The first Art Basel opens in Doha this week, and its pace is markedly different from that of fairs in Basel, Paris, Hong Kong or Miami Beach. The format of the Qatar Fair focuses on a reduced number of galleries, individual displays and a layout that encourages visitors to move slowly. This change is of great significance and has been widely praised by on-site dealers and visitors. Different booths are suddenly talking to each other, but both the art and the visitors have room to take a deep breath.

However, sales are more selective. Many dealers describe opening day as a period of orientation and discovery rather than a rush of deals.

The atmosphere felt closer to an introduction than a full-blown commercial test. That’s intentional, as ahead of the swanky event, Basel executives spoke glowingly about how iterations of the show have been as much a business endeavor as a meditation. art news It is understood that many visitors, including collectors from the region, will be attending the art fair for the first time, and the scaled-down format makes the entire exhibition easier to understand, both for veterans and newcomers.

“This is a very thoughtful creation,” said Amar A. Zahr, a partner at AAZ Art Consulting, based in Dubai and Berlin, who works primarily with Middle Eastern collectors. “The art fair is unstoppable. Here, you can really see it.” Zar described the opening day as an opportunity to see how the Doha market is shaping up. Zal added that collectors in the region have access to Middle Eastern and North African artists who may not have been aware of them before.

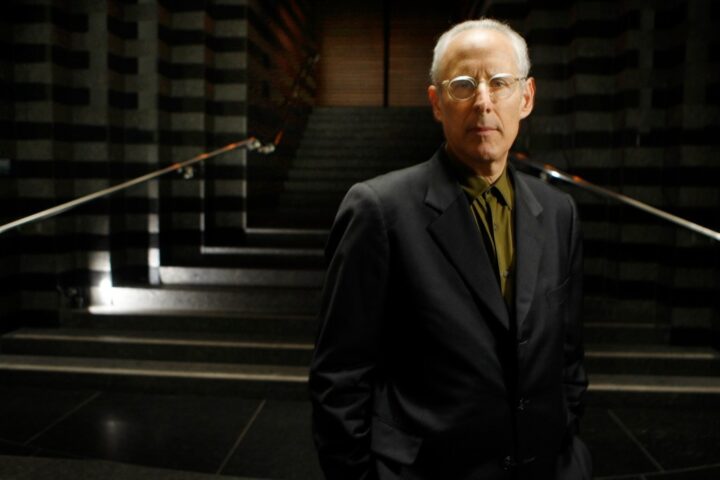

Lehmann Maupin Gallery showing the works of Nari Ward.

Andrea Rossetti

Few galleries reported sales on opening day, putting the show on hold. Several dealers said a large number of works at the show were retained and granted first refusal rights following a private inspection by members of the Qatari royal family on Monday. Galleries said they hope to know tomorrow whether the holdings will translate into purchases, a development that helps explain why some dealers, including Sadie Coles, ATHR, Almine Rech, Gladstone, Pace, Lisson, Lehmann Maupin and Gray, have shown strong interest but have not disclosed confirmed sales figures.

Art Basel’s leadership has been careful not to frame Doha’s debut purely on early sales figures. Vincenzo de Bellis, chief artistic officer of the fair, said art news The commercial aspect of the fair remains critical, but success will be measured by several additional metrics, including new relationships formed, regional engagement and long-term collector development.

De Bellis said the individual artist format, while seemingly riskier for the gallery, is a deliberate attempt to slow down viewing and encourage deeper engagement. However, he said the show’s format was likely to evolve over time and the event was always planned as a long-term commitment rather than a one-time experiment.

Installation view of ATHR’s exhibition showcasing the work of Ahmed Mater.

Ismail Noor

The format of individual presentations also leaves little room for the unexpected, a reality highlighted by unexpected changes to the floor at Stephen Friedman Gallery. The gallery had planned to display a booth dedicated to the work of the late Huguette Caland, and Friedman’s name is still listed on the fair’s map. The gallery also promoted its booth at the show on Instagram last week. Callander’s work is indeed exhibited in Doha, but now by the Huguet Callander Estate rather than by Friedman. sources revealed art news The Lisson Gallery The company underwrote the presentation after Stephen Friedman withdrew from the show at the last minute. Art Basel declined to comment on the specific reasons for the change, citing its standard policy regarding exhibitor participation.

A look at Stephen Friedman Gallery’s UK filing provides more background. Public records show the gallery lost around £1.7m in 2023 and its auditors warned the company was relying on external financing to cover day-to-day costs, raising questions about how it can easily meet short-term obligations or even stay afloat. art news Several attempts were made to enter the gallery without success.

“We are a commercial enterprise first and foremost,” DeBellis said, noting that the gallery needed to be sold. At the same time, he points to contacts among international galleries and regional collectors, some of whom are new to buying art, as an equally important early indicator or sales data.

Dealers and consultants don’t expect much in the way of immediate results. A few dealers said they had conducted sales before the show, but most delayed pre-sales out of curiosity to understand the background, scale and seriousness of the Doha project.

For collectors from the region, the fair is more of a discovery platform, especially for artists from the Middle East and North Africa. The fact that the clients interested in international blue-chip names are collectors who can already buy these works in Basel, Paris or London makes regional artists a more natural focus for some collectors in Doha.

Exhibition of Mohamed Monaiseer’s works at the Gypsum Gallery booth

Intstagram @karendexterphoto

Some galleries are bringing emerging regional artists to Art Basel Qatar, creating an interesting dynamic. Aleya Hamza, director of Cairo gallery Gypsum, which exhibits outstanding Salon-style textile works by Egyptian artist Mohamed Monaiseer, described the difficulty of pricing works for international fairs without disrupting the local market. Prices, which appear modest in the context of Art Basel, already represent an important step for artists whose careers remain rooted in their home countries, she said, especially as dealers try to raise prices after sold-out shows and successful fairs.

“The core of the gallery is to work with young artists and create work for them, while also hosting international exhibitions and nurturing their careers. So we have to be very careful,” Hamza said. Despite this, the gallery’s stand was almost sold out, mainly to collectors from Dubai, Saudi Arabia and Abu Dhabi, with prices ranging from a few hundred euros to around 14,500 euros.

Looking back years from now, it’s easy to imagine the inaugural Art Basel Qatar as an early investment rather than a guaranteed business opportunity. Iwan Wirth of Hauser & Wirth said that although sales were not immediate, the show felt “authentic” and well-structured. He said Voss was fully aware that some visitors were encountering art fairs and the idea of buying art at fairs for the first time. “However, Doha has the potential to become the center of gravity for the region, which is certainly exciting.”

Voss and others point to institutional interest and the presence of museum groups as encouraging signs, while acknowledging that it’s too early to draw firm conclusions. “It’s the magic combination,” Voss said, referring to the unpredictable combination of people, place and time that makes the fair both a success and a commercial success.

The main question is whether Art Basel and Qatar can “reverse engineer” the art market by bringing in large international fairs before building a dense local commercial gallery infrastructure. The success of this strategy depends less on first-week sales than on whether galleries return and whether collectors feel more confident returning next year. But for now at least, Art Basel Doha appears to be going according to its plan.