Alert the gold insect. Your celebration just has adequate time to finish the remainder of the beverages in the last round and afterwards the enjoyment finishes as the gold cost visit 20%.

This is the most up to date projection from financial investment financial institution Citi, and one more financial institution, UBS, which has actually revealed care concerning the leads of gold, among the most effective financial investments in the previous 3 years, yet is functioning to remain to increase.

Gold rates are anticipated to drop.

The financial development and the beginning of the rates of interest decrease cycle are anticipated to raise gold by 108%, in the last twelve month, in trading about $3394 per ounce and 45% in the previous twelve month.

Yet gold has actually been having a hard time to make purposeful progression given that getting to $3,433 per ounce in April, with Israel releasing an air battle of Iran recently yet falling short to keep higher energy today.

UBS stated in a note flowed to Australian capitalists it stays favorable for gold, yet miners’ advice “is not without threat” in advance of the yearly revenue record finishing June 30.

Available Advancement Purchase Newmont

Given that the start of 2025, Australia’s 2nd biggest Found diamond is Australia’s 2nd biggest Found diamond, which has actually been reduced to UBS (UB).

” We no more have evaluation assistance and downgrade advancement target sales,” UBS stated, with the last sales projection for the cost projection dropped 21.7% to cost $8.56.

Australia’s biggest gold manufacturer, Northern Celebrity, was reduced to neutral by UBS, although its share cost might still increase to $23, with sales up 9% last time to a share cost of $21.08.

Newmont is a big Australian-listed Goldmena, the only Thrive of the 3 titans to obtain acquire guidance from UBS, many thanks to Australia’s affordable totally free capital with Stocks, which enhanced by 17.4% to $105.

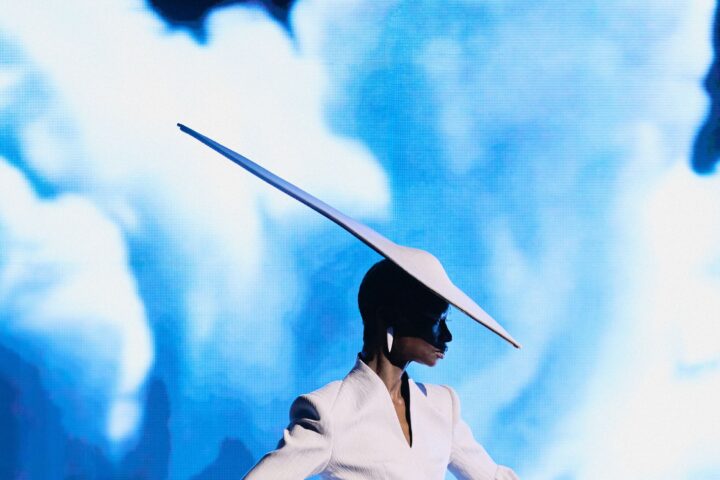

Treat it very carefully in the past going down. (Digital Photography by David Gray AFP through Getty Images)

Citi’s sight is that need for financial investment in gold will certainly start to go out up until 2026 later on this year.

” In the short-term, the flow of profession contracts (with the UK, China, Japa, India and Europe) and (internet stimulation) big expenses must boost feelings and avoid gold from relocating greater,” Citi stated.

” Undoubtedly, we really did not see the energy of Bond Vigilante throughout 2025/26, as the BBB Delta is mostly moneyed by toll profits.

” Additionally, over the following 6 to 9 months, we’re seeing the Fed’s series of development belief from limiting plans to nonpartisanship.”

Citi stated it had actually advised that gold miners utilize the long-lasting cost of five-year ahead trading at a long-lasting cost of $4,000 per ounce to guarantee the decrease listed below $3,600/ oz to $3,700 per ounce per ounce.

See the peak

According to Citi, gold might combine concerning $3,100/ oz to $3,500/ oz in the following 3 months.

” Yet our job reveals we have actually seen highs (for gold),” Citi stated.

The financial institution stated its research study reveals that the gold deficiency must come to a head in the 3rd quarter of this year, after which the marketplace ought to essentially damage afterwards.

” Our job reveals that gold returns $2,500/ ounce by the 2nd fifty percent of 2026,” Citi stated.