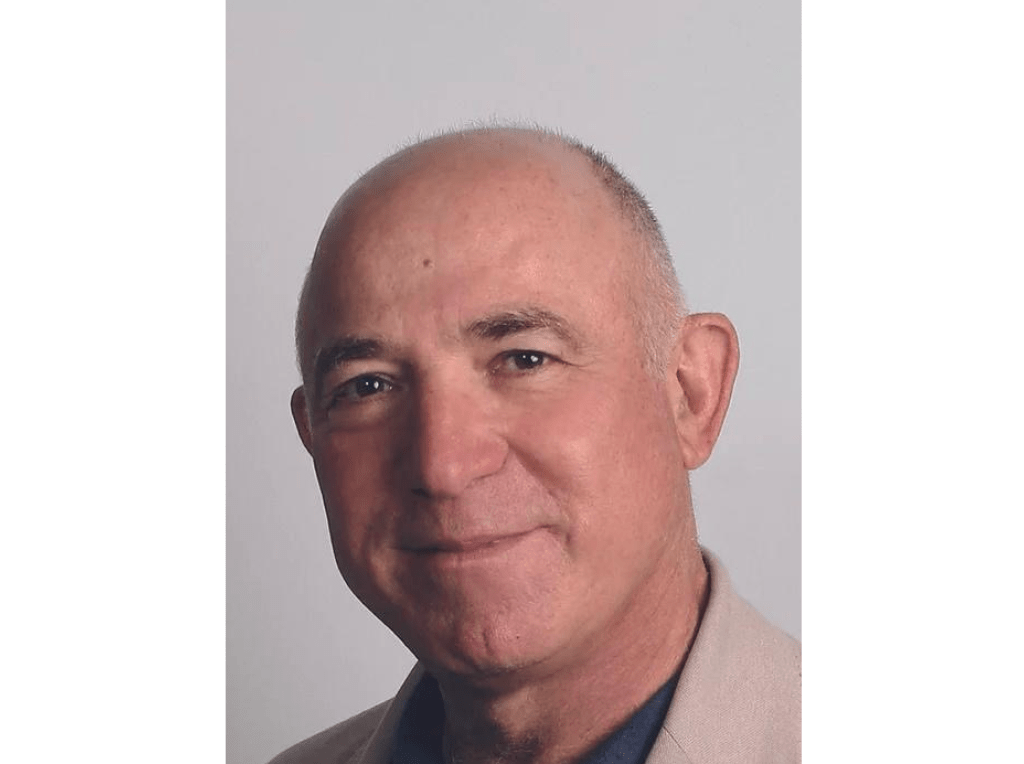

For 2 years, Adam Chinn, previous principal running police officer of Sotheby’s, has actually silently developed a shop art lender, worldwide art funding, and has actually obtained financing and assistance from participants of the Nahmad household, respected collection agencies and dealerships of Ultra Blue Chip Art. Current meeting Artnews Chinn exposed that the firm has actually currently paid virtually $400 million in car loans and is anticipated to get to $500 million by the end of 2025.

Chinn is the most recent arts market professional that can puncture art car loans. Last autumn, 6 art loan providers of all dimensions informed Artnews Regardless of the high rate of interest, business is still flourishing.

The IAF asserts to be at a benefit over rivals in regards to dimension and rate: Chinn states it can pay car loans in 10 days, with a common loan-to-value proportion of concerning 50%, although he states the car loan proportion is greater in situations entailing phenomenal security. His firm uses temporary car loans (typically 6 to twelve months) to connect liquidity requirements around sales, realty strategies or company procedures.

” We do not intend to be your financial institution for 5 years,” Chinn informed Artnews “We are a bridge.”

The firm’s typical car loan dimension has to do with $8 million, with a number of deals surpassing $40 million. Customers vary from excellent collections to musician estates and medium-sized galleries. Chinn stated the argument in between exclusive collection agencies and profession customers is approximately also.

