China’s world-beating automobile market is gazing right into a void.

Its carmakers and dealerships are battling to generate income and strong competitors has actually left ratings of companies on the verge of collapse. At the same time, lots of countless automobiles are being cost a portion of their cost, or left deserted entirely in automobile graveyards.

Those are the searchings for from a substantial examination accomplished by Reuters, which evaluated countless car-sales listings and thousands of federal government records, state-media records, court filings and customer grievances, and talked to with some 20 market gamers, consisting of dealerships, purchasers, experts and producing execs.

Likewise on AF: Huang Voices Frustration After China Bans Nvidia’s AI Chips

Market execs claim earning a profit is almost difficult for mostly all car manufacturers in China, where electrical cars begin at much less than $10,000– in raw comparison to the United States, where carmakers provide simply a couple of under $35,000.

A lot of Chinese dealerships can not generate income, either, according to a sector study released last month, due to the fact that their whole lots are obstructed with excess stock.

At the origin of the issue are years of aids and various other federal government plans targeted at making China a worldwide automobile power and the globe’s electric-vehicle leader.

China has a lot more residential brand names making even more automobiles than the globe’s greatest automobile market can take in due to the fact that the market aims to strike manufacturing targets affected by federal government plan, rather than customer need, Reuters discovered.

And to deal with the resulting excess, Chinese car manufacturers and dealerships have actually considered uncommon techniques that recommend a prospective shakeout impends for the globe’s biggest automobile market.

A plan mess

The seeds of the existing state of China’s automobile market were grown in Beijing, where nationwide policymakers as much back as the 1990s wished to place China in the vehicle driver’s seat of electrical automobile manufacturing.

In 2009, Beijing introduced a program to urge carmakers to generate EVs and customers to purchase them, backed by billions of bucks in aids.

By 2017, EVs had not removed. That year, Chinese federal government authorities prepared a car-making plan plan that described an objective of generating 35 million cars a year by 2025– approximately double the United States yearly sales document.

The promote EVs came to be specifically extensive as an overheated home field started to attack city governments and unsold condominium obstructs started evaluating on the Chinese economic climate. The automaking plan came to be a prompt different financial column for city governments that had actually started to count on land sales and real-estate tax obligation income.

The 2017 strategy assisted sustain a shuffle by neighborhood authorities to charm EV manufacturers. And by in 2015, China resembled the target, developing greater than 31 million cars, according to market body CAAM.

This competitors developed a playbook throughout China: City governments offer rewards to car manufacturers and need manufacturing and tax-revenue targets in return. Car manufacturers commonly concentrate a lot more on striking those targets than profiting. Gradually, makers that may fall short in various other markets are commonly survived by city governments that have a beneficial interest in their survival.

” When there is a regulation from Beijing that this is a calculated market, every rural guv desires the automobile manufacturing facility. They intend to remain in good condition with the event,” claimed Rupert Mitchell, an Australia-based macroeconomics analyst that formerly operated at a Chinese EV start-up. “Eventually, what occurs is that it makes the present automobile field double down on financial investment.”

Some good fortunes

Federal governments that bank on the appropriate car manufacturer saw enormous gains. In 2021, as an example, the area federal government of Changfeng, in Anhui district, brought in automobile large BYD with extremely low-cost land. In return, the area, whose primary market was making standard flatbread, obtained a BYD mega-factory.

Over 5 years, BYD acquired up 8.3 square kilometres of land in Changfeng at a typical cost 40% listed below that paid by various other purchasers, Reuters established from property-sales filings released by China’s federal government. BYD really did not attend to concerns regarding the setup and various other issues elevated in this record. An individual gotten to by phone at Changfeng area’s publicity workplace claimed several of the coverage was imprecise and decreased to clarify.

In 2023, the year after BYD began manufacturing in Changfeng, the area’s financial development surpassed the nationwide price by 9.1 portion factors. In 2015, it stayed 5.6 portion factors greater.

The main Individuals’s Everyday paper admired Changfeng in March for its impressive development, pointing out BYD as a significant element.

2 Communist Celebration authorities in Changfeng connected to the BYD job, Follower Shaobin and Li Mingshan, got promos to greater degrees of federal government in 2024, notifications released by the event’s Anhui Provincial Board program.

Complying with a comparable playbook. smart device manufacturer Xiaomi started purchasing land in Beijing’s Yizhuang area in 2022 for an EV manufacturing facility. By 2024 it had actually acquired greater than 206 football areas’ well worth at a typical cost 22% listed below the price others spent for commercial land, land-sales filings reveal. The city of Beijing needed the plant to produce a minimal yearly income of 47 billion yuan, regarding $6.6 billion, at complete manufacturing, according to the filings.

