The Bank of Japan (BOJ) is headquartered in Tokyo, Japan.

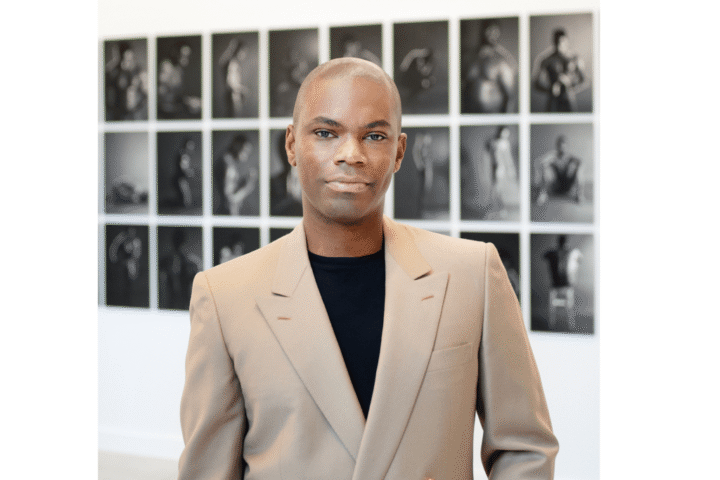

Toru Hanuchi/Bloomberg

As Jerome Powell faces clamor in Washington to end the Fed’s independence, the silence in Tokyo has been deafening.

In recent weeks, U.S. President Donald Trump’s White House has stepped up efforts to oust and bully Federal Reserve Chairman Jerome Powell. Those efforts included an ostensible threat to sue over a renovation project at the Federal Reserve dormitories.

Powell wisely called the bluff, dismissing the Justice Department’s focus on construction projects as an “excuse” for Trump’s push to rein in the Fed.

“The threat of criminal charges is the result of the Fed setting rates based on our best assessment of serving the public, rather than following the president’s preferences,” Powell said.

The play has received support from abroad. The heads of monetary authorities such as the European Central Bank, Bank of England, Bank of Canada, and Bank of Korea have defended Powell. Central bank governors, including European Central Bank President Christine Lagarde, said in a joint statement that “we stand in full solidarity” with Powell, adding that “central bank independence is a cornerstone of price, financial and economic stability and is in the interest of the citizens we serve.”

Former Bank of England official Jonathan Haskell told new york times “It is in no one’s interest to have concerns and instability in the United States. Other countries hold large amounts of U.S. assets. European savers will be implicitly invested in U.S. stocks. As the AI revolution continues, the United States is in many ways a flagship engine. No one in the world wants to see it at risk.”

but it yes are in danger, and threats are unfolding in real time. All of this makes it disappointing for the Bank of Japan to sit on its hands. As the world’s most powerful central bank faces an unprecedented attack, we hear crickets from Bank of Japan Governor Kazuo Ueda’s team.

The Bank of Japan said it was out of character to get involved in a global controversy like Trump’s versus Powell’s. In the context of Tokyo, it is believed that silence on such issues actually helps protect the Bank of Japan from political interference. That may be true in theory, but what’s happening in the United States poses an existential threat to central banks’ ability to conduct monetary policy correctly and responsibly.

“This logic is flawed,” Kumiharu Shigehara, former chief economist at the Bank of Japan, wrote in a note. japan times column. “Independence of a central bank does not mean immunity from interpretation. It means delegation of discretion – the power to make policy decisions free from day-to-day political pressures. This delegation is sustainable only if the institution explains how it uses its discretion, the assumptions that underpin its decisions and where the uncertainties lie.”

There are two reasons why we need to listen to the Bank of Japan now. First, because its independence can be said to be inferior to that of the Federal Reserve. The Bank of Japan officially became independent in April 1998. But a year later, it cut rates to zero, where they have essentially stayed since.

Last December, when the Ueda team raised rates to their highest level in 30 years, it was just 0.75. Monetary authorities that are not truly independent will cut interest rates to zero or close to zero forever. Or implement quantitative easing permanently. However, this is where Ueda’s BOJ finds itself, as new Prime Minister Takaichi Sanae aims to reopen the stimulus floodgates to stimulate the economy.

Second, Japan is by far the largest holder of US Treasury bonds, holding approximately US$1.2 trillion. Tokyo should make it clear to Trump that it expects his White House to protect Japan’s vast array of state assets.

Against this backdrop, Friday’s Bank of Japan meeting was the least suspenseful in years. Ueda’s team stood on its hands, in part because it had zero freedom to continue normalizing interest rates – with Koichi making clear that Tokyo was accelerating policy acceleration. It is not the case that Trump’s tariffs have hurt the growth prospects of the United States and Japan.

All of this raises real questions about the Bank of Japan’s ability to sustain its rate hikes so far. Or, be forced to retreat and lower them.

Takaichi’s Liberal Democratic Party has long struggled with the central bank. Her mentor, Prime Minister Shinzo Abe from 2012-2020, tricked the Bank of Japan into monopolizing the government bond market and becoming the largest holder of Tokyo stocks. By 2018, the Bank of Japan’s balance sheet exceeded Japan’s $4.2 trillion economy. This is a first for the G7 economies.

Given these risks, now is not the time for the Bank of Japan to pretend it doesn’t see the Fed trying to avoid becoming the People’s Bank of China. If Team Ueda thinks America’s guardrails will save the Fed, it’s time to reconsider. And say it out loud.