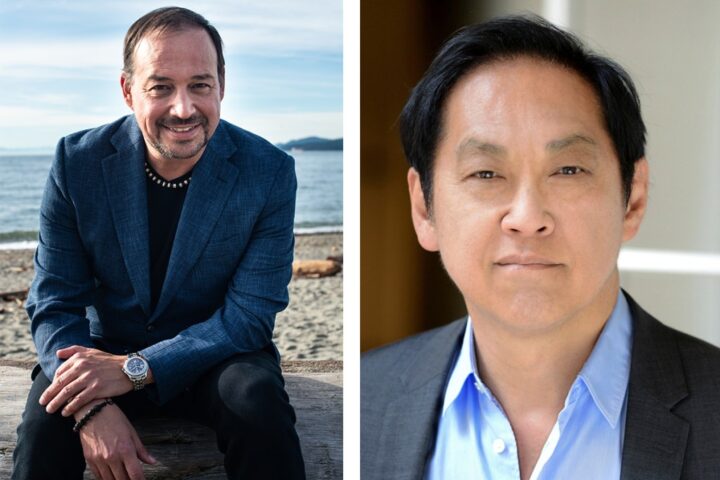

However the genuine distinction of the IAF might be its financing resource – the household of billionaires Nahmads, one of the most respected collection agencies and dealerships in the art globe.

The truth that Nahmads not just sustains the firm, yet likewise values the art work inside has actually come under some examination, offered their comprehensive participation on the market. Regardless of this, Chinn urges that the IAF is a different entity: “a different lawful entity, a different treatment,” he stated. “I do not recognize what occurred to their various other company.”

When asked whether the inner web links in between the IAF and the Nahmad household can be clashed in case of a lending default, Chinn responded: “As lenders, we are in charge of the responsibility to patronize the aid of the debtor’s genuineness and justness. So, thus far, we have actually carried out a public auction when it comes to settlement concerns.”

IAF’s car loans are non-recourse, which suggests that the art work itself (not the debtor’s annual report) is security. The firm carries out basic Know Your Consumer (KYC) and Anti-Money Laundering (AML) checks, yet does not assess the more comprehensive monetary scenario of the consumers. “If it ends up that you are not an authorized individual and the art work will certainly be looked into, we will certainly obtain it,” Chinen stated.

In the firm’s news release, Joe Nahmad placed IAF as normally broadening the household’s function in structure collections for leading customers for years. “Worldwide art money is the tail end of the challenge,” he stated, describing the system as “at every phase of the collection trip” that sustains collection agencies, dealerships and estates.

It is clear that Namad’s participation has actually aided the firm range up quickly. Comparative, it has actually inhabited the art companion (a veteran gamer in the wild) for 9 years Regarding $400 million in car loans. However, FAP owner Phillip Hoffman informed Artnews It is anticipated to get to $1 billion in 3 years. He included that his firm is moneyed by capitalists, and the IAF is “pertaining to a household that can draw [funding] at any moment,”

” We are neutral,” he included. “We have no dispute. We offer via individuals that do the most effective task for our consumers.”

Various other individuals in the Art Financing Area consist of Sotheby’s Financial Solutions, which has actually stemmed from car loans in 70 groups for greater than $10 billion, consisting of arts, autos, precious jewelry, bourbon and red wine. In April, the public auction home revealed a $700 million securitization contract called Sotheby’s Artfi Master Depend on, intending to increase its financing company. Significant banks such as Financial institution of America likewise provide art-backed car loans, although terms differ commonly based upon the total account of the debtor and the more comprehensive financial partnership.

Like several art loan providers, Chinn thinks the market is planned for development. Such car loans have actually ended up being a more vital component of the financialization of the marketplace, with establishments and people progressively seeing art as a spiritual things and a property, commonly an incredibly fluid thing.

” There are greater than a trillion bucks in art secretive hands, and just one item of leveraged is leveraged,” Chin stated. “Individuals obtain cash on a daily basis. Why not art?”