Artnews Leading 200 collection agencies Jeff Bezos, Bernard Arnault and Alice Walton have actually shed billions of bucks in the stock exchange offered out in the previous 3 trading days, a brand-new “countdown” toll on all various other nations and a brand-new “countdown” toll on the opportunity of an international economic crisis triggered by the profession battle.

” This will certainly influence whatever,” a blue chip gallery with 3 places Artnews After the opening of the exhibit on April 4.

Nasdaq Composites dropped greater than 6%, the S&P 500 dropped almost 5%, while the Dow Jones dropped greater than 1,700 factors, or greater than 1,700 factors, or 4%, and the loss of the waterfall started on April 3. These decreases remained to infect Oriental and European stock exchange on April 4 and April 7. On April 7, Hong Kong’s Hang Seng dropped by greater than 13%, the most significant one-day decrease given that 1997.

When the united state market opened up on Monday, the 3 significant indexes dropped even more, down greater than 3 days at the three-day top, with the S&P 500 and the Nasdaq getting in bear area greater than 20%. “This is the most awful three-day efficiency of the S&P 500 given that October 1987.” Bloomberg Information Podcast host Joe Weisenthal published on social networks.

The worldwide index decrease in between April 3 and April 7 was a lot even worse than the billion-dollar losses in very early March after Trump formerly introduced greater tolls on imports from Canada, Mexico, China and Hong Kong.

According to information evaluation, after 3 days of trading days, there are presently 30 of the leading 200 collection agencies on Bloomberg’s Billionaire Index. Artnews Amongst the 32 billionaire collection agencies, 21 shed greater than $1 billion, 4 of the 25 shed greater than $5 billion, and 19 of the 32 art collection agencies shed 10% or even more.

LVMH proprietor Bernard Arnault shed one of the most in 3 days at $19 billion, minimizing his total assets 11% to $150 billion. Throughout the exact same duration, Walmart Beneficiary Walton, the total assets owner and Walmart successor, dropped $7.54 billion (-7%), adhered to by $7.2 billion (-8%) for Dependence Industries chairman Mukesh Ambani and $6.6 billion (-3%) for Amazon Chief Executive Officer Jeff Bezos.

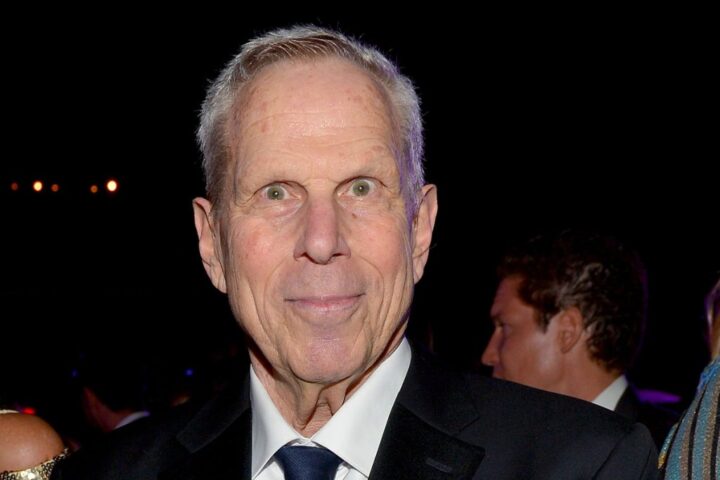

Various other Leading 200 collection agencies that saw ten-figure choices in their total assets consisted of previous KKR chief executive officer George Roberts, Chanel chairperson Alain Wertheimer, Uniqlo Chief Executive Officer Tadashi Yanai, KKR founder Henry Kravis, HCL Business chairperson Shiv Nadar, British developer James Dyson, SAP founder Hasso Plattner, Beauty Global Monitoring Chief Executive Officer Leon Black, French business owner Francois Pinault and treasurer Charles Schwab.

Although Arnault’s overall internet worth loss is the biggest Dyson was 16%, adhered to by Kravis, Roberts’ total assets visit 15%, in addition to Prada exec supervisor Patrizio Bertelli and Miuccia Prada. KKR shares dropped greater than 20% on Thursday and Friday to a 52-week reduced, however got on Monday’s follow up. In between April 3 and April 7, Prada’s supply dropped greater than 17%.

Both leading 200 billionaire collection agencies that did not endure any type of losses in between April 3 and April 7 are American enjoyment exec David Geffen and Castle owner Ken Lion.

The New York City Times “Investors for concerning a month have actually lowered their use take advantage of and various other unstable trading devices throughout concerning a month,” Lion “has actually expanded more powerful and more powerful that Mr. Trump would certainly create a turmoil, stating 2 workers would certainly not enable 2 workers to be permitted to be called as the equipment of the fund.”

Especially, Lion additionally gave away $100 million to outside costs teams in the 2024 political election, which caused previous Head of state Donald Trump winning a 2nd term. According to information launched by the Federal Political Election Payment, the quantity is just traditional, the 5th biggest variety of private benefactors, and information from not-for-profit research study and openly covertly examined by federal government openness teams. Lion’s payments consist of $30 million in overall fundraising to the Us senate Management Fund, greater than a quarter (25.8%) of overall fundraising ($ 116.5 million).

The mass sell-off in the worldwide stock exchange has actually additionally activated margin calls from several hedge funds, a very early art dealership informed Artnews Several collection agencies just recently called them in an effort to sell off numerous bucks in job. Throughout the Covid-19 pandemic, Deutsche Financial institution margin additionally triggered leading 200 collection agencies Ron Perelman to market 71 items of excellent musicians worth almost $1 billion in between 2020 and 2022.

If Trump additionally intimidates to raise tolls on Chinese imports if the nation does not remove or decrease its 34% or even more anti-temporal counter-sales on April 7, and Trump additionally intimidates to raise tolls on Chinese imports.

” If China is tomorrow on April 8, 2025, the USA will certainly enforce added tolls on China on April 9, and beginning with April 9, the USA will certainly enforce a lot more tolls on China,” Trump stated in a social media sites article. “On top of that, all arrangements with China concerning their demand to consult with us will certainly be ended!”

United States tolls on imported products from China had actually currently been elevated to 54 percent on April 4. While artworks, collection agency’s items, and vintages are still exempt to the brand-new United States tolls under Phase 97 of the Harmonized Toll Arrange of the USA, the United States additionally imports huge quantities of products, workplace products, art-related clothes a goods, furnishings, steel, paper, published publications, and electronic devices from China yearly.

The European Payment additionally recommends a 25% anti-election proposal on a range of united state products.

Reports concerning the 90-day time out of the brand-new tolls quickly motivated energetic trading task, however the losses recuperated after the White Residence provided a declaration calling it “phony information.” Head of state Trump was straight asked if his brand-new tolls can be trademarked after a problem of details from elderly authorities throughout media looks Sunday and Monday.

” They can both be actual,” Trump responded in an interview. “There might be irreversible tolls, and arrangements can be performed since along with tolls, we require something.”

An art transportation manager informed Artnews He quickly got queries from his customers concerning the brand-new tolls. The unpredictability of the future– consisting of a lot more anti-propaganda opportunities, problems concerning his capability to quickly get in and leave the USA, in addition to the safety and security of his prompt household, and the safety and security of his prompt household– he once more presented him in very early 2020.

” Similar to Covid,” he stated. “Other than this moment, the infection remains in the White Residence.”