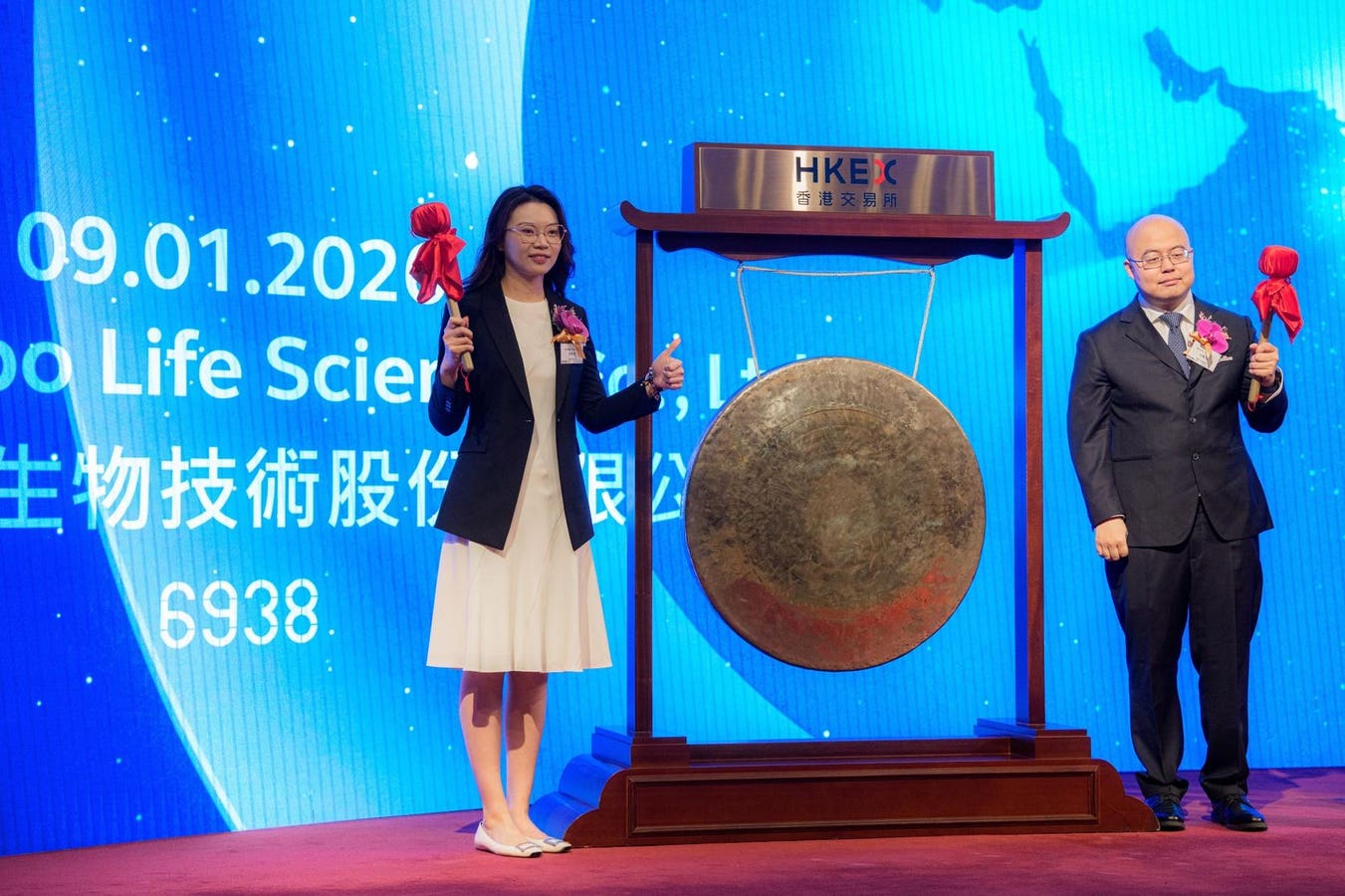

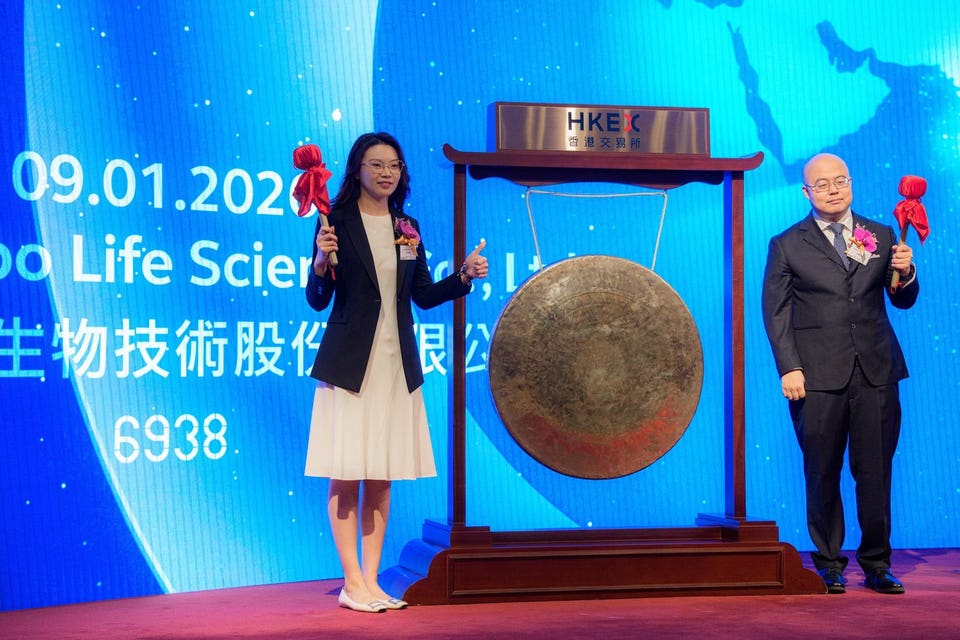

On January 9, MiniMax Group Inc. CEO Yan Junjie (right) and COO Yun Yeyi attended the company’s listing ceremony on the Hong Kong Stock Exchange. MiniMax is one of China’s largest generative artificial intelligence startups. It emerged in Hong Kong after its IPO and raised US$619 million in funding, making Yan Junjie a new billionaire. Photographer: Lam Yik/Bloomberg

© 2026 Bloomberg Financial Limited

Stock markets in Hong Kong and mainland China have performed strongly over the past 12 months. Hong Kong’s main Hang Seng Index rose 37% and China’s benchmark CSI 300 Index gained nearly a quarter. With the domestic stock market so strong, what are likely to be the key wealth trends for Greater China’s wealthy in the coming year?

To learn more, I spoke via email this month with Eva Lee, head of Greater China equities at UBS Global Wealth Management’s chief investment office in Hong Kong. Lee is a spokesman for UBS Group AG’s annual Billionaire Ambition Report, released in December, which examines global trends in billionaire wealth.

One key regional theme in 2025 that may continue into this year is the boom in technology stocks. Lee said the rise in Greater China tech stocks this year is “clearly related to the recovery of Chinese tech stocks since the beginning of 2025.” It’s also part of a global craze, largely related to the use of artificial intelligence.

For mainland entrepreneurs, “we believe this trend may continue until 2026,” Li said. New mainland tech billionaires emerging this month alone include MiniMax chairman Yan Junjie and Zhipu chairman Liu Debing.

Although mainland China has far more billionaires than Hong Kong, Hong Kong leads the way in intergenerational wealth transfer, another trend that may continue this year, Li said.

What’s the reason? Demographics. Compared with Hong Kong, “Mainland billionaires are younger, so the amount of potential transferable wealth in the next 15 years is smaller,” Li said. “Mainland China’s billionaires are mainly self-made, accounting for 98% of the total number of billionaires, the highest among all key regions. In other words, the billionaires surveyed hold first-generation wealth,” she said.

Mainland China’s billionaire pool is younger, as government economic reforms unleashed the power of China’s private sector and sparked a historic wave of entrepreneurship that didn’t begin until the 1980s; Hong Kong’s success as a global business center dates back to the British colonial era, which ended in 1997.

Hong Kong lost one of its best-known billionaires this year, Lee Shau-kee, the former chairman of Henderson Land Development, at the age of 97, underscoring the relatively advanced age of some of its wealthiest people. In 2024, Lui Che-woo, Hong Kong billionaire and founder of K. Wah Group and Galaxy Entertainment, passed away at the age of 95. Li Ka-shing, senior adviser to CK Hutchison Holdings and long-time Hong Kong business icon, has died at the age of 97. Although mainland China lost 79-year-old Wahaha beverage billionaire Zong Qinghou last year, Zhang Yiming, the richest man on the 2025 Forbes billionaire list, was 41 when the list was released last spring.