A vicious circle

While some federal governments won large, these plans increased overcapacity throughout the nation, leading to a cost battle that has actually currently surged on for 3 years.

Worries around cost cuts have actually been such that in June, after BYD introduced ruthless brand-new cost cuts, the principal of Great Wall surface Motors, among China’s earliest carmakers made a collection of unusual public declarations declaring cost battles were ruining all-time low lines of automobile business and their vendors, while additionally producing a hill of financial debt.

” The EV market’s Evergrande is currently right here,” Wei Jianjun claimed describing China’s once-largest home programmer that went belly-up in 2022 as a result of its greater than $300 billion well worth of financial debt. Car manufacturers such as Geely and GAC Aion supported Wei.

The only retreat would certainly entail allowing lots of car manufacturers fall short, some experts claim. Yet lots of Chinese authorities have actually withstood that tough-love course, which market experts claim would certainly run the risk of mass discharges and dropping customer costs.

That leaves car manufacturers and city governments secured a boosting downward spiral, claimed Yuhan Zhang, primary economic expert at The Meeting Board’s China Facility, a research study team.

” They’re feeding each various other, enhancing each various other, which can catch the marketplace in a vicious circle,” he claimed.

He Xiaopeng, the chief executive officer and founder of Chinese EV start-up Xpeng, forecasted in 2023 that each Chinese car manufacturer would certainly require to offer 3 million automobiles a year by 2030 to endure– which just 8 companies would certainly be left standing. Xpeng offered 190,000 automobiles in 2015.

A couple of large gamers are striking or coming close to those quantities and show up placed to profit in a shakeout. In January, Geely claimed it intends to offer 5 million cars yearly by 2027, greater than double the 2.2 million it offered in 2015.

Market leader BYD has actually additionally established enthusiastic targets for 2025, though its growth has actually been slowing down. In August, its quarterly earnings dropped for the very first time in greater than 3 years. Inside, BYD has actually downsized its initial strategy to offer 5.5 million cars and currently anticipates to relocate at the very least 4.6 million, Reuters reported this month.

A lot of market gamers are marketing a portion of those quantities, yet are still cranking up manufacturing– in at the very least 3 situations at the wish of federal government authorities.

In 2015, as state-owned car manufacturers such as Changan, Dongfeng and FAW fell back their exclusive peers in the EV race, the nationwide regulatory authority of government-owned companies introduced that it desired the state business to expand market share and manufacturing, instead of concentrate on earnings. Neither the car manufacturers neither the regulatory authority, the State-owned Properties Guidance and Management Compensation, dealt with Reuters’ concerns regarding the regulation.

In July, Changan claimed it wished to quadruple sales of new-energy cars by 2030. “We will certainly function in the direction of coming to be a leading 10 international and first-rate automobile brand name,” chairman Zhu Huarong claimed at a July 30 interview.

Cushioning sales quantities

On The Other Hand, some EV brand names such Neta and Zeekr have actually considered blowing up sales in recent times, with Neta doing so for greater than 60,000 automobiles. The car manufacturers scheduled automobiles to be guaranteed also prior to they were offered, so the cars can be officially scheduled towards month-to-month sales targets.

Neta’s moms and dad, Hozon, which remains in personal bankruptcy management, was just one of China’s most popular EV startups simply 3 years earlier

At the same time, Zeekr claimed in July the automobiles had actually been guaranteed with necessary web traffic insurance policy to guarantee their security while showed, which they were legitimately brand-new when offered to purchasers.

Neta and Zeekr exemplify industrywide extra padding of sales numbers, a lot of it including ‘ zero-mileage’ utilized automobiles that have actually been guaranteed and scheduled as offered, dealerships and experts claim. Suppliers and investors export those automobiles as utilized, commonly with the support of city governments, or offer them locally with grey markets.

In June, 4 local supplier teams called car manufacturers’ rewards “a masked means of requiring dealerships to misstate sales quantity,” without determining automobile business.

Obtained ta maintain marketing

Chinese brand names currently much outmatch international competitors in supplying brand-new designs. Car manufacturers have manufacturing facility ability to generate two times the 27.5 million automobiles they made in 2015, according to working as a consultant Gasgoo Automotive Research study Institute.

The issue is specifically severe in gas cars, for which need has actually cratered in the previous couple of years as Beijing motivated EVs. At the very same time, the variety of EV manufacturing facilities multiplied as business and neighborhood authorities stacked in. AlixPartners, an additional working as a consultant, anticipates just 15 of the 129 EV and crossbreed brand names in China will certainly be economically practical by 2030.

