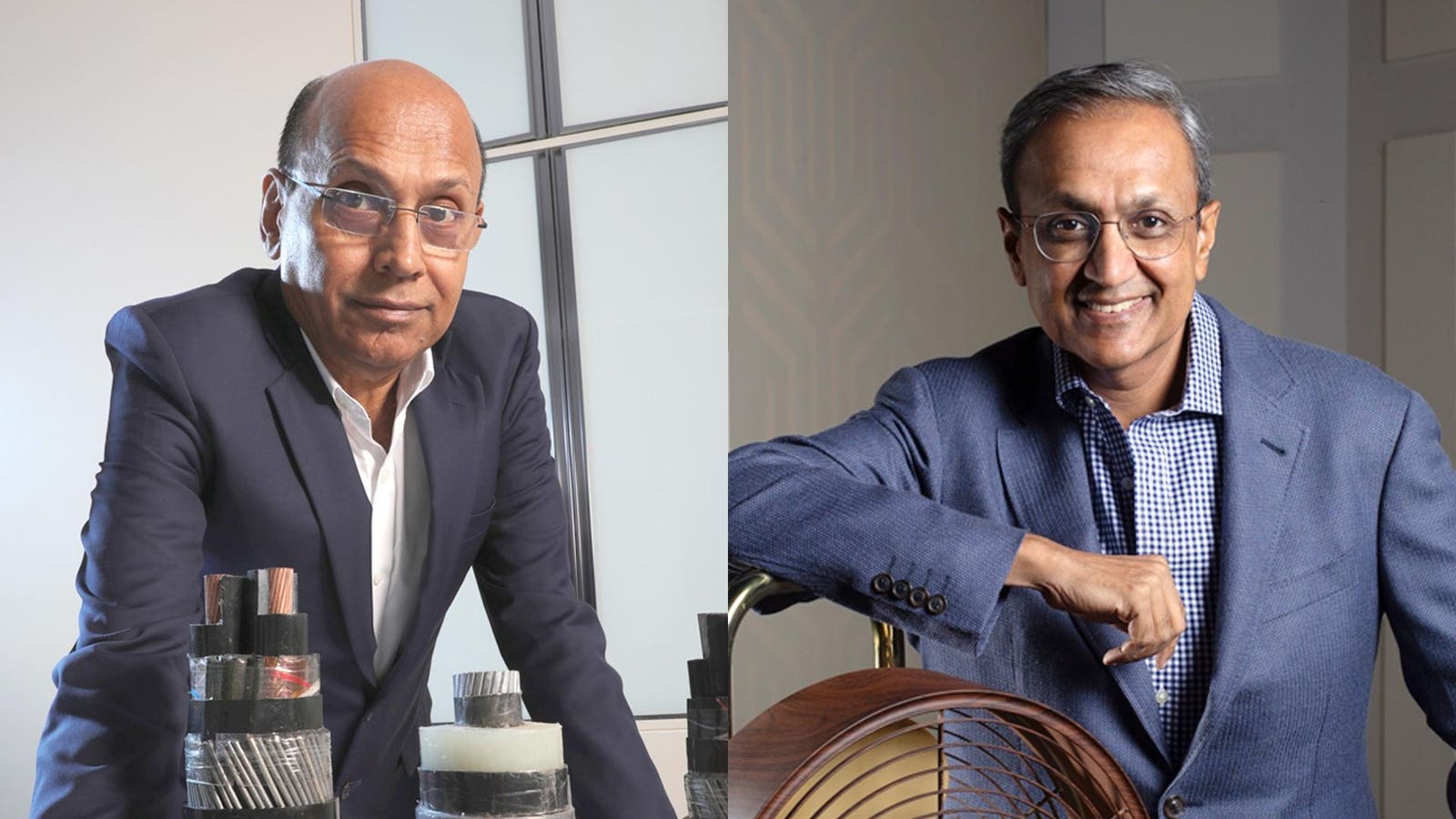

From left: Inder Jaisinghani and Anil Rai Gupta.

Jaisinghani: Mexy Xavier/Forbes India; Gupta: Madhu Kaapparath/Forbes India

This post belongs to Forbes’ 2025 insurance coverage of India’s wealthiest individuals. See complete listing below

India’s framework advancement and flourishing realty field have actually enhanced need for items varying from concrete to electric devices. 2 participants of the last listing made their ton of money throughout the boom, with their riches greater than increasing in 5 years: Inder Jaisinghani, that runs Polycab, a Mumbai-based cable and cord manufacturer, and Vinod and Anil Rai Gupta, the mother-son duo of Havells, a prominent Delhi-based home appliance brand name.

The approaching access of 2 brand-new gamers right into the nation’s $25 billion electric market is anticipated to trigger fiercer competitors as sales remain to rise, deteriorating capitalists’ leads for incumbents. While Jaisinhani’s family members ton of money has actually been virtually level this year, the Gupta family members’s total assets has actually reduced by virtually a quarter, in accordance with the decrease in the Havel family members’s supply rate.

Kumar Birla.

Aditya Birla Team

In February, Kumar Birla’s Aditya Birla Team shared passion in the market, preparing to invest 1,800 crore rupees ($ 203 million) over the following 2 years via its noted concrete subsidiary UltraTech Concrete to construct a cord and cord plant in the western Indian state of Gujarat, where it can resource the essential basic material copper. The job is anticipated to be finished by the end of 2026. The action “remains in line with our vision of giving extensive services to finish consumers in the building market,” Birla, chairman of the team, stated in a declaration.

Uttam Kumar Srimal, elderly study expert at Mumbai-based Axis Stocks, created in a record in March that the job is a critical suitable for the team, which counts realty programmers and service providers as customers and has actually developed a solid existence in the building market via its across the country network of 4,400 structure products shops. Nonetheless, he cautioned that relocating right into non-core organizations “will certainly increase issues amongst capitalists”. Srimal anticipates UltraTech’s earnings to expand by greater than a 3rd to 96.3 billion rupees in 2027 from 71 billion rupees in 2015.

Gautam Adani.

Sumit Dayal/Bloomberg

After That in March, Gautam Adani’s front runner Adani Enterprises revealed its very own prepare for the market via its freshly developed Praneetha Ecocables. The joint endeavor in between Adani Enterprises subsidiary Kutch Copper and Gandhinagar-based fabric producer Praneetha Ventures will certainly make cables, cable televisions and steel items.

Mumbai-based economic solutions strong Motilal Oswal approximates market sales will certainly expand at a compound yearly development price of 13% to get to Rs 1.6 trillion by 2030 from Rs 90,000 crore in 2025, driven by even more economic sector costs and the federal government’s ongoing promote framework advancement.