Chinese supplies increased to ten years on Friday, with Shanghai’s criteria over 3,800 factors and positive outlook concerning the residential AI overview as high as 3,800 factors.

The Shanghai Compound Index increased 1.5% when it shut at 3,825.76, the highest degree given that August 2015. This is up 3.5% each week, the most effective run given that November 2024.

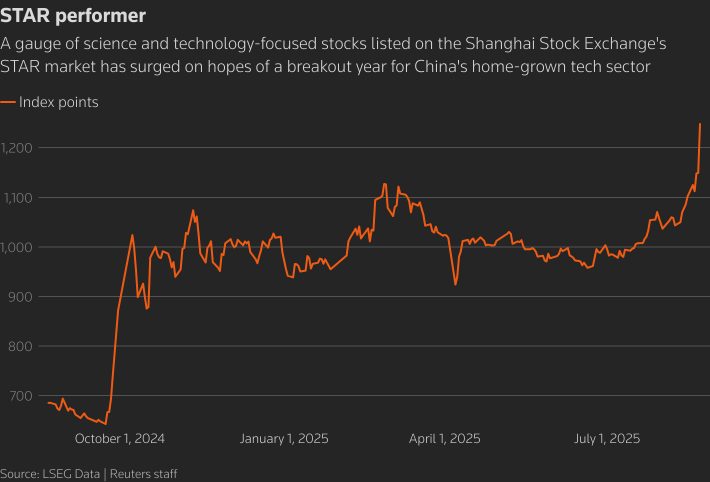

Heaven chip CSI300 index increased 2.1% to a 10-month high and finished a week with a 4.2% boost, while the technology-focused Star50 index increased 8.6%. The increase and the comparison with the decrease of AI-related supplies in the USA Discuss AI “bubble” And mentioned a whole lot Services obtain little organization gain from AI financial investment

See likewise: China’s success and breast realty titans will not miss it

” Venture and institutional financiers are speeding up property redistribution and moving funds from bonds to supplies,” stated Zheng Yu, profile supervisor of the Allianz Global Investors China Structure department.

” There is a growing number of agreement, and we are seeing the manufacturing of a booming market.”

Supplies connected to residential AI led the land increase on Friday, while the CSI semiconductor market increased 9.5% after rising as high as 10%, and the CSI AI index increased 6.6%.

Chipmakers Cambricon Modern Technology and Hygon Infotech both climbed up a 20% limitation each day to videotape highs. Market gigantic Smic leapt greater than 14%.

The innovation rally obtained energy after Reuters reported that NVIDIA asked Foxconn to put on hold work with the H20 chip, one of the most innovative design presently permitted by united state business to offer in China.

This is highlighting Beijing’s press towards CHIP self-sufficiency after DeepSeek launched an upgrade of its front runner V3 AI design on Thursday with residential semiconductor assistance.

Shanghai criteria has actually expanded 23% given that April

New technical positive outlook might better worsen China’s rally, while the Shanghai criteria is currently up 23% from its April reduced as residential financiers transform funds right into supplies Relieving stress in between the USA and China and Beijing opposes overcapacity press

A-shares on Shanghai and Shenzhen Supply Exchanges went beyond 2 trillion yuan for 8 successive days, the lengthiest winning touch on document.

” In the meantime, FOMO view continues to be leading, causing an adjustment of decrease in web traffic for every single market,” Goldman Sachs experts stated.

Usually, onshore financiers think that the threat of the disadvantage is reduced in the close to term which the marketplace might have sufficient area for more event.

Hong Kong’s benchmark Hang Seng Index shut 0.9%, offseting earlier losses in a week to make a 3rd successive gain.

Modern technology supplies likewise generated incomes in the city, with the sub-index expanding by 2.7% and the AI market expanding by 2.6%.

” Hard Distinctions with the Slower”

However Nomura experts led by Ting Lu beware, stating that given that September in 2014, China’s securities market rally has actually been driven mostly by strong basics.

They kept in mind that all A-share indexes covering all A-shares rose 56% throughout that time, while the overseas Hang Seng Index expanded 40%.

Nonetheless, based upon what has actually occurred previously, “success has the prospective to result in illogical success, boosted take advantage of and bubble development.”

In the 2nd fifty percent of the year, financial basics might be substantially compromised in all elements, and “the securities market itself might not supply much inspiration for the genuine economic situation.

” Our team believe that Beijing might require to stomp thoroughly over the following couple of months to take care of the complicated department in between the downturn and the increasing securities market.”

- Jim Pollard’s extra editor Reuters