And with better manufacturing comes boosted stress to strike sales targets and acquire market share.

Lorry makers in China are driven to maintain marketing and generating, also at deep losses, due to the fact that this makes sure capital, which is vital to survival, claimed Liang Linhe, the chairman of Sany Heavy Vehicle, among China’s biggest vehicle manufacturers.

” It resembles riding a bike: As long as you maintain pedaling, you may really feel worn down, yet the bike remains upright,” he informed Reuters.

Grey markets and TikTok livestreams

The marketplace problems so developed have actually left car manufacturers with couple of choices to handle increasing stocks. Some automobiles wind up in grey markets, where automobiles can wind up being cost as high as a quarter of their listing costs.

In one display room on the borders of Chengdu, Reuters reported in your area made Audis being cost 50% off. Likewise, a seven-seater SUV from China’s FAW has to do with $22,300, got on sale for greater than 60% listed below its price tag.

The offers were being provided by a business called Zcar, which claimed it purchases wholesale from car manufacturers and car dealerships.

Zhou Yan, Zcar’s advertising supervisor, informed Reuters it can cost deep price cuts due to the fact that it purchases some cars straight from car manufacturers in sets.

When Reuters saw Chengdu in June, livestreamers were promoting a set of GM’s Chevrolet Malibus. Zhou claimed Zcar had actually obtained greater than 3,000 Malibus in China from SAIC-GM, the United States car manufacturer’s Chinese joint-venture entity, and was marketing them for under $14,000 each, below a price tag of $24,000.

GM informed Reuters that “certified dealerships are the only authorities networks for our automobile sales,” which Zcar “isn’t a supplier associated whatsoever” with SAIC-GM. It decreased to clarify.

Zcar ultimately informed Reuters its subsidiary, Cheshi, had actually gotten 3,428 Malibus mainly for wholesale circulation to car dealerships, without defining from whom.

Zcar included that it provides “preferred, eye-catching designs to bring in consumers to our shops” and commonly offers them muddle-headed. Its sell the Malibus hasn’t been formerly reported.

Some Audis were valued at half off when Reuters saw. Audi decreased to talk about Zcar’s techniques yet informed Reuters it does not sustain grey-market profession, which damages the lasting worth of its cars.

Zcars has actually currently reached to generate TikTok influencers to liquidate automobiles. On such live-streaming host, Wang Lihong, lately informed his 1.25 million fans that Zcar was Sichuan district’s greatest vendor of zero-mileage “utilized” automobiles.

He claimed they are generally offered in March, June, September and December, “when dealerships hurry to satisfy the quarter or yearly sales targets established by the car manufacturers for cash money refunds.”

” There’s no automobile that can not be offered, just a cost that isn’t right,” Wang claimed in a livestream in July.

‘ The marketplace will certainly pass away!’

The flooding of brand-new automobiles has actually additionally made it harder for dealerships to make a profit, claimed Chen Keyun, a retired supplier in Jiangsu district. His evaluation was supported by 4 dealerships that talked on problem of privacy.

And it has actually compelled dealerships to offer brand-new automobiles at losses, or unload them to investors that offer them on as zero-mileage “utilized” automobiles. Simply 30% of dealerships pay, an August study by the China Car Dealers Organization (CADA) discovered.

In June, supplier teams in Henan and Sichuan districts and the Yangtze River Delta broadcast their complaints openly.

” We advise car manufacturers to develop sales advice plans that line up with market truths,” the Henan Car Market Chamber of Business claimed in an open letter to undefined car manufacturers. “If the sales networks collapse, the marketplace will certainly pass away!”

Larger car dealerships overpurchase stock to strike car manufacturers’ sales targets and get manufacturing facility refunds, Chen claimed.

” If you have handled to offer 16 out of the 20 systems targeted for the month, what will you make with the continuing to be 4 systems on the really last day of the month?” claimed one supplier in Jiangsu. Offering those automobiles, also at fire-sale costs, would certainly suggest getting a benefit of around 80,000 yuan, or $11,200, and placed him near break-even.

Lang Xuehong, replacement secretary-general of the CADA market team, recognized dealerships were costing as much as 20% listed below their expense. This was “unmatched,” she informed Reuters in a June 24 meeting.

A zombie auto graveyard

At the same time, some new cars that aren’t offered wind up in automobile graveyards. City governments have actually stressed to tidy up abandoned-car whole lots, which eat land and produce ecological risks.

