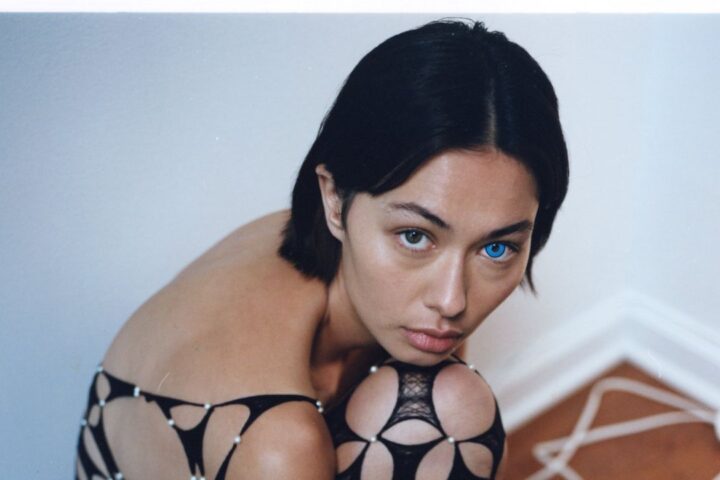

William Heinecke, creator and chairman of resort and dining establishment chain driver Minor International, talks at the Forbes Global Chief Executive Officer Meeting in Jakarta on October 14-15, 2025.

Forbes Asia

Minor International, a Bangkok-listed business regulated by billionaire William Heinecke, claimed it intends to provide a resort property investment company (REIT) in Singapore in the initial quarter of 2026 to elevate $1.5 billion.

Heinecke, 76, claimed in a meeting on the sidelines of the Forbes Global Chief Executive Officer Meeting in Jakarta recently that the IPO would certainly help in reducing the business’s financial debt and fund development intends as resort and dining establishment drivers profit from the post-pandemic traveling boom.

Heinecke claimed Minor intends to infuse some resorts right into the REIT to seek an asset-light approach. “We are relocating some hefty properties right into the REIT, yet we continue to be the bulk investor in the REIT,” claimed Chairman Heineke.

The business was started in Thailand in 1970 by Heinecke (birthed in the USA and a naturalized Thai person) when he was a small, for this reason the name. The business has actually because turned into among Asia’s biggest resort chains, running some 600 resorts with greater than 90,000 spaces globally and making Heinecke among Thailand’s wealthiest males, with a real-time total assets of $1.3 billion. Forbes‘ information.

Minor has 60% of its resort profile, with the rest had by various other celebrations. Over half of the resorts remain in Europe and belong to Madrid’s NH Resort Team, which Minor obtained in 2018 for EUR2.3 billion (after that $2 billion).

Anantara Vienna Resort.

Offered by Little International

The objective is to enhance its variety of getting involved resorts to 850 by 2027 and greater than 1,000 by 2030, Heinecke included. “We’re expanding extremely rapidly,” he claimed. “We’re getting in a great deal of markets that we have actually never ever remained in previously.”

In August, Minor began on its initial task in Singapore, the 200-room Avani Resort, which is readied to open up in very early 2027 and will certainly be co-owned and taken care of by Minor.

One more objective is to come to be progressively asset-light. Minor as soon as had 75% of the resorts in its profile, yet that portion has actually been decreasing. As soon as a few of these properties are moved to the target REIT, possession must go down listed below 60%.

To increase its development strategies, Minor has actually been authorizing a lot more monitoring agreements with third-party resort proprietors. In March, it created a joint endeavor with Tokyo-listed Royal Holdings Co. to construct 21 resorts throughout Japan over ten years. By 2030, the business wishes to invite visitors to its initial Japanese hotel, Anantara Karuizawa.

In India, Minor is tipping up its development, with strategies to establish and take care of regarding 50 buildings within a years. In 2017, the business made its initial venture right into the globe’s most heavily populated nation, opening up Oaks Bodhgaya in the northeastern Indian state of Bihar. In 2014, the business opened its front runner deluxe brand name Anantara Gem Bagh in Jaipur in the northwest Indian state of Rajasthan.

Anantara Gem Bagh Jaipur

Offered by Little International

The business has actually been reducing financial debt. In 2024, it will certainly go down 9.7% year-on-year to 93 billion baht. In July this year, Minor retrieved EUR400 numerous elderly safeguarded notes due in 2026. “High rates of interest and the closure of a lot of resorts throughout the pandemic have actually placed a great deal of stress on us,” Heinecke claimed.

Minor’s incomes recoiled highly after publishing a document bottom line of 21.4 billion baht ($ 650 million) in 2020 at the elevation of the Covid-19 pandemic. Internet earnings raised 44% to 7.8 billion baht in 2024, many thanks to greater income and reduced monetary expenditures. Heinecke claimed the development was driven by climbing need for deluxe traveling experiences, which increased the business’s income also as tenancy prices continued to be level.

” Prospective REITs might additionally speed up deleveraging and enhance returns on spent funding, supplying a near-term re-rating stimulant,” UBS experts claimed in an Oct. 9 note. The brokerage firm ranked Minor’s shares a buy with a 12-month rate target of 34 baht. The supply folded 0.4% at 22.9 baht in Bangkok on Friday.