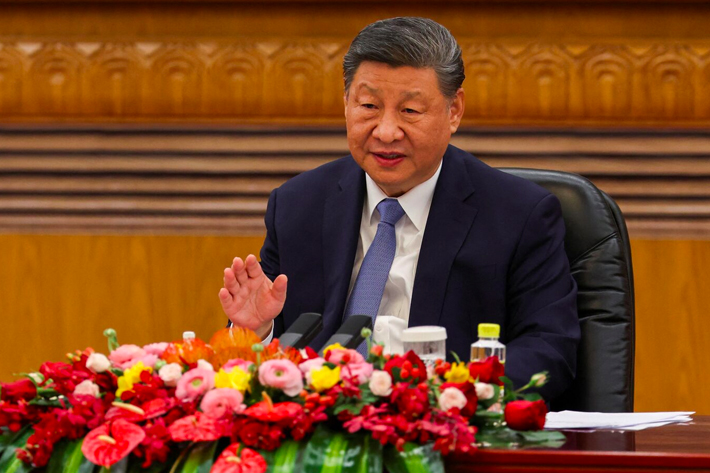

Overlooking at Xintandi in main Shanghai. Xintandi is a provided buying and dining establishment facility that has actually accomplished terrific success in its passion in food and an excellent life. (Digital Photography by Ryan Pyle/Corbis using Getty Images)

Corbis using Getty Photos

Exactly how to enhance China’s customer costs as a share of GDP is a warm subject in the nation and worldwide. In this week’s economic record, Xintiandi, the programmer chairman of among China’s a lot of legendary retail and business realty tasks, has actually intensified the existing customer fads in the existing customer fads.

Shui, in a most recent acting record launched by a Hong Kong noted business on Wednesday, created in a current acting record by a Hong Kong-listed business that drawing away customer perspectives and financial unpredictability has actually resulted in substantial modifications in China’s retail costs.

” The retail landscape in China is undertaking substantial modifications, with the financial overview unclear as customer perspectives rise and fall as usage is mainly controlled by better and seasoned experiences at the cost.”

” Residential usage is a vital part of financial task: “However due to weak customer self-confidence, restricting development. As a result, promoting residential need will certainly remain to be a crucial job in the coming years.”

China’s GDP development is targeted at 4.5% in 2025 and 4.5% in 2025 as worldwide profession constraints and unpredictabilities on exports, making financial investment and labor need. It explained: “Along with temporary stimulation, China requires to depend a lot more on house usage as a development engine. Constant renovation of house usage will certainly need higher reform passions.”

Xintiandi opened up in main Shanghai in 2001. As opposed to knocking down the run-down structures and developing brand-new homes that will certainly be marketed out swiftly, Shui On, major engineer Benjamin Timber protected a number of the initial structure products from the location and transformed them right into an icon of city site visitors, seeing them millions annually. Retail lessees consist of lots of worldwide brand names such as Lululemon and Salomon. Simply this month, Italy’s Ludovico Martelli opened up a specialized Xintiandi shop for its Marvis tooth paste. Marvis sets you back greater than $10 for tube A.

Freshly opened up Marvis tooth paste shop in Xintiandi, Shanghai.

Mavis

Lo kept in mind in his notes that Shui On’s Xintiandi retail residential property gain from the change of the customer landscape. They had the ability to preserve high tenancy, balanced 94% in the very first 6 months of the year, while spread and sales expanded 10.5% throughout that duration. Capitalists have actually enhanced Shui’s share cost by greater than 7% over the previous year.

Lo belongs to among one of the most renowned service family members in Hong Kong. Success started with his papa, Lo ying Shek, that introduced the family members’s initial front runner Huge Eagle as a realty advancement business in 1963. The enthusiastic Vincent body got on the board of the Hong Kong-listed Big Hawks however bought alone in 1971, obtaining $100,000 from his papa and HK$ 100,000 from his papa. “I have actually made a great deal of resolution considering that I was a youngster,” his bro KS Lo informed Forbes Asia in a 2010 meeting.

Vincent got here in landmass China in 1982 and not long after he developed himself as “Mr. Shanghai”, an organization supporter for the city. He openly appreciated Shui’s public structures and products in Hong Kong in 1997; realty financial investment was ultimately included right into the land in 2004, which was released in 2006. Today, he deserves $1.4 billion on Forbes’ real-time billionaire checklist.