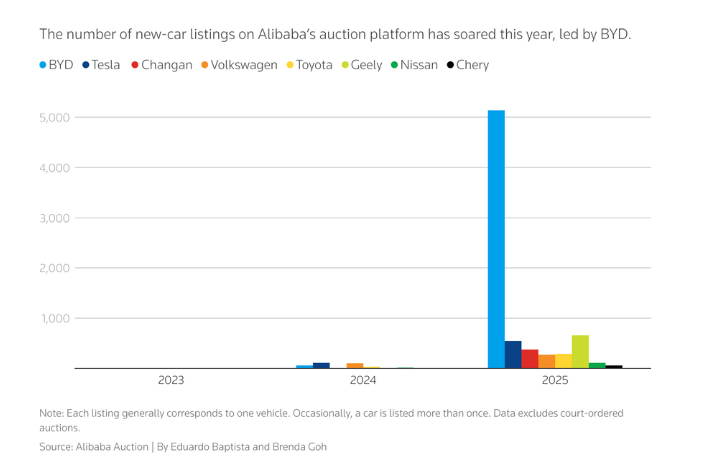

Various other automobiles wind up parked for the long-term on public auction websites, consisting of those run by ecommerce large Alibaba. Lots of obtain no prospective buyers. A Reuters testimonial of Alibaba listings recognized greater than 5,100 public auction notifications this year for new BYD automobiles that had actually been guaranteed and signed up, up from 61 in 2024.

Chinese courts, as well, have actually been holding public auctions for brand-new and unsold automobiles coming from defaulted dealerships.

One Alibaba listing in April 2024 that marketed a set of 94 automobiles made by Dongfeng Honda revealed images of cars parked inside. The white body of one was covered with gunk, with the pole positions covered in plastic sheets. Dongfeng really did not react to concerns; Honda claimed it could not talk about the tasks of its certified dealerships.

An additional clean-up purchased by a Shenzhen court entailed almost 2,000 automobiles constructed in 2018 by Denza, currently totally had by BYD. The cars were parked in Chengdu, Guangzhou and at BYD’s manufacturing facility in Shenzhen after the customer, ride-hailing company Guizhou Qianxi, entered into a disagreement with Denza in 2020 over refunds and undefined legal issues.

The cars rested gathering dirt till 2023, when the court placed them up for public auction. Court-appointed assessors discovered the automobiles had actually been hardly driven and their insides were new. They had actually been left in different places– consisting of a location alongside a supermarket where citizens hang their washing.

The automobiles quickly started showing up on social-media systems. Livestreamers were marketing the cars for just $9,000– a quarter of their initial cost.

Repercussions for the Chinese economic climate

Yet, regardless of the mess in the automobile market, sugar from city governments remain to move.

In June, Guangzhou authorities released a plan file that claimed the city wished to cultivate as much as 3 manufacturers of “brand-new power cars,” that include totally electrical automobiles along with crossbreeds, per generate 500,000 cars a year. In return, Guangzhou would certainly honor as much as 500 million yuan (regarding $70 million) yearly per car manufacturer that developed brand-new assembly line and made 100,000 cars within 3 years. The city really did not react to an ask for remark.

A minimum of 6 various other city governments in between 2023 and 2025 released plans to tempt car manufacturers to raise result, plan records reveal.

The issue of overcapacity, on the other hand, is not restricted to simply the EV market, yet additionally others such as the home market that continues to be much from seeing any type of recuperation, and the solar market, which is presently in the center of a shakeout. The concern is so deep rooted in the Chinese market that it has actually gained it very own monicker– neijuan, or ‘involution’— a term utilized to describe hyper-competition that comes to be suicidal and incentivises uneven techniques.

In current months, however, Chinese authorities have actually begun to appear alarm system bells on the automobile cost battles, stating the competitors was unreasonable and unsustainable This summertime, Head of state Xi Jinping told off rural authorities, doubting why every district was competing to buy a handful of innovations such as EVs and expert system.

The developing situation has bigger effects for China’s economic climate, where the automobile market and relevant solutions make up regarding one-tenth of gdp.

Federal government plans that prioritise sales and market share commonly do so as a result of bigger objectives for work and financial development.

Yet with losses placing for many carmakers, there is expanding talk amongst some market experts of a stressful shakeout.

Still, 3 market numbers and 2 experts informed Reuters a sudden shock is not likely: Combination can take years, and city governments would possibly sustain smacking car manufacturers, consisting of the after effects.

” The issue of excess ability in China is a systemic issue,” Michael Pettis, an elderly other at Carnegie China research study centre, claimed.

- Reuters, with extra modifying by Vishakha Saxena