Welcome to the Set the Store series, in which we take you to the most dynamic and emerging luxury shopping malls around the world to introduce you to your customers and understand what’s driving the local market.

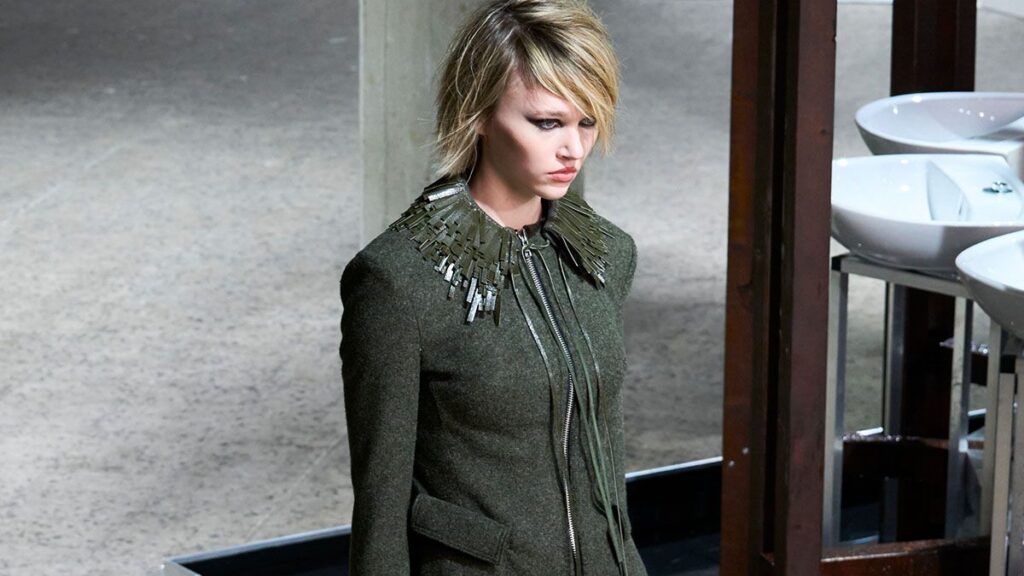

Taxis may be moving very slowly on the South Korean capital’s wide, busy roads, but everything else in Seoul seems to be passing by quickly. In addition to its well-known high-speed Wi-Fi, the city is also known for its vibrant music, fashion, and beautiful scene.

Seoul’s population of 10 million has remained stable since the late 1980s. But lately, the city has gotten busier thanks to a boom in South Korea’s cultural soft power, which has attracted record numbers of tourists to indulge in K-pop and more. According to VisitSeoul, tourist numbers hit a record high in July 2025, with 1.36 million people flocking to the capital, a year-on-year increase of 23.1%.

As increased footfall translates into increased spending, brands are seizing the opportunity. “Shopping accounts for approximately 37.8% of tourist spending, making Seoul not only a trend incubator but also a key retail destination for international visitors,” said Nick Bradstreet, head of retail at Savills Asia Pacific. “The combination of fast fashion trends and high tourist spending gives Seoul a competitive advantage over other fashion capitals in Asia.”

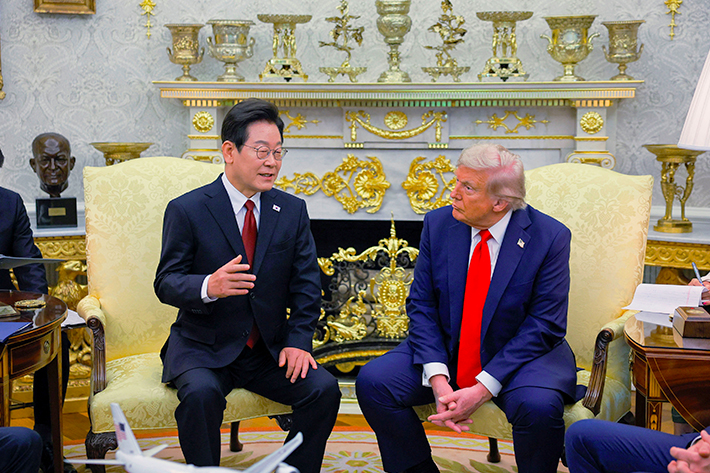

As the slowdown in China’s luxury goods industry continues, major players are leaning more towards Seoul. Louis Vuitton has just opened its largest ever store at The Reserve at Shinsegae Main Store – a six-story giant with a view, underscoring LVMH’s commitment to the city. Luxury hotels are also making inroads, with Mandarin Oriental and Rosewood planning to open hotels over the next five years while attracting more spendthrift tourists.

But it’s the cultural platform Seoul provides that attracts global players to the city. “Seoul stands out in fashion retail because of the strong influence of K-pop and K-beauty, which raises the profile of local products and elevates their global profile,” Bradstreet said. “What really sets Seoul apart is the synergy between its young, trend-savvy consumer base and the global influence of Korean culture. Many trends originate here and then spread to Asia, which is why global brands often use Seoul as a test bed.”

Despite its luxurious firepower, the city is full of quirks and unique challenges, making it a rocky terrain for unprepared brands. Here’s what you need to know before opening a store in Seoul, and how to keep it running once you open it.

the truth

Seoul’s fashion scene is diverse and immersive, with in-house multi-brand spaces, towering department stores and a steady stream of openings and pop-ups keeping everything new and exciting. Chaebols – South Korea’s family conglomerates – dominate department stores, with Shinsegae, Lotte, Hyundai and Hanwha cementing themselves as the Big Four. However, disruptors are emerging, such as e-commerce group Musinsa, as even digitally native brands understand the importance of being in cities.

Through it all, experience is king. Bradstreet said the purpose of opening the store in Seoul was not to drive pure sales, but to create an immersive flagship experience to complement their online presence. “This shift has led to the concentration of physical retail in high-impact neighborhoods such as Seongsu, Hannam, Dosan Park and Hongdae, where young locals and international tourists gather,” he added.

Thriving in Seoul today requires a dynamic approach that constantly adjusts to the fickle consumer tastes, as well as a deep understanding of the local market. The short-lived presence of grocery giants Walmart and Carrefour, unable to compete with local retailers, should be a warning sign. “It’s not easy because Korean culture is really unique and customers are a bit picky,” said Jae Lee, a fashion business strategist and professor at Seoul’s Fashion Institute of Technology (FIT). “Brands coming here need to find the right distribution partners, otherwise it will be difficult,” he said, adding that players should consider a “landing period” of several years to adapt to the market.