imports of totally developed high-end vehicles encounter Indian tax obligations and tax obligations of concerning 100%.

So while Tesla’s brand-new passion in India will certainly reveal development with talks with Modi, the Volkswagen situation might trigger one more uncertainty and pressure international business to review their strategies to purchase the nation.

The straight influence of the Volkswagen situation is that tax obligation specialists and lawyers are currently asking customers anxious inquiries concerning exactly how years-old tax obligation instances will certainly return to trouble them.

Customer needs to know the “Destiny of Delivery Reviews”, an attorney Inform Reuters

- Reuters, various other editors and inputs with Vishakha Saxena