Today, capitalists have actually decreased their returns, with a 26% returns decreasing BHP Billiton’s yearly revenue, bringing the globe’s biggest extracting business’s share cost by 1.5%.

Although the business’s internet revenue dropped from $13.7 billion to $10.2 billion in one year, the supply cost climbed to $42.

Iron ore is a significant factor to BHP Billiton’s yearly revenue, however copper is capturing up swiftly. (Fairfax Media using Getty Picture using Getty Picture)

Fairfax Media By Getty Pictures

Earnings and Various Other Charges gross (EBITDA) dropped from $29 billion to $25.9 billion.

Investors will certainly obtain a last returns of 60 cents per share, with a last expense of 74 levels Celsius 14c in the previous year, with a yearly circulation of $1.10, while 2024 revenues of $1.46

Iron ore is the biggest revenue generator for BHP, the globe’s lowest-cost manufacturer of big steel miners, adding $14.4 billion from the EBITDA Team, many thanks to $18.9 billion in the previous year, many thanks to dropping iron ore costs.

Copper is quickly coming to be the business’s major revenue generator, with EBITDA adding $12.3 billion, a 44% rise from $8.6 billion the previous year.

Coal problem

Make money from coal, mostly metallurgical or steel-made products, dropped from $2.3 billion to $573 million, and cautioned administration that high Australian tax obligations and aristocracies might close down limited price mines.

Unless the cost of steel (made use of to make stainless-steel and made use of for rechargeable batteries) boosts, the business’s nickel service might be marketed.

The worldwide nickel service has actually been interfered with by an extra-large nickel excess from Indonesia’s low-priced mines, and BHP will certainly proceed in the close to term.

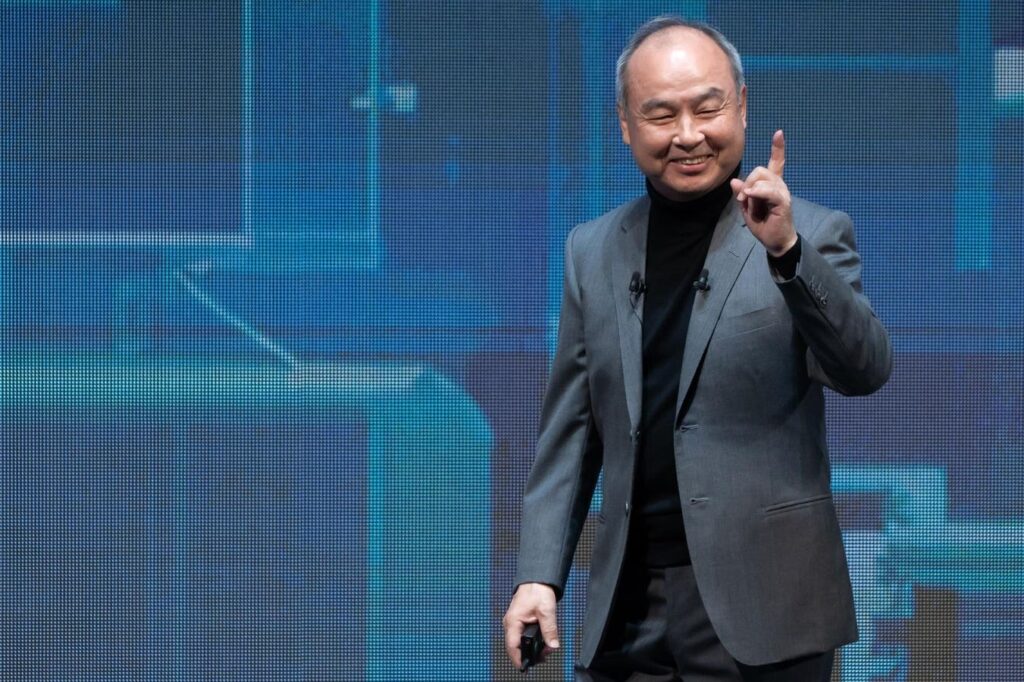

Mike Henry, Chief Executive Officer of BHP. (Wayne Taylor/ Australian Financial Testimonial by Getty Images)

Fairfax Media

BHP chief executive officer Mike Henry concentrates on solid manufacturing of the business’s service, consisting of document manufacturing of iron ore and copper.

” The Treasury 2025 is one more solid year for BHP Billiton, with document manufacturing, continuous market management and corrective funding allowance,” he stated.

Henry stated there is a demand for the possibility of products to mix with each other.

” Expanding to 3% or somewhat reduced in the short-term because of adjustments in profession plan, however need for products continues to be solid, particularly in China and India,” he stated.

Financial investment in brand-new tasks is anticipated to control information circulation from BHP Billiton over the following 2 years, which proceeded in 2015’s fad, when capital investment for mine advancement got to $10 billion, two times as high as 3 years earlier.

Capital investment on advancement and expedition are anticipated to be $11 billion this year and following, prior to being up to $10 billion in outside years.

The initial potassium plant food in 2027

Canada’s Jansen Potash job is the business’s major advancement emphasis, with the business’s initial business manufacturing of plant plant foods set up to happen in mid-2027, while Jansen’s 2nd stage has actually been delayed.

Financial investment experts invite the RBC’s funding markets of the financial institution Royal Canada financial institution informed customers that returns are much better than anticipated and prices are less than anticipated.

Royal Financial Institution of Canada (RBC

” The business is stabilizing the change to development (i.e. copper) and is remaining to pay engaging returns, hence enhancing the financial investment instance.”