Eve Lee, head of Greater China equities at the chief investment office of UBS Global Wealth Management in Hong Kong, said intergenerational wealth transfer, healthy returns on technology investments and new metal purchases will be the wealth trends in Greater China this year.

UBS

UBS said that large-scale intergenerational transfers of wealth are taking place not only in Greater China but also globally. The company said that by 2025, 91 heirs – 64 men and 27 women – will inherit a record $297.8 billion. The report noted that despite the overall decrease in the number of heirs, this number is 36% higher than in 2024. UBS said: “Globally, inheritance has increased the number of multi-generational billionaires, with approximately 860 multi-generational billionaires currently managing a total of $4.7 trillion in assets. This is up from 805 in 2024, with a total of $4.2 trillion in assets.”

Looking ahead, “as wealth transfers continue to accelerate, there will be an increasing number of billionaires and millionaires in the coming decades,” UBS wrote. The report states that by 2040, the world’s billionaires are expected to transfer approximately US$6.9 trillion in wealth, of which at least US$5.9 trillion will be transferred to their children directly or indirectly through their spouses.

UBS pointed out that internationally, multi-generational billionaires are slowly extending downwards with the transfer of wealth. In the UBS 2025 report, the number of second-generation billionaires increased by 4.6%, the number of third-generation billionaires increased by 12.3%, and the number of fourth-generation and above billionaires increased by 10%.

Looking at Asia Pacific’s wealth prospects over the next 12 months from a broader perspective, Lee sees investment interest extending beyond the technology sector. “Among Asia-Pacific billionaires, their investment intentions over the next 12 months are hedge funds, followed by equities (developed markets) and then precious metals,” she said. Just today, Chinese buyers pushed the price of three-month copper up 11% to a record annual high, Reuters reported.

UBS’s Billionaire Ambition Report focuses on the wealth and ambitions of the elite, describing it as a “historic era of wealth creation, business innovation and impact philanthropy.” UBS conducted an online survey of 87 billionaire clients who made reservations in Switzerland, the rest of Europe, Singapore, Hong Kong and the United States between July 10 and September 25 last year. In-depth interviews followed in September and October. The report also draws on the UBS/PwC database.