When Forbes Asia launched in September 2005, it marked the start of a dedicated focus on, as we then described it, the world’s most economically dynamic region. Over the past two decades our network of reporters and editors has documented the titans and companies forming the backbone of Asia’s economies and creating the wealth that has underpinned regional growth.

We’ve journeyed with our readers through China’s prosperity boom and slowdown, India’s transformation under Prime Minister Narendra Modi, ASEAN’s trade and economic expansion, the fallout of the 2008 global financial crisis, and, most recently, the aftermath of the Covid-19 epidemic.

As the trusted chronicler of wealth, we’ve tracked the explosion in the number of billionaires in this region. There were 115 Asians worth a collective $364 billion on our World’s Billionaires list of 2006. This tally has since soared. In the 2025 rankings, there were a total of 1,046 billionaires from the Asia-Pacific, collectively worth $4.2 trillion. China (including Hong Kong) and India had the second- and third-largest number of billionaires in the world after the U.S., with 516 and 205, respectively. Our dozen country rich lists, where the typical minimum net worth requirement of $1 billion does not apply, cast a wider net, though in China and India that sum is no longer enough to earn a berth among their 100 richest.

We drilled deeper to uncover top-performing businesses (and future billionaires) through our annual Best Under A Billion list, which highlights 200 publicly listed small and midsized companies with sales below $1 billion. In 2012 we kicked off an annual roster to celebrate the growing presence of Asia’s power businesswomen. And 2016 saw the debut of a regional 30 Under 30 list to foreground young achievers, including entrepreneurs, artists and athletes. Our 100 to Watch list of small companies and startups on the rise was launched five years ago.

The accompanying pages showcase many of the moguls featured on our covers over the past 20 years whose achievements have contributed to planting Asia firmly on the global economic map.

Edited by Mary E. Scott

Forbes Asia September 5, 2005

Forbes Asia

September 5, 2005

We shadowed India-born, U.S.-based venture capitalist Promod Haque of Norwest Venture Partners as he crisscrossed his homeland searching for high-tech gold. In his 35-year career, Haque rolled the dice on some 70 companies, roughly 10% in India, with a combined exit value of $40 billion. That put him on the Forbes Midas List of top VCs more than a dozen times. Now in a part-time role at Norwest, the 77-year-old still believes India provides ample “opportunity for great investment success.”

Forbes Asia October 31, 2005

Forbes Asia

October 31, 2005

This compendium of Asia-Pacific’s 200 top-performing small and midsized companies with annual revenue under $1 billion often has titans in the making. Notable alumni of the Best Under A Billion list over the years range from China’s Alibaba, Baidu and Tencent to Malaysia’s AirAsia and the Philippines’ Jollibee to India’s Infosys and Biocon.

Forbes Asia December 26, 2005

Forbes Asia

December 26, 2005/February 2024

We highlighted Singapore Airlines in the aftermath of the SARS epidemic, when it posted profits amid high fuel prices and a threat from Dubai-based Emirates. It has since won accolades as one of the world’s best carriers. In 2024, we revisited the airline after it had scooped up a 25% stake in the privatized Air India, partnering with the Tata conglomerate. Net profit hit a record $2.8 billion in the year to March 31, though the Air India bet has yet to pay off.

Forbes Asia January 9, 2006

Forbes Asia

January 9, 2006

U.S.-educated brothers Victor and William Fung were named our 2006 businessmen of the year for converting their family company, Li & Fung, into a world-class enterprise connecting American and European consumers to factories in 40 countries. While they still retain significant stakes, Victor’s son Spencer is now group executive chairman. In 2020, the family partnered with Singapore logistics firm GLP to take Li & Fung private, delisting it from the Hong Kong stock exchange after a 28-year run.

Forbes Asia May 6, 2006

Forbes Asia

May 6, 2006

Korean skincare and cosmetics maker Amorepacific drew our attention long before the K-beauty phenomenon exploded, with products now routinely flogged by influencers on social media. In 2015, we named its billionaire chairman and CEO, Suh Kyung-bae, grandson of the founder, as businessman of the year. Today, as Americans panic buy their favorite K-beauty brands before the Trump tariffs hit, the company’s $3 billion in annual revenue looks set to get a lift.

