3 financier conferences for several of the globe’s biggest mining firms are arranged to happen over the following 6 days, establishing the phase for possibly significant adjustments worldwide’s copper sector.

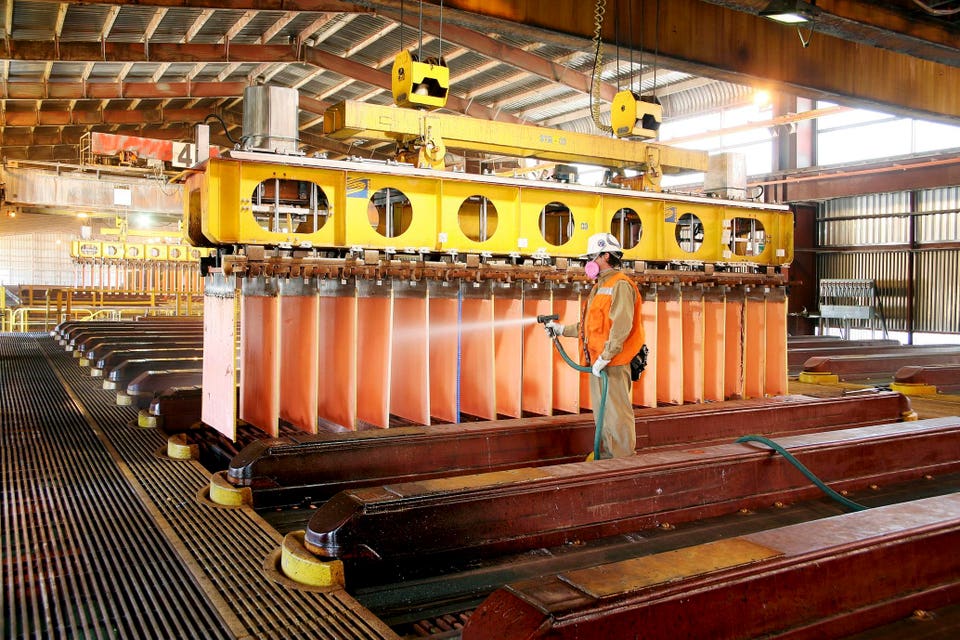

Employees tidy copper cathodes at the Escondida mine in Chile. (Picture by Oliver Lanessa Hesse/Architectural Photography/Avalon/Getty Pictures)

Getty Pictures

Switzerland-based Glencore stood apart for the very first time at a funding markets seminar later on today (December 3), with the firm’s copper mining and trading procedures drawing in one of the most interest, which have actually become its major resource of revenue as a result of dramatically climbing copper rates.

London-based Rio Tinto additionally held its very own Resources Markets Day occasion on Thursday, which will certainly be the very first significant look by brand-new president Simon Trott, that has actually recommended basic adjustments to the means the firm runs as climbing copper earnings test iron ore earnings.

Canada’s Teck Resources will certainly hold an unique conference of investors following week on Dec. 9 to elect on a recommended merging with London-based, South Africa-focused Anglo American.

What copper shares

Copper is the common measure that links the 3 firms, with present concentrate on strategies to combine 2 huge South American mines right into among the globe’s major resources of copper.

One of the most discussed copper possession is Quebrada Blanca, situated high in the Atacama Desert in north Chile, beside the bigger Collahuasi mine.

Combining both right into a solitary service had actually long been viewed as a sensible step, yet the firm distinctions and complicated logistics could not relapse.

Collahuasi is possessed 44% by Glencore, 44% by BHP and 12% by Japanese trading firm Mitsui.

Quebrada Blanca is 60% possessed by Teck Team, 30% by Japanese trading firm Sumitomo and 10% by Chilean state-owned mining firm Codelco.

Glencore is presently on the sidelines in the reshuffle of copper properties, yet it attempted to combine with Teck 2 years back. It was brought in by the worth production prospective brought by incorporating Collahuasi and Quebrada Blanca, and ultimately acquired Teck’s coal properties as payment.

Rio Tinto is additionally taking a wait-and-see strategy, yet it was reported to have actually held talks with Glencore in the center of this year regarding a merging to develop an international copper mining titan.

Australia-based BHP Billiton, the globe’s biggest miner, which has actually had its merging propositions declined 3 times by Anglo American, is not entailed yet its eager onlookers and prospective company raiders can bring the copper event to its knees.

BHP is additionally not associated with the present stage of the company copper video game, yet will likely maintain a close eye on the recently developed Anglo American/Tektronix plc adhering to the merging of Anglo American and Tektronix.

Employees at a glacier high in the Andes Hills of South America. (Picture by Oliver Lanessa Hesse/Architectural Photography/Avalon/Getty Pictures)

Getty Pictures

What’s driving whatever in the race for copper properties is the rate overview for the steel, which has deep heritage markets in building, transport and electronic devices and is seeing quickly expanding need as whatever energizes and feeds information facilities developed to take care of the power needs of expert system.

Copper rates on the London Steel Exchange have actually increased 30% to $11,189 a heap considering that the beginning of the year, with rates climbing somewhat in the USA, where need is more powerful as a result of unpredictability over tolls on imported steels.

Copper rates are anticipated to proceed climbing. Financial investment financial institution UBS anticipates rates to be US$ 11,500/ heap in the very first quarter of following year, progressively climbing in the remainder of 2026, getting to US$ 12,000/ heap in June, US$ 12,500/ heap in September, and US$ 13,000/ heap by the end of following year.

An additional financial investment financial institution, Citi, forecasts that copper rates will certainly be US$ 12,000/ heap in the following 6 to twelve month, with a 40% possibility of a booming market rate of US$ 14,000/ heap.