Tin, a practically neglected crucial steel, adhered to silver’s document today, increasing to an all-time high of $50,000 a load.

Like silver, which cost over $60 an ounce for the very first time, tin is driven by a mix of solid need and supply lacks from the electrification of whatever.

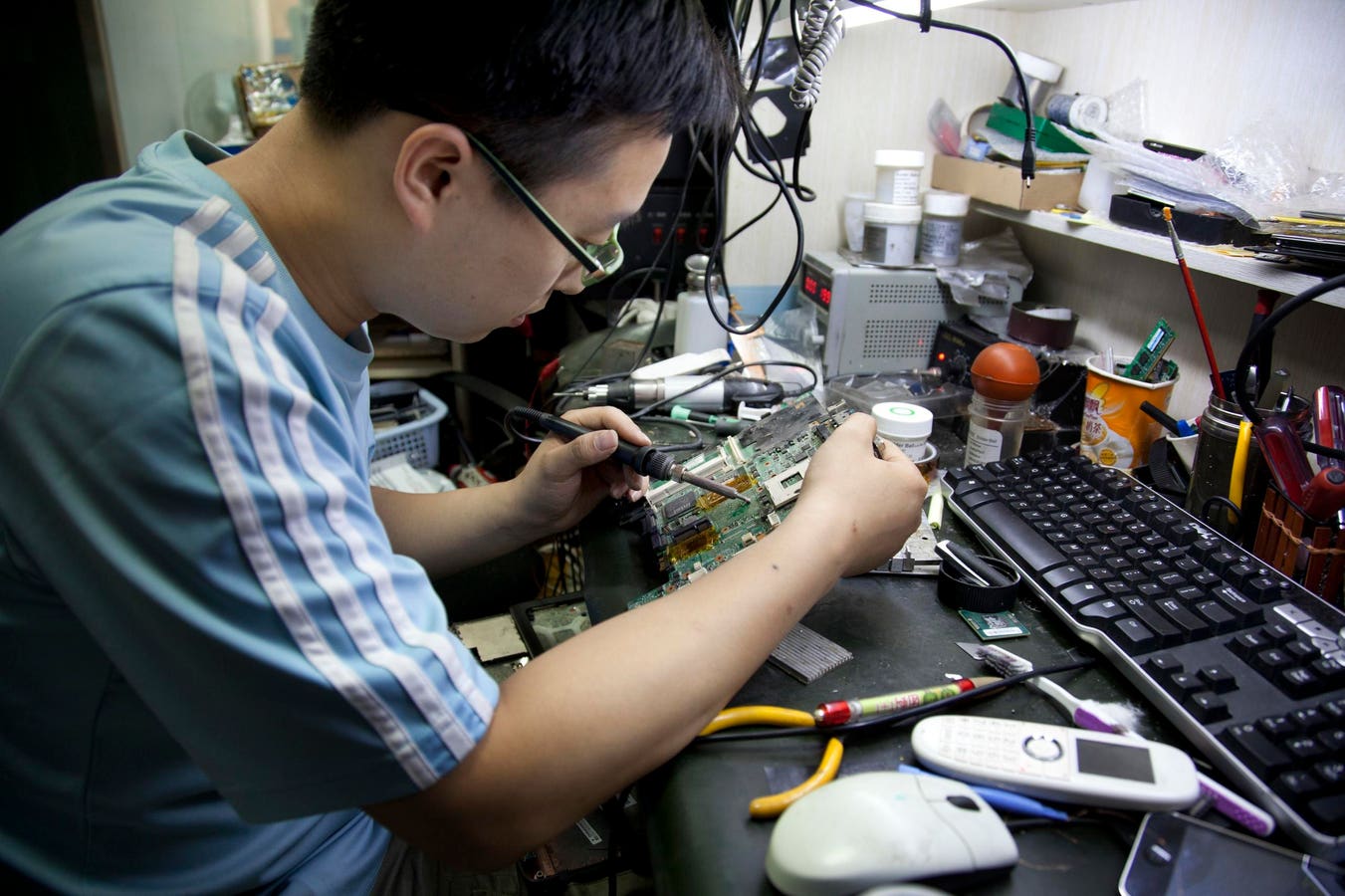

Silver, best recognized for its usage in precious jewelry, is locating brand-new markets because of having the very best electric conductivity of all steels, while tin’s high conductivity is improved by its reduced melting factor, making it a perfect solder in circuit card.

Tin is made use of to fix circuit card. (Picture by In Photo Ltd./ Corbis by means of Getty Images)

Corbis by means of Getty Photos

Tin is occasionally called the “adhesive” in electronic devices, and as a financial investment it has the extra allure of remaining in brief supply, with the majority of the offered tin originating from risky nations such as Myanmar, China and Indonesia.

Burma’s simmering civil battle has actually restricted materials from the nation. China utilizes whatever it can generate in its substantial production market, while Indonesia’s manufacturing has actually been harmed by the federal government’s suppression on unlawful mining.

1,000 unlawful tin mines shut

The Indonesian federal government has actually shut greater than 1,000 little unlawful tin mines this year, worried regarding shed tax obligation profits and ecological damages brought on by miners removing tin from rivers and lakes.

Extreme flooding partially of the nation lately, eliminating around 900 individuals, was partially condemned on river financial institution disintegration.

Typical tin mining in Indonesia. (Picture by Mahendra Moonstar/Anadolu Agency/Getty Photos)

Getty Photos

Ecological elements are likewise a problem for nickel; Indonesia generates huge amounts of an additional steel, triggering various other nations to be required to shut mines.

Because the start of this year, tin rates have actually increased 37% to US$ 39,884/ heap, consisting of a 10.7% rise in the previous 4 weeks.

The most recent rates imply tin has actually gone beyond experts at Fitch Solutions BMI’s cost projection of $35,000/ heap for following year and is close to the $40,000/ heap anticipated last month by financial investment financial institution Citi.

Citi’s projection has a 60% opportunity of happening, and the even more intriguing cost of $50,000/ heap has a 20% opportunity of happening.

The tin advancing market is creating

The mix of quick electrification and undependable supply underpinning tin need can place Citi’s tin bull situation in the limelight earlier than financiers assume.

If need raises considerably and provides continue to be limited, the document cost of $47,800/ heap gotten to in very early 2022, soon after Russia attacked Ukraine, can be gone beyond later on this year.