Forbes Asia December 11, 2006

Forbes Asia

December 11, 2006

Nandan Nilekani was facing a problem at Infosys, the software company he cofounded: hiring 28,500 people in one year. In today’s AI world, the Indian IT behemoth has reportedly slowed recruitment. More than 80% of the 324,000 people it employs—up fivefold since 2006—are tagged “AI aware.” Nilekani left Infosys in 2009 to work with the government to build Aadhaar, India’s mammoth identity card scheme. A boardroom shake-up eight years later brought him back to Infosys as chairman.

Forbes Asia January 8, 2007

Forbes Asia

January 8, 2007

We profiled Li Ka-shing, nicknamed Superman, who at the time was the richest man in Asia and running his telecom-to-ports empire with an eye on China expansion. Today the 97-year-old’s CK Hutchison, from which he retired as chairman but remains as senior advisor, is in the throes of a complex $23 billion deal to sell its port assets, including two at the Panama Canal, which is strategically important to both the Americans and Chinese. The possible buyer is a consortium that includes U.S. investment firm BlackRock and, potentially, state-owned China Cosco Shipping. Li, who got his start making plastic flowers, is now among Asia’s richest with a $40 billion fortune.

Forbes Asia November 26, 2007/October 2020

Forbes Asia

November 26, 2007 and October 2020

Vaccine billionaire Cyrus Poonawalla, founder of privately held Serum Institute of India, was the face of our 2007 list of 50 richest Indians. By 2014, the roster had expanded to 100 and each had to be worth at least $1 billion to qualify. In 2020, when the pandemic shut down the world, Poonawalla’s son Adar stepped up to produce a Covid-19 vaccine licensed from AstraZeneca. Last year was a record breaker for the list: the combined wealth of India’s 100 richest surpassed $1 trillion for the first time.

Forbes Asia December 24, 2007

Forbes Asia

December 24, 2007

When we met with Edwin Soeryadjaya, he was dead set on restoring the family fortune, wiped out when his father sold a stake in automotive group Astra to bail out a bank that was run by another son. Soeryadjaya rebuilt the clan’s wealth largely through a stake in coal miner Adaro. Lately he’s been greening his portfolio with solar and carbon-offset investments.

Forbes Asia January 7, 2008

Forbes Asia

January 7, 2008

Nvidia was named company of the year when the California-based chipmaker’s graphics processors were revolutionizing how we watched TV, gamed and used the internet. Today, the company is making a bigger killing as the supplier of the world’s most powerful AI chips, propelling its market cap to over $4 trillion. Founder and CEO Jensen Huang’s wealth has ballooned to $157 billion, making him the world’s seventh-richest person.

Forbes Asia January 28, 2008

Forbes Asia

January 28, 2008

In 2020, Hong Kong billionaire Francis Choi put his money behind biodegradable plastics to make environmentally friendly toys. This was a break from 2007, when Choi’s Early Light Industrial’s China-made toys for Mattel were found to contain lead paint. The “King of Toys” now has broader interests, from property to luxury watch retailing.

Forbes Asia October 27, 2008

Forbes Asia

October 27, 2008

Unfazed by the global financial crisis, brandy billionaire Andrew Tan teamed up with Malaysian gaming tycoon Lim Kok Thay’s Genting to invest $1.6 billion in building two casino resorts to make Manila the next Monte Carlo. While the partnership ended in 2023, it was a smart bet for Tan. Last year, the Philippines hit a record $7 billion in gross gaming revenue, higher than Singapore’s estimated $6 billion but dwarfed by the $27 billion for Macau, still the world’s top gambling city.

Forbes Asia December 8, 2008

Forbes Asia

December 8, 2008

Just months after featuring on our cover, William Amelio stepped down as CEO of Lenovo after a four-year stint; Yang Yuanqing—who in 2004 transformed Lenovo into a global tech player by buying IBM’s PC business for over $1 billion—was reinstated in his place, and founder Liu Chuanzi returned as chairman. The leadership overhaul came after sales plunged and the company slid into the red. Today, Lenovo is the world’s No. 1 PC maker in unit terms, up from No. 4 in 2008. Yang is CEO, chairman, and a billionaire. Liu is honorary chairman.

Forbes Asia March 2, 2009

Forbes Asia

March 2, 2009

Tadashi Yanai’s goal was to have more people wear his threads than those made by rivals Gap, H&M and Zara owner Inditex. He has since nearly tripled Uniqlo’s store network to some 2,500 outlets worldwide. Based on its $21 billion revenue for fiscal 2024, Yanai’s Fast Retailing has trounced Gap, is closing in on H&M, but has still to catch up with Inditex. Yanai, who became Japan’s richest person in 2009 and is now worth $45 billion, has said that he spends the bulk of his time mentoring potential successors.

Forbes Asia March 30, 2009

Forbes Asia

March 30, 2009

Our World’s Billionaires List saw a wealth meltdown in the aftermath of the global financial crisis, and India’s Gautam Adani was no exception. We met the commodities-and-infrastructure tycoon three months after he’d narrowly survived a terror attack by gunmen in a Mumbai hotel. Atop a shipping container at his Mundra port, Adani posed gamely for our photographer. He went on to greater heights, briefly surpassing the likes of Jeff Bezos, Warren Buffett and fellow Indian Mukesh Ambani in 2022 to become the world’s second-richest person, worth $143 billion. Months later, that went into freefall when U.S. firm Hindenburg Research accused Adani and his companies of financial fraud and stock market manipulation, allegations the businessman denied. His wealth has climbed again since, though not to the same stratospheric level.

Forbes Asia September 21, 2009

Forbes Asia

September 21, 2009

One year after we profiled Baidu cofounder and CEO Robin Li, Google quit China amid a cyberattack and concerns about censorship, clearing the way for Baidu to become the mainland’s top search engine. The homegrown internet giant has waded into cloud computing and is investing heavily in AI with a ChatGPT-like service called Ernie.

Forbes Asia March 2010

Forbes Asia

March 2010

Australian trucking billionaire Lindsay Fox declared that the global economic downturn had delivered a record year for his privately owned Linfox, a mover of goods across Asia-Pacific: “Everyone’s eating more at home, everyone’s drinking, and everybody who’s a miner is digging.” A decade later, Covid-19 was a mixed bag. Linfox snagged a government contract to transport tens of millions of vaccines but profits were hit by higher supply chain costs. Fox, 88, has handed running of the business to son and executive chairman Peter.

Forbes Asia August 2010

Forbes Asia

August 2010

Quitting his career as a banker, Singapore’s Simon Cheong plunged into property development, founding SC Global in 1996 to build ultra-luxury properties, well before the influx of the wealthy from overseas turned into a flood. Known for his meticulous attention to detail, Cheong set a then-record with the Marq, where a four-bedroom unit fetched $16 million in 2011.

Forbes Asia December 2010

Forbes Asia

December 2010

Tony Fernandes single-handedly made air travel affordable for millions of people when he relaunched AirAsia as a no-frills carrier in 2001. The journey’s been bumpy at times, but the former music industry executive is still flying high as CEO of Capital A, the holding company for the Malaysia-based airline.

Forbes Asia March 2011

Forbes Asia

March 2011

Charles Chao, CEO of news and entertainment portal Sina, launched microblog Weibo just as Twitter (now X) and Facebook (now Meta) were banned in China. Weibo took off, becoming a forum for popular opinion since surging to 600 million active monthly users. But its Nasdaq-listed shares are down about 90% from a high of $142 in 2018, battered by a massive data breach in 2020 and a weak advertising market.

Forbes Asia July 2011

Forbes Asia

July 2011

Our reporter tagged along with Jackie Chan as he raced around Asia combining his job as an action movie celebrity with charitable works, which put him on our annual Heroes of Philanthropy list. His Jackie Chan Charitable Foundation, launched in 1988, offers scholarships to students as well as medical services and aid during natural disasters. In 2004, he kicked off his Dragon’s Heart Foundation to build schools and help the elderly in remote parts of mainland China. Chan has said he plans to give his estimated $400 million fortune to charity when he dies.

Forbes Asia December 2011

Forbes Asia

December 2011

Thailand’s richest person, Dhanin Chearavanont, was then busy hatching a plan for his Charoen Pokphand group, an early mover in China, to build megafarms to feed the country’s growing middle class. In 2024, the group’s Bangkok-listed CP Foods unit drew two-thirds of its $18 billion revenue from overseas. Dhanin stepped back from running his agribusiness-to-telecoms conglomerate in 2017, handing charge to his two sons, though he remains senior chairman.

Forbes Asia March 2012

Forbes Asia

March 2012

Teresita Sy-Coson was the cover star for our inaugural Asia’s Power Businesswomen list. More than a decade later she remains at the top of the Sy family’s SM Investments holding company, building on the vision of her father, founder Henry Sy, who died in 2019. In the 20 years since listing on the Philippine Stock Exchange, the retail, banking and property conglomerate has seen its shares soar almost sevenfold.

Forbes Asia July 2012

Forbes Asia

July 2012

Vincent Tan brought McDonald’s to Malaysia, laying the foundation for Berjaya, a retail, property and financial services group that made him one of the country’s richest people. But in 2012, on turning 60, Tan took a back seat to embark on a new mission, helping ordinary Malaysians speak better English. Tan returned as Berjaya’s executive chairman five years later, moving into an advisory role in 2023. He reportedly plans to donate half his estimated $800 million fortune to charity.

Forbes Asia December 2012

Forbes Asia

December 2012

At the time, Taiwan Semiconductor Manufacturing (TSMC), founded by Morris Chang in 1987, was growing fast, driven by surging demand for its chips for smartphones and tablets. Today, the AI boom is fueling sales at one of the world’s largest chipmakers, with Apple and Nvidia among its biggest customers. With substantial investments in the U.S., TSMC is likely to be exempted from Trump’s tariffs. Chang, 94, who has long since retired, was named by Forbes in 2017 as one of the 100 Greatest Living Business Minds.

Forbes Asia January 2012

Forbes Asia

January 2013

Peter Woo, one of Hong Kong’s ten richest people, spoke to us at a time when Hong Kongers were complaining about the influx of mainland Chinese visitors. The owner of two flagship shopping malls, whose wealth had doubled in a year to $8 billion thanks to the shopping frenzy, was more welcoming. Two years later, Woo handed charge of his holding company, Wheelock, to son Douglas.

Forbes Asia March 2013

Forbes Asia

March 2013

We outed Pham Nhat Vuong, founder and chairman of Vingroup, one of Vietnam’s largest conglomerates, as the country’s first billionaire. The self-made Vuong, now worth around $13 billion and the country’s richest person, has been on an expansion binge since, muscling into everything from EVs to renewable energy and hotels. In June, Vingroup revealed plans to build a $14 billion port-and-logistics hub outside Hanoi, where it is based.

Forbes Asia June 2013

Forbes Asia

June 2013

The founder and executive chairperson of Biocon, which made her the richest self-made woman in India when it went public in 2004, has poured her energy and resources into making a range of low-cost drugs, including for chronic diseases. After losing a friend to cancer, Kiran Mazumdar-Shaw set up a cancer center in Bangalore as well as centers for advanced therapeutics and research. Shaw, now 72, whose late husband, John, was also a cancer patient, has pledged to leave 75% of her $3.3 billion wealth to charity.

Forbes Asia March 2014

Forbes Asia

March 2014

Chew Gek Khim wrested control of Singapore’s Straits Trading in 2008 after a high-profile bidding war with OCBC’s Lee family. Then she got busy revamping the staid colonial-era tin smelter into a sleek 21st-century holding company, broadening its activities to include property, hospitality and asset management. Known for her signature cheongsams, Chew still runs the show as executive chairman.

Forbes Asia April 2014

Forbes Asia

April 2014

Neil Shen cofounded Sequoia Capital China in 2005, at a time when Chinese internet companies were way behind their American counterparts, and turned it into an investment juggernaut. The key, disclosed the China-born, Yale-educated Shen, was to understand Chinese culture and business practices. Sequoia Capital China was split from its Silicon Valley parent in 2024 and renamed HongShan Capital Group, where Shen is founder and managing partner. The billionaire investor has been on our Midas list more than a dozen times.

Forbes Asia June 2014

Forbes Asia

June 2014

Piyush Gupta retired as CEO of Singapore’s DBS in March, more than a decade after he shared with us his plan to turn the stodgy local bank into a nimble regional player by digitalizing its services. The bank has been named the world’s best digital bank several times and continues to harness cutting-edge technology such as blockchain and AI. Gupta handed charge to DBS veteran Tan Su Shan, who earned a place on our Asia’s Power Businesswomen list in 2024.

Forbes Asia December 2014

Forbes Asia

December 2014

Lei Jun, founder, chairman and CEO of China’s Xiaomi, which made smartphones affordable for hundreds of millions of people, was a shoo-in for our businessman of the year. Xiaomi, which means “small rice” in Mandarin, was founded in 2010. Since our sit-down with Lei, it has expanded its portfolio to include wearables, IoT devices and more recently, EVs. Lei’s $42 billion fortune makes him China’s sixth-richest person today.

Forbes Asia April 2015

Forbes Asia

April 2015

This issue was largely dedicated to Singapore’s founding father, Lee Kuan Yew, who died March 23, 2015. Remembered by Steve Forbes and others as one of the great statesmen of the post-WWII era, LKY was a clear-eyed pragmatist with superb political skills who built Singapore into the economic powerhouse it is today. LKY also shared his views with our readers as a Forbes columnist for 15 years, starting in 2001.

Forbes Asia June 2015

Forbes Asia

June 2015

The then-34-year-old Frank Wang was the world’s first drone billionaire, having amassed a fortune with DJI, the company he founded in 2006 and ran out of his dorm room at a Hong Kong university. Today, Shenzhen-based DJI continues to dominate the consumer-drone space, giving Wang a net worth of $5.4 billion.

Forbes Asia September 2015

Forbes Asia

September 2015

Nepal’s first, and only, billionaire, Binod Chaudhary, raced to the rescue when a 7.8 Richter-scale earthquake devastated the country, distributing essentials in the immediate aftermath, including his company’s Wai Wai instant noodles, and helping longer term with rebuilding. His Chaudhary Foundation, the philanthropic arm of his CG Corp Global conglomerate, was set up in 1995 to support education, disaster management and healthcare, particularly for children.

Forbes Asia March 2016

Forbes Asia

March 2016

The year marked our first 30 Under 30 Asia list of the Millennials making good in this part of the world. Ten editions later, the roster continues to showcase young entrepreneurs, innovators and artists who are disrupting their chosen fields; only now, Gen Z is taking over, with nearly half of the 2025 cohort aged 27 or under.

Forbes Asia April 2016

Forbes Asia

April 2016

We flagged Nita Ambani, wife of Mukesh Ambani, chairman and managing director of Reliance Industries, as the first lady of Indian business and an Asian power businesswoman. At the time, she was a Reliance director, overseeing the launch and branding of telecoms arm Jio, which now has almost 500 million subscribers. Though she retired from the board in 2023 as her children stepped up, she remains chairperson of philanthropic arm Reliance Foundation and is even more visible today. Nita shows up at Premier League cricket matches, rooting for Reliance’s Mumbai Indians team. As a member of the International Olympic Committee, she’s lobbying for the Games to be held in India. A prominent cultural and convention center in Mumbai that was her brainchild bears her name.

Forbes Asia April 2017

Forbes Asia

April 2017

Hary Tanoesoedibjo, founder and executive chairman of Media Nusantara Citra group, is sometimes called Indonesia’s Donald Trump. Hary (as local media call him) built a fortune in real estate and TV broadcasting and likes to post on social media. He also happens to be the U.S. president’s business partner, owning several Trump-branded resorts in Indonesia. Hary attended the 2017 presidential inauguration and was hobnobbing in Washington D.C. when Trump was sworn in for his second term. He had ambitions to become Indonesia’s president but gave control of the political party he founded to daughter Angela last year.

Forbes Asia August 2017

Forbes Asia

August 2017

Sonia Cheng grew up in hotels owned by New World Development, a property company founded by her grandfather, Cheng Yu-tung. Under her guidance as CEO, its Rosewood Hotels brand, acquired in 2011, was quickly becoming one of the world’s fastest-growing upscale hotel chains. It now manages 33 properties, including The Carlyle in New York and Hotel de Crillon in Paris, with 27 more being developed. In 2022 Cheng also took on the role of co-vice chairman at Chow Tai Fook Jewellery, the Cheng family’s crown jewel. Meanwhile, New World has been weighed down lately by debt.

Forbes Asia November 2017

Forbes Asia

November 2017

What was only a dream in 2017 is now reality: Wang Chuanfu’s BYD is the largest EV maker in the world in terms of auto sales. The company’s 2024 revenue exceeded $100 billion, blowing past chief rival Tesla. However, BYD’s shares are off the all-time high they hit in May as investors worry about an EV price war.

Forbes Asia January/February 2018

Forbes Asia

January/February 2018

Joseph Tsai, cofounder and then-executive vice chairman of e-commerce giant Alibaba, had a slam-dunk year in 2017. Of note: his high-profile acquisition of 49% of the Brooklyn Nets basketball team for $1 billion. Three years later, the sports fan paid nearly $1.4 billion for the remaining stake. (He has since sold part of his holding but maintains control.) Tsai rose to chairman of Alibaba in 2023 and is now worth $11.5 billion.

Forbes Asia May 2018

Forbes Asia

May 2018

We were among the first to spot standout executive Jane Jie Sun, CEO of Trip.com Group (formerly Ctrip). She was in the midst of transforming the China-based online travel agency into a global player that today offers the gamut, from flights and hotels to rail travel and rental cars anywhere in the world. Sun still runs the company—and marathons.

Forbes Asia October 2018

Forbes Asia

October 2018

Referred to by his staff as “big brother Zhang,” the high school dropout became the world’s richest eatery entrepreneur after listing his Sichuan hot pot chain, Haidilao, in 2018. The business, which Zhang Yong cofounded with his wife, Shu Ping, is not quite sizzling these days. A consumer spending slump in mainland China prompted Zhang, now a Singapore citizen and resident, to diversify into other dining options as well as focus on U.S. expansion.

Forbes Asia October 2019

Forbes Asia

October 2019

In an exclusive interview, Eduardo Saverin, cofounder of Facebook, explained the investment mantra of B Capital Group, the venture capital firm he established with business partner Raj Ganguly. The duo, based in Singapore and Los Angeles, respectively, were out to prove that innovation can happen anywhere, not just in Silicon Valley. It certainly has. B Capital’s assets under management now stand at $8 billion, invested in more than 190 companies in sectors such as healthcare and AI.

Forbes Asia November 2019

Forbes Asia

November 2019

Once China’s richest person, beverage billionaire Zong Qinghou talked candidly of his efforts to rekindle sales at his privately held Hangzhou Wahaha Group with its portfolio of bottled water and milk drinks. He also spoke about his daughter, Kelly, as a potential successor. A year after Zong’s death in 2024, Kelly, who now leads Wahaha, is embroiled in an inheritance fight with three people who claim to be the late Zong’s offspring.

Forbes Asia December 2019/January 2020

Forbes Asia

December 2019/January 2020

In the year 2000, Forbes Global (the forerunner of Forbes Asia) put Jack Ma, cofounder of China’s Alibaba, on its cover when the e-commerce company had just 150 employees (vs 124,000 today). Almost two decades later, as Ma stepped down as chairman, announcing that he was switching his focus to philanthropy, he graced the cover again. The former teacher’s meteoric rise as one of China’s top tech entrepreneurs earned him the Malcolm S. Forbes Lifetime Achievement Award in 2019.

Forbes Asia March 2020

Forbes Asia

March 2020

Martin and Peter Lee, the sons of Lee Shau Kee, then Hong Kong’s richest person, had spent less than a year as co-chairmen at the family’s property flagship, Henderson Land, when they agreed to open up about how they planned to carry the legacy forward. The patriarch’s death in March 2025 makes them co-owners of one of Hong Kong’s largest landlords at a time when the property market is in a prolonged slump.

Forbes Asia May/June 2020

Forbes Asia

May/June 2020

In 2020, Masayoshi Son, founder of Japanese investment giant SoftBank, had hit a wall. Some big-money bets made by his $100 billion Vision Fund had gone spectacularly south, forcing Son to divest assets to pay down debt. Today, the entrepreneur has a new vision, one focused on AI, with investments in ChatGPT creator OpenAI and chip giants Nvidia, TSMC and Intel. The result: Softbank returned to profit in fiscal 2025 after four years in the red, and a surge in its stock has made Son once again Japan’s richest person with a $54 billion fortune.

Forbes Asia August 2020

Forbes Asia

August 2020

When most businesses were reeling under Covid-19 lockdowns, Singapore-based Sea, an online provider of shopping, games and payment services, led by cofounder Forrest Li, was on a high. It had become Singapore’s most valuable company with a market cap of $69 billion. Today, New York Stock Exchange-listed Sea’s market cap exceeds $110 billion amid buoyant revenue from its gaming (Garena), e-commerce (Shopee) and payments (Monee) arms. Li was first covered by us as an entrepreneur to watch in 2010.

Forbes Asia September 2020

Forbes Asia

September 2020

Roshni Nadar Malhotra became chairperson of HCL Technologies in 2020, taking over from her billionaire father, Shiv Nadar, who cofounded the company as a garage startup in 1976. That made the former TV news producer one of the first women to lead a listed IT outfit in India and earned her a spot on our annual Asia’s Power Businesswomen list.

Forbes Asia July 2021

Forbes Asia

July 2021

With the successful takeover of Indonesia’s Bank Permata in 2020, third-generation president Chartsiri Sophonpanich set the stage for a significant expansion of Bangkok Bank’s regional presence. The $2.7 billion deal was the biggest in the bank’s history and marked a departure from its past strategy of growing organically. It also gave Chartsiri, who agreed to a rare interview, a way to cement his legacy at the institution cofounded by his grandfather in 1944.

Forbes Asia November 2021

Forbes Asia

November 2021

Grab’s group CEO, Anthony Tan, gave us the lowdown on how he planned to take his Singapore-headquartered superapp company, best known for its ride-hailing and delivery services, to the next level. His blueprint included transforming Grab, which he cofounded in 2012, into a listed entity and boosting its presence in fintech. A month later, Grab went public on the Nasdaq via a SPAC merger that valued the company at $40 billion, making it the biggest-ever listing of a Southeast Asian business. Its market cap has since halved to $21 billion.

Forbes Asia December 2021

Forbes Asia

December 2021

Data centers are multiplying around the world, and one person who saw the coming wave and rode it to become a multibillionaire is Otto Toto Sugiri, cofounder of DCI, Indonesia’s biggest data center operator by capacity. The serial tech entrepreneur launched the country’s first internet service provider in 1994 and is sometimes referred to as Indonesia’s Bill Gates.

Forbes Asia September 2022

Forbes Asia

September 2022

We sat down with GGV Capital’s Jenny Lee, the first woman to break into the top ten of the Midas ranking in 2012 and who had just completed an unbroken, 11-year run on that list. Now as senior managing partner at Granite Asia, which was split off from GGV in 2024, Singapore-based Lee’s winning streak continues. She was at No. 75 on this year’s Midas List and successfully launched Granite’s first private credit fund in May, securing more than half the targeted $500 million from anchor investors.

Forbes Asia October 2022

Forbes Asia

October 2022

In the Philippines, billionaire Enrique Razon, known for his twin successes in ports and casinos, was systematically building a third source of wealth: infrastructure. With interests in water utilities, hydropower, gas fields and solar farms, Razon stressed he wasn’t fazed by bureaucratic hurdles. “We’re very persistent, very aggressive. We don’t make crazy proposals. We study things very carefully.”

Forbes Asia December 2022

Forbes Asia

December 2022

Skyrocketing coal prices resulted in a fivefold jump in the wealth of Low Tuck Kwong, the founder of coal miner Bayan Resources, pushing him to No. 2 on our Indonesia rich list from No. 18 the year before, with a $12.1 billion fortune that has since more than doubled. Despite the global shift toward renewables, Low said he was confident the so-called black gold had a profitable future and of Bayan’s industry prospects, thanks to its low-cost base and low-emissions coal.

Forbes Asia February 2010 and February/March 2023

Forbes Asia

February 2010 and February/March 2023

Hong Kong developer Vincent Lo gambled big on mainland China after the Asian financial crisis in the late 1990s, ploughing money into his Xintiandi lifestyle and entertainment district in Shanghai. The bet paid off, turning his listed Shui On Land into his empire’s crown jewel. A meticulous planner, Lo chose daughter Stephanie as his successor. He continues to bet on China, despite its property distress, agreeing in June to invest in a premium Shanghai project.

Forbes Asia August 2023

Forbes Asia

August 2023

The wealthy Aboitiz family of the Philippines has a track record of reinventing its portfolio to keep pace with the times. We dug deep into Sabin Aboitiz’s $7 billion blueprint to expand century-old Aboitiz Equity Ventures, the country’s second-biggest electricity producer, into a banking, infrastructure and F&B powerhouse. “We’re transforming from a 100-year-old man to a 25-year-old athlete,” the fourth-generation president and CEO said.

Forbes Asia April/May 2024

Forbes Asia

April/May 2024

Malaysian billionaire brothers Lee Yeow Chor and Lee Yeow Seng, who inherited palm oil business IOI from their late father, Lee Shin Cheng, caught our eye for their bet on property in neighboring Singapore. Up next: a REIT listing that could hold as much as $6.2 billion in assets.

Forbes Asia August 2024

Forbes Asia

August 2024

The repositioning of Philippine F&B giant San Miguel as a nation builder by chairman Ramon Ang was a compelling story of a self-driven tycoon seeking to cement his legacy while preparing his son John Paul Ang to carry it forward.

Forbes Asia November 2024

Forbes Asia

November 2024

Third-generation scion Miwako Date’s strategy to double down on Mori Trust’s hotels and resorts business now looks savvy: visitors to Japan, led by the Chinese, surged 21% in the first half of 2025 to 22 million, putting the country on track to draw 45 million visitors this year, as estimated by Mori.

Forbes Asia February/March 2025

Forbes Asia

February/March 2025

Kuok Meng Wei, whose legendary grandfather Robert Kuok was described by Forbes as the world’s shrewdest businessman in a 1997 cover story, revealed his strategy of driving the storied Kuok Group into what he believes is the hottest industry in decades. Backed by his family, the 42-year-old’s K2 Strategic has become one of the leading builders of data centers in the region, notably in Malaysia, Indonesia and Thailand.

Forbes Asia July 2025

Forbes Asia

July 2025

Not long after she brokered a deal with Sam Altman of OpenAI, Shina Chung, the first woman CEO of Kakao, outlined to us her plan to tap its next-gen technology for AI virtual assistants to jumpstart growth at the Korean internet giant.

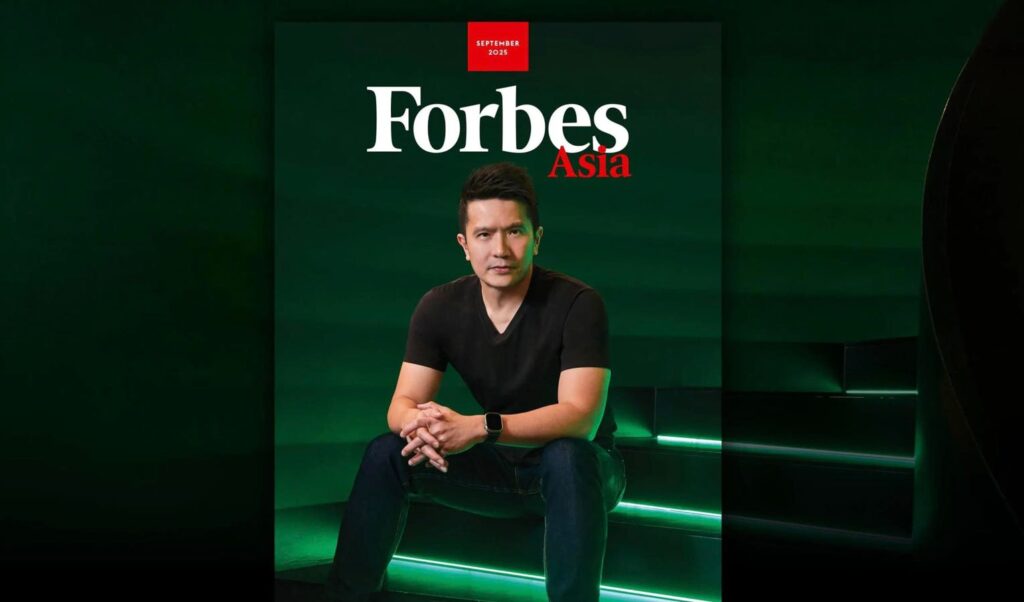

Forbes Asia August 2025

Forbes Asia

August 2025

Nikhil Sawhney, fourth-generation successor of a Delhi clan that got its start in the sugar business, gave us the lowdown on how he transformed Triveni Turbine, a company appearing on our Best Under A Billion list for the second year, from a small domestic outfit into the world’s second-largest maker of turbines of up to 100MW capacity. His strategy: a laser focus on R&D and staying “paranoid